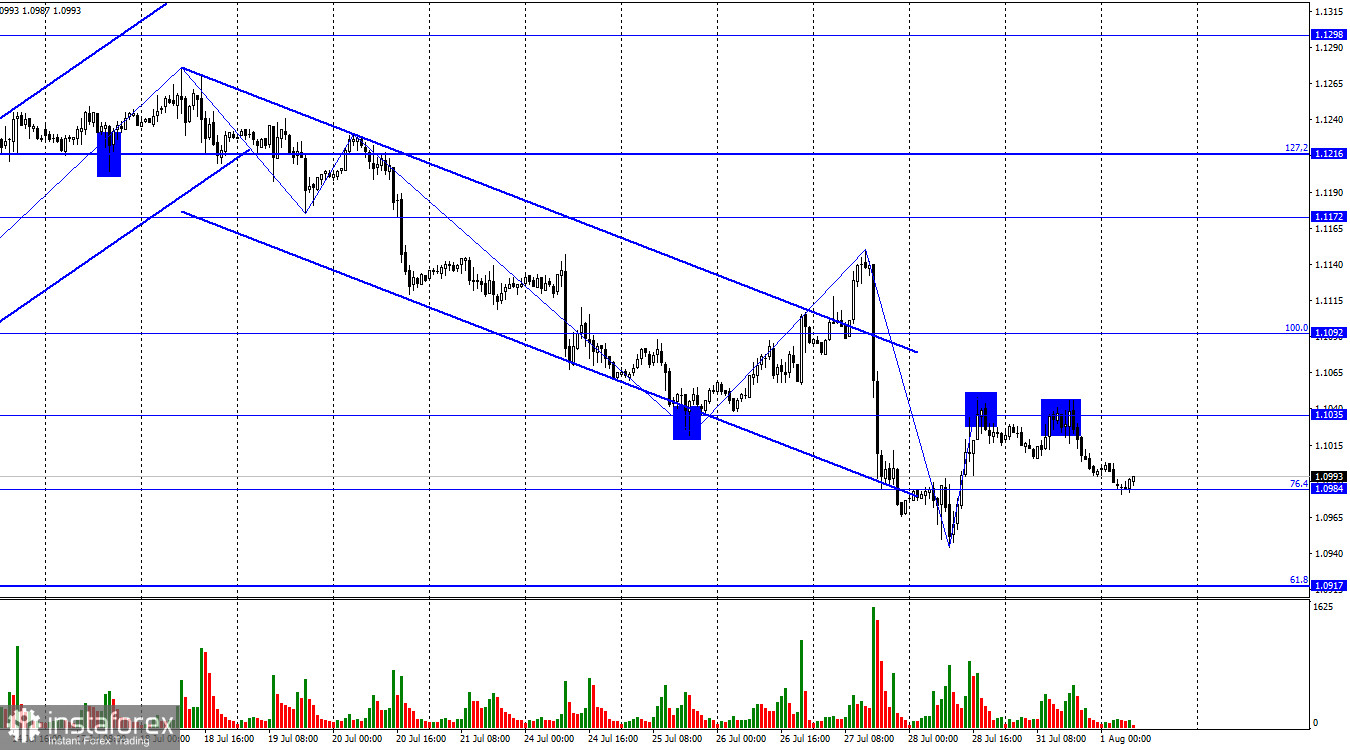

On Monday, the EUR/USD pair experienced a rebound from the 1.1035 level, which continues to act as a price "magnet." This led to a reversal in favor of the American currency, resulting in a decline toward the Fibonacci level of 76.4% (1.0984). A rebound of the pair's rate from this level would favor the European currency, propelling it back to the 1.1035 level. If the pair solidifies below the 1.0984 level, the probability of further decline toward the next corrective level of 61.8% (1.0917) will increase.

The waves continue to signal the same thing: the "bearish" trend persists, and there are no signs of its completion. The latest upward wave failed even to approach the previous peak. If the new downward wave fails to break the last low, we will have reasons to believe that the "bearish" trend has either concluded or paused.

