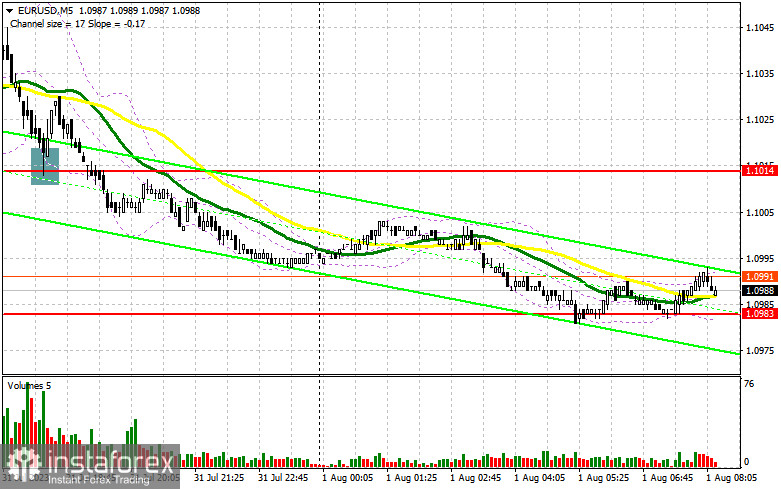

A sole entry signal came yesterday. Let's look at the 5-minute chart to get a picture of what happened. Previously, I considered entering the market from the level of 1.1042. An increase in value occurred in the first half of the day after the release of Q2 GDP data in the eurozone. However, the instrument still failed to reach the mark of 1.1042. After protecting the level of 1.1014 in the second half of the day, the pair showed growth of 15 pips, and the pressure of the instrument increased again.

When to open long positions on EUR/USD:

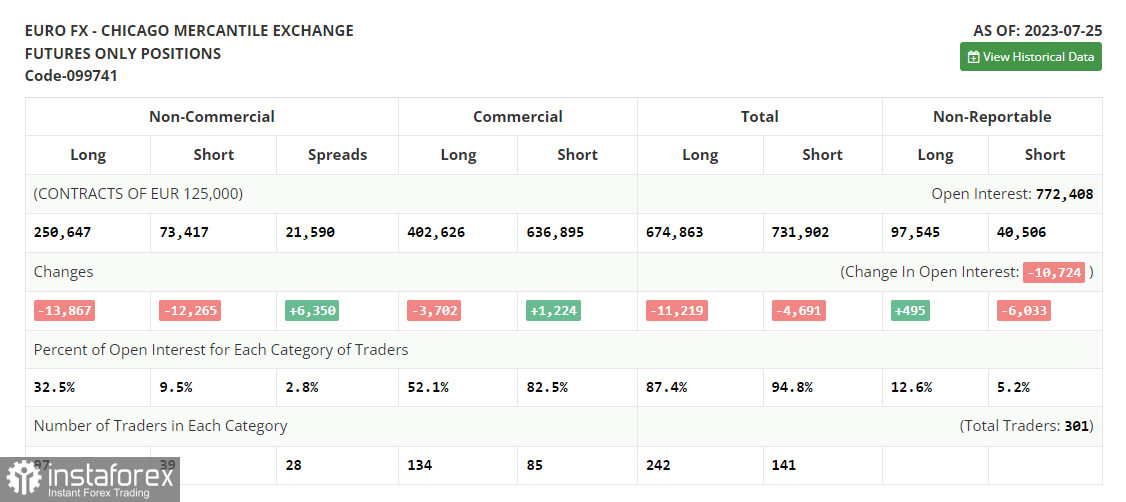

Before analyzing EUR/USD from the technical point of view, let's take a good look at the futures market and see how the Commitments of Traders have changed. The COT report of July 25th, logged a drop in long and short positions, a natural reaction to the meetings of the US Fed and the ECB. However, this particular report does not show how these events have affected the general picture. The decisions of the central banks came in line with economists' expectations, preserving the equilibrium state of the market. However, it was then broken by the macro data from the US, which revealed a strong economy in Q2. Anyway, despite a downward correction, a medium-term trading plan now remains to buy the euro on a fall. The COT report showed a decrease in the non-commercial long position by 13,867 to 250,647 and a drop in the non-commercial short position by 12,265 to 73,417. The gap between long and short positions increased by 6,350, providing support for EUR buyers. The close price fell to 1.1075 from 1.1300 a week earlier.

