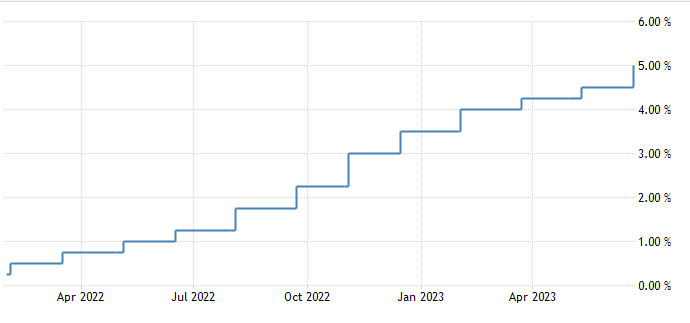

The pound sterling is influenced by various factors, and its future might hinge on the Bank of England's August meeting. This meeting could spark a rally if the rates appear hawkish. Growth and inflation forecasts will be in the spotlight; their changes could affect the pound's performance.On Thursday, August 3, the Bank of England is likely to raise rates by a quarter of a percentage point to 5.25%. However, economists and markets see the risk of a half-point increase, as happened in June. The country's inflation remains higher than in other major economies.

Since the last rate hike on June 22, predictions about the Bank of England's peak rates have significantly changed. Investors are now trying to understand if the country has a deep-rooted inflation issue or if the fast price growth is about to sharply slow down, as seen in other countries.

Notably, after the news about record wage growth on July 11, the central bank's peak rate expectations reached 6.5%. However, they decreased after an unexpected drop in inflation.

At present, 50% of investors expect the peak to be at 5.75%, while others predict 6%. Notably, the peak might be reached by late 2023 or early 2024.

The cost of mortgage loans has hit its highest level since 2008 because of rising rate expectations. The rate increase is putting pressure on housing construction and a few other sectors. A recent survey showed that private sector growth this month has dropped to a six-month low.

Most economists polled by Reuters foresee a rate increase to 5.25% from the current 5% on Thursday, with the peak reaching 5.75%.

The Bank of England's governor, Andrew Bailey, has stated this month that it is vital to complete the plan for curbing inflation. His deputy, Dave Ramsden, emphasized that even after recent drops, inflation remains too high.

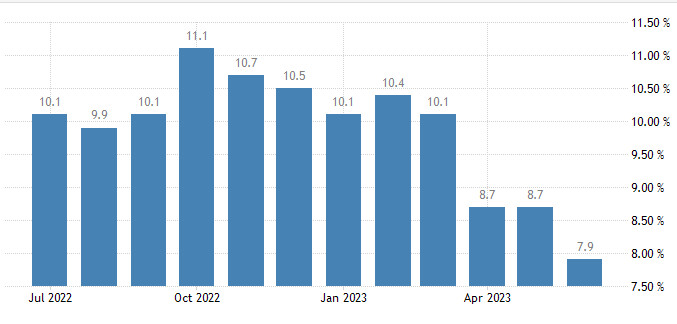

Year-on-year inflation fell to 7.9% in June from 8.7% in July. That is significantly more than markets anticipated and is in line with the Bank of England's forecasts made in early May when markets expected the rate to peak at around 5%.

However, this inflation level still nearly quadruples the Bank of England's 2% target and is twice as high as in the US. Ramsden suggests the fall in inflation was primarily caused by short-term changes in energy prices, but long-term pressure remains.

The picture of the UK job market is ambiguous. The yearly wage growth excluding bonuses remained at 7.3% for three months until May, the highest level since 2001.

However, unemployment unexpectedly increased to a 16-month high of 4%.

Data interpretation depends on the observer's viewpoint and could be used to justify an increase of either 25 or 50 basis points.

Meanwhile, annual producer prices fell to 0.1% in June, the lowest level since December 2020. This is in comparison to a nearly 20% high in July 2022.

Fresh forecasts

The Bank of England plans to update its growth and inflation outlooks. Both estimates are expected to be lower than in May due to higher market expectations about the rate. The key rate is the main component in making a forecast.

According to the International Monetary Fund, the UK economy is likely to expand by 0.4% this year. This is the second-lowest figure among the G7 developed countries, with only Germany lagging behind.

As a rule, deviations from the 2% target of the BoE's inflation forecast for the next two to three years signal how much the central bank agrees with market rates.

However, in recent months, the Bank of England has paid less attention to its medium-term forecasts. Instead, Governor Andrew Bailey and Chief Economist Hugh Pill focused on the risk of persistent inflation, which was not reflected in the main forecasts.

GBP is at a crossroads.

In July, the British pound reached new 2023 highs against the euro and the US dollar. However, the second half of the month led to a slowdown in this upward trend. Nonetheless, the Bank of England's August policy meeting could reignite the rally if the decision is deemed hawkish enough.

Last week, the Federal Reserve and the European Central Bank hinted at the possibility of pausing monetary policy tightening. The Bank of England may follow their example. It could change its approach and signal to markets that it does not plan to raise rates too sharply, given concerns about an economic downturn.

Recent inflation data for June was cooler than expected, opening up the possibility for such a move. If the Bank of England takes a softer approach to the prospect of further rate hikes, the British pound is likely to weaken against the euro, the US dollar, and other G10 currencies.

The scale of the rate hike will be a key point as markets are divided over whether the Bank will opt for a 50-basis-point increase, as was the case in June, or a 25-basis-point rise.

A 25-basis-point rate hike will signal that the regulator intends to slow growth, which, in turn, could lead to the pound's depreciation. However, analysts do not rule out the possibility of a 50-basis-point hike, especially if the committee believes another rate hike is planned for the future, possibly as early as September.

If the rate is increased by 50 basis points, the GBP/USD pair could rise towards the resistance level of 1.3140. In general, analysts see growth to around 1.3000 and lows around 1.2700 in case of dovish pressure.

According to Lloyds Bank, a 50-basis-point rate hike to 5.50% is expected in August. They also note that the inflation data for June showed worrying signs of instability in the core inflation indicators, which may cause additional concerns.

If the BoE's inflation forecasts turn out to be higher than in May, it could push the pound sterling upwards. This would signal the need for a stricter approach to rates in the future.

However, the central bank is likely to pay less attention to its forecasts when developing policy. This is to avoid repeating past mistakes when the forecasts turned out to be inaccurate.

Therefore, the August inflation report will determine the UK interest rate decision and the future movement of the British pound.