Yesterday, the information background was simultaneously strong and weak. The Eurozone's GDP and inflation reports could have caused a 100-point movement if their values did not match traders' expectations. The second-quarter GDP grew by 0.3% q/q and 0.6% y/y. Inflation decreased from 5.5% y/y to 5.3% y/y, while core inflation remained at 5.5%. These figures are favorable for the euro. A growing GDP (even if weakly) gives the ECB an additional opportunity to raise rates. On the other hand, a slight and weak decrease in inflation provides the ECB with further justification for tightening policies.

Therefore, today we may witness a renewed rise in the European currency, and a breakout above yesterday's peak around the 1.1035 level would indicate the completion of the "bearish" trend. However, there will also be important American reports today which could support the bearish sentiment.

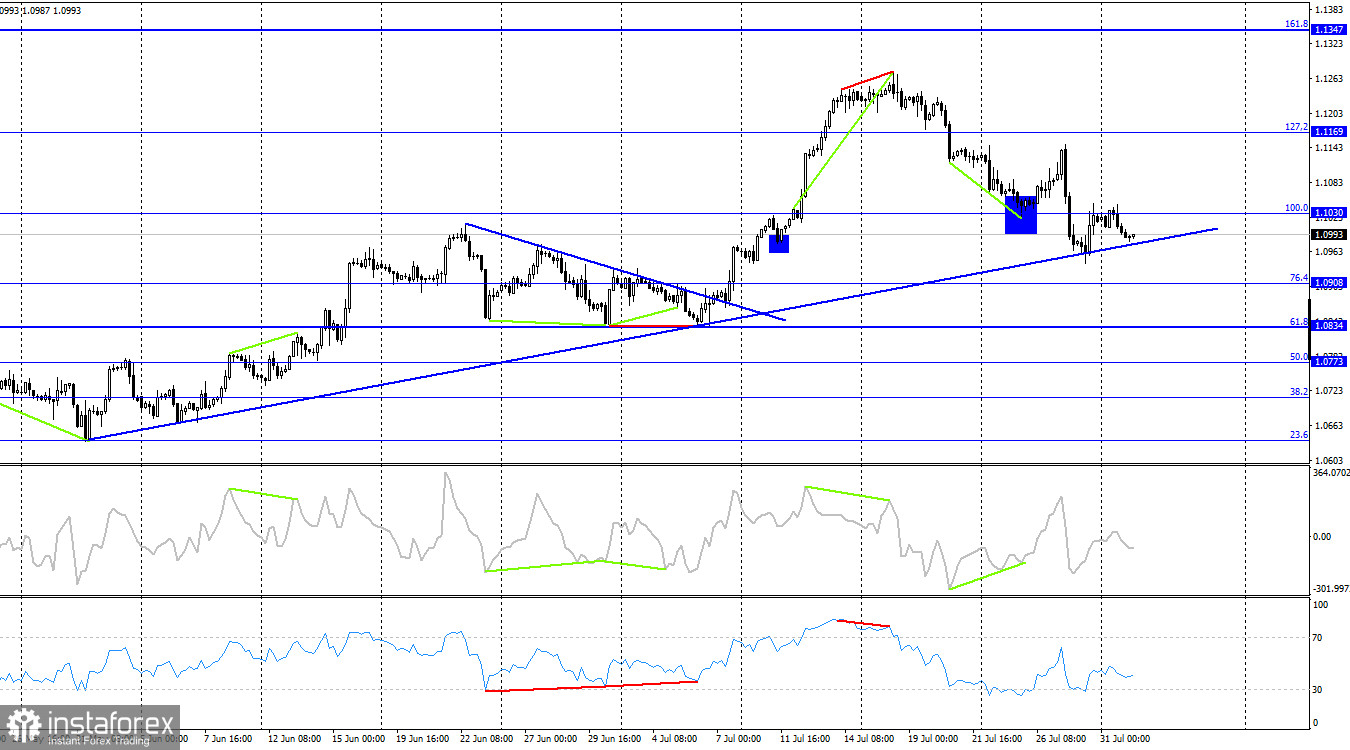

On the 4-hour chart, the pair returned to the ascending trendline. A new rebound from it might lead to some growth in the pair, but it failed to close above 100.0% (1.1030). A close below the trendline would support the continuation of the quote decline toward the Fibonacci level of 76.4% (1.0908). No emerging divergences are observed for any of the indicators today.

