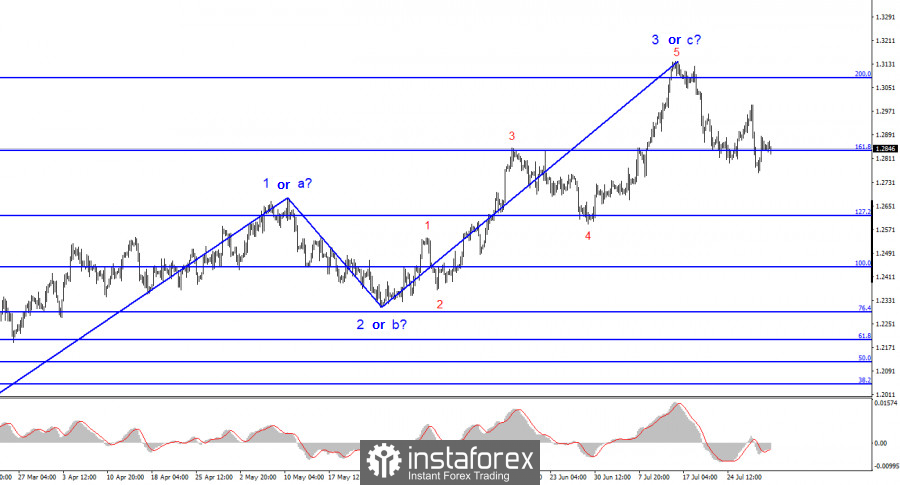

Regarding the GBP/USD pair, the wave analysis remains relatively straightforward. The construction of upward wave 3 has been completed, and a potential new downward trend segment, possibly wave 4, has started. The British pound lacks strong reasons for further growth, as supported by various reports and events. However, the wave analysis has become more complex, with wave 3 appearing more extended than anticipated by many analysts a couple of months ago. If the market finds new grounds for long-term purchases, the entire upward trend segment may take the form of a five-wave pattern.

For the British pound, the wave structure now appears simpler and more convincing than the euro. I expect the continuation of the downward wave, which started as predicted. Even if it is the fourth wave within an ascending set, it should be extensive or significantly three-wave in appearance. Three waves are already visible within it, and the current week's news background is crucial. Will the British pound find new reasons for growth?

The Bank of England must adopt a decisive stance. As the GBP/USD exchange rate remained unchanged on Monday with limited volatility, the market's behavior was understandable due to the lack of significant news background. However, this week, the Bank of England is expected to raise the interest rate by another 25 basis points. I doubt this will stimulate demand for the British pound again. Here's why:

Similar to the ECB and the Federal Reserve, the market has already anticipated the 25 basis point interest rate increase by the British regulator for several weeks. The Bank of England has no alternative but to continue tightening its policy. Therefore, I expect an increase in demand for the pound only if Andrew Bailey's rhetoric is notably hawkish or if the Bank of England explicitly signals its readiness to continue raising interest rates until the year's end, considering the high inflation levels.

However, if Bailey's rhetoric softens, hinting at a pause or expressing concerns about the impact of strict policies on the economy, the demand for the pound will continue to decrease. The turning point for the pound has yet to be reached. It may resume its upward trend within the fifth wave of the ascending segment, but strong news background support is required for this scenario. This week will determine whether the pound finds such support.

Overall Conclusions:

The wave pattern of the GBP/USD pair suggests a decline. While the attempt to break above the 1.3084 level was successful, my readers could initiate sales, as mentioned in my recent reviews. However, there is now a risk of completing the current downward wave if it turns out to be wave 4. In such a case, a new upward wave (wave 5) may emerge from the current levels. Although this scenario is not the most likely one, this week's strong news background does not necessarily have to favor the U.S. currency.

The pattern is similar to the EUR/USD pair on a larger wave scale, although some differences exist. The downward correctional trend segment is completed, and the construction of a new ascending segment is underway, which may either be already completed or eventually develop into a full-fledged five-wave pattern.