Analysis of macroeconomic reports:

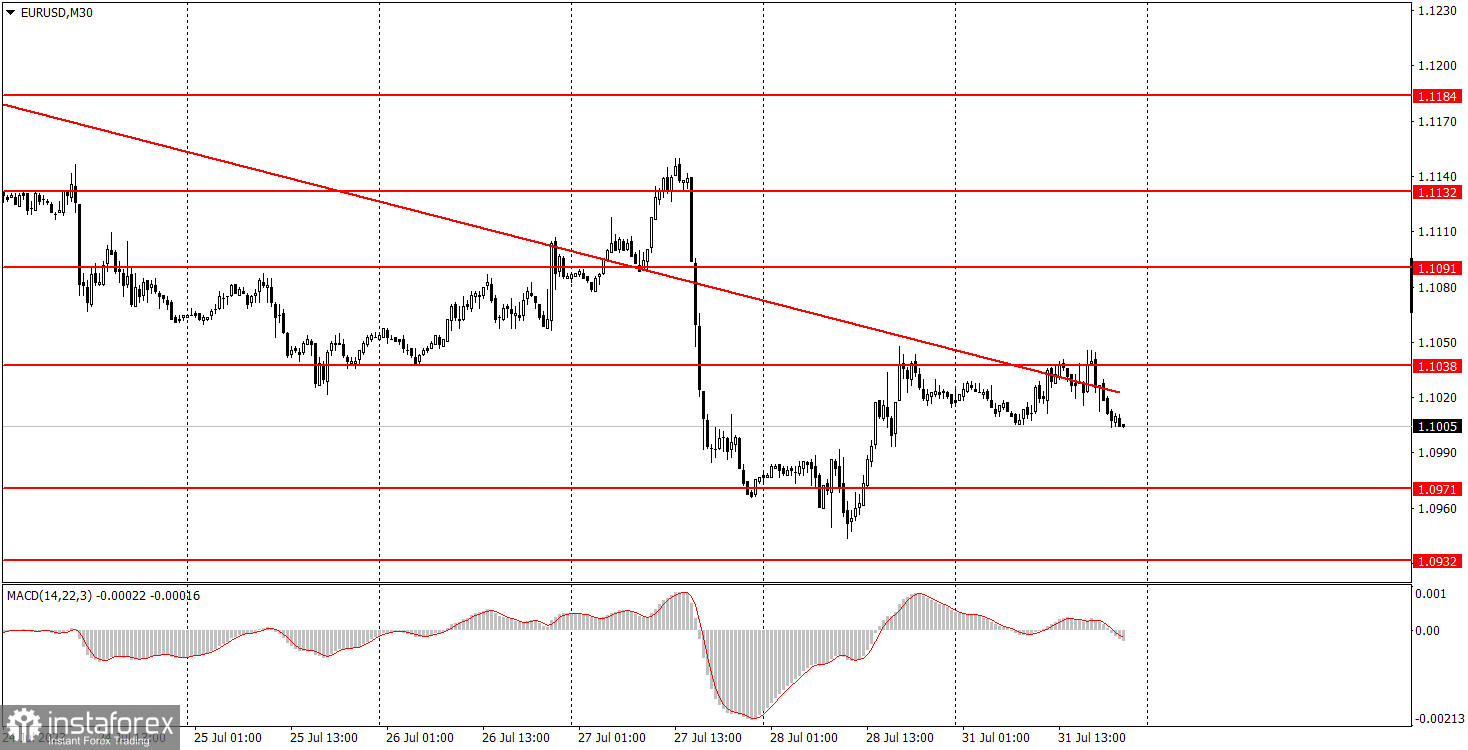

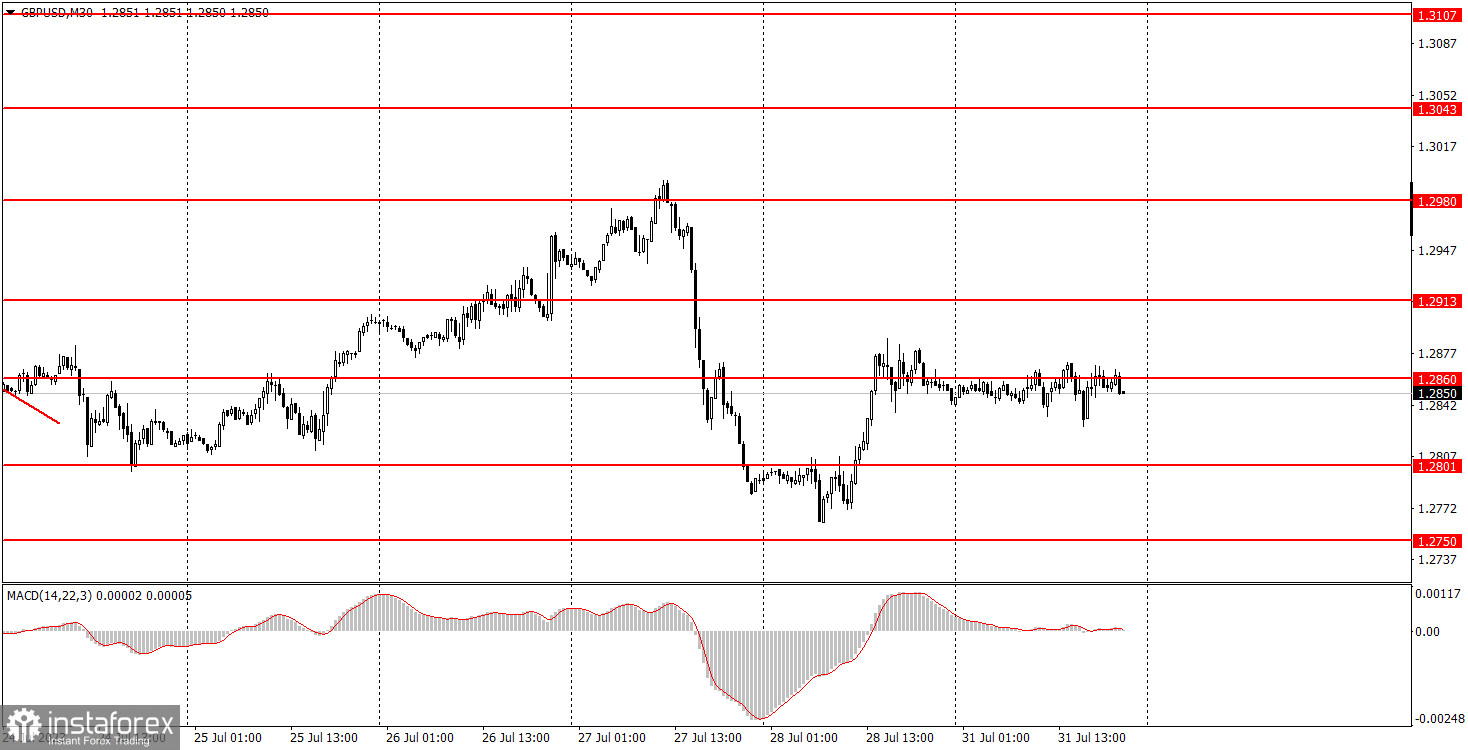

The new week kicked off with some interesting reports and a completely flat trend in both EUR/USD and GBP/USD. Tuesday is also shaping up to be quite an engaging day. It will begin with the release of reports from Germany concerning manufacturing sector business activity and unemployment. These reports of minor importance are unlikely to captivate traders much. The same applies to similar reports in the Eurozone, where the unemployment rate and the final estimate of the manufacturing sector business activity index for July will be published. As the market is already clear about the expected figures, the response is likely to be muted.

The most exciting developments are scheduled in the US. The ISM Manufacturing Business Activity Index is likely to come to the spotlight. There will also be a publication of the regular manufacturing business activity index's second estimate, but it will undoubtedly be overshadowed by the ISM index. There are no anticipations of a decline for this index for July. The JOLTS Job Openings report will also be released, and its forecasted value is lower than the previous one. However, what's crucial for us is how the actual figure will compare to the forecast. If it's higher, it's excellent news for the US dollar.

Analysis of fundamentals:

As for fundamental events, there's nothing to highlight for Monday. Throughout the week, several speeches from ECB and Fed representatives are scheduled, many of which are not even listed on the event calendar. However, several ECB officials already spoke on Friday, each providing valuable comments on the prospects of the key rate. Some of them confirmed the possibility of a pause in rate hikes in September.

Key takeaways:

On Monday, two significant reports were published in the US, while other releases were of minor importance. The euro may remain under pressure as the monetary rhetoric of ECB representatives weakens. As for the British pound, the situation is more complicated, as it's currently unclear how the Bank of England's stance will change following the July meeting.

Basic rules of a trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.