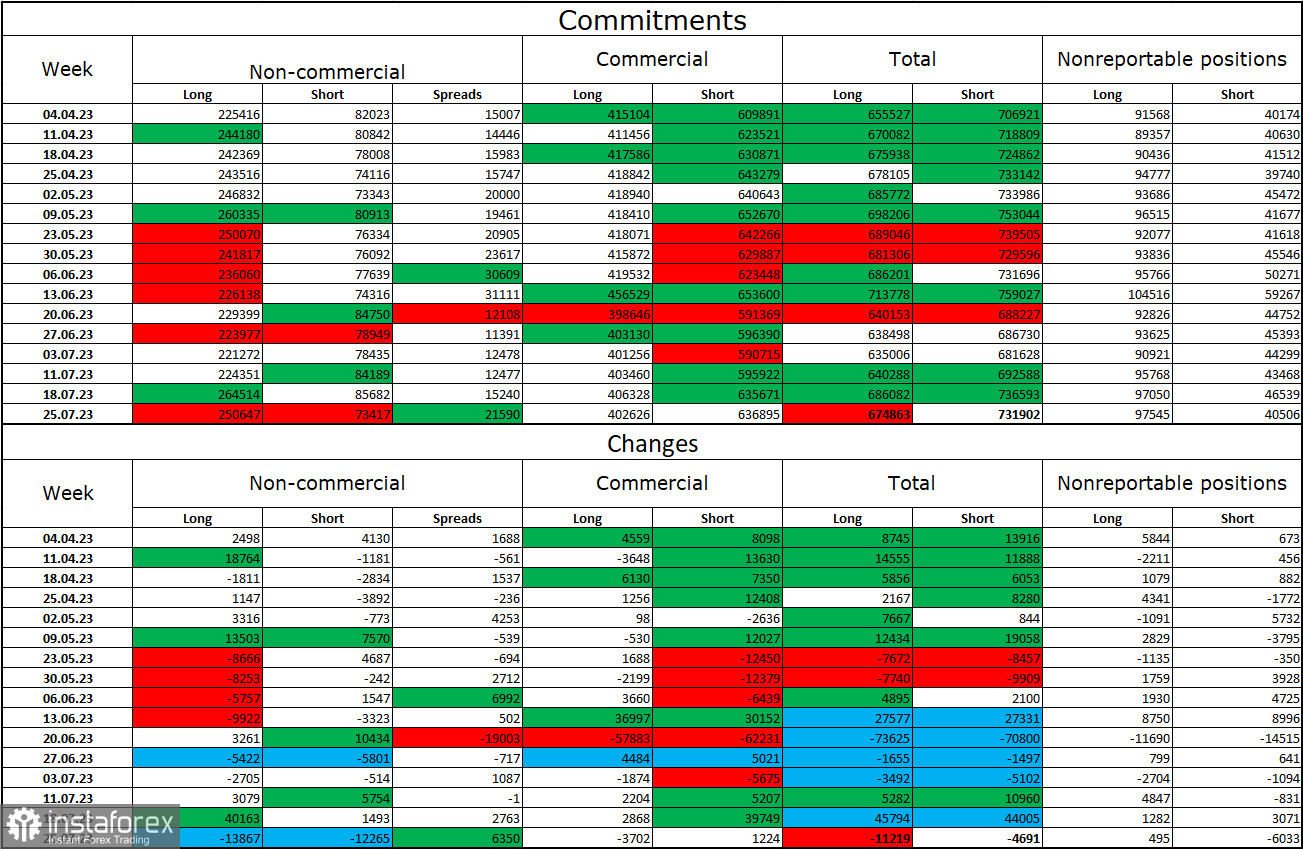

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 13,867 long contracts and 12,265 short contracts. Major traders maintain a "bullish" sentiment, which has only slightly weakened over the past week. The total number of long contracts speculators hold is 250,000, while short contracts stand at only 73,000. The bullish sentiment remains, but the situation will likely change in the opposite direction soon. The significant number of open long contracts suggests buyers might close them soon due to an overly strong bias toward bullish positions. The current figures indicate a potential decline in the euro currency in the coming weeks. The ECB's signals increasingly point to the upcoming end of the tightening policy.

News calendar for the US and the Eurozone:

- Eurozone - Germany's Manufacturing Purchasing Managers' Index (PMI) at 07:55 UTC.

- Eurozone - Germany's Unemployment Rate at 07:55 UTC.

- Eurozone - Manufacturing