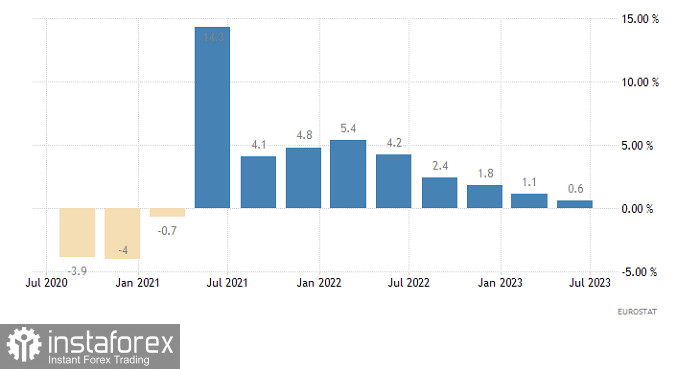

The latest inflation data in the eurozone exceeded expectations, slowing from 5.5% to 5.3%, instead of to 5.2%. This could convince the European Central Bank to continue raising interest rates, so euro started to rise yesterday, albeit at a modest pace. The slightly worse GDP data for the second quarter restrained the price growth, as the figure fell to 0.6%, from a revised first quarter data of 1.0%.

GDP data in the eurozone

Euro went down confidently, dropping below the value it started to trade. The reason may be the recent media reports saying that the recession in Europe will be even deeper than in 2008-2009.

Most likely, both euro and pound will continue to lose positions because unemployment in Europe could rise from 6.5% to 6.6%. This, along with the slowing economic growth, may convince many that the recession in Europe will be quite deep and protracted.

Unemployment level in the eurozone

Business activity data in the manufacturing sectors of both Europe and the US will not have any impact as they should only confirm preliminary estimates. If they differ from them, some adjustments will follow. Similarly, data on open vacancies in the US, although should decrease from 9.8 million to 9.500 million, will not indicate anything, as it has no direct connection with employment and unemployment levels.