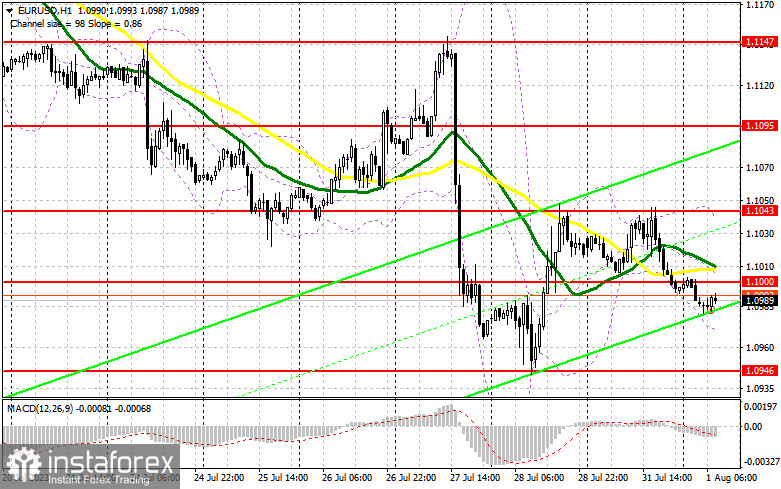

A row of macro releases is scheduled for today in the eurozone countries, including manufacturing business activity. Germany's and the eurozone's figures will draw investors' attention as they will be downwardly revised. That will likely trigger a sell-off in EUR/USD. Meanwhile, their unemployment statistics will hardly significantly affect the market. A decrease in the reading will drive the price to a weekly low of 1.0946. A false breakout there will generate a buy signal, resuming growth to intermediate resistance at 1.1000. The mark is in line with the bearish moving averages. A breakout and a test of this range to the downside will boost demand for the euro, with the price rising to 1.1043. The most distant target is seen at 1.1095. If quotes touch the level, a new uptrend will begin. I will also take profit there.

Suppose EUR/USD goes down and there are no buyers at 1.0946, the battle for the level of 1.1000 will be lost, and the bears will become more active aiming to begin a new downtrend. Therefore, only a false breakout at 1.0911 support will produce a buy signal. I will open long positions on a bounce from a low of 1.0871, allowing a bullish correction of 30-35 pips intraday.

When to open short positions on EUR/USD:

With the bears trading more actively, there is a likelihood of a downtrend, especially if macro data in the eurozone and Germany disappoints. The bears may count on resistance at 1.1000 formed yesterday. It is of primary importance to protect this level. Meanwhile, failed consolidation on the back of disappointing statistics may generate a sell signal, able to push EUR/USD to 1.0946. A lot depends on this mark because if the price returns below it, a row of stop orders will trigger. Consolidation below this range and its upside retes may push quotes to 1.0911. The most distant target stands at a low of 1.0871 where I will take profit. Should EUR/USD rise amid the absence of the bears at 1.1000 during the European session, the bulls will take the situation under control, and the instrument would be able to receover. I will open short positions at 1.1043 resistance if consolidation fails or on a bounce from a high of 1.1095, allowing a bearish correction of 30-35 pips.

Indicator signals:

Moving averages:

Trading is carried out below the 30-day and 50-day moving averages, which indicates a bearish continuation.

Note: The author considers the period and prices of moving averages on the 1-hour chart that differ from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

Support stands at 1.0970, in line with the lower Bollinger band. Resistance is seen near the upper Bollinger band at 1.1040.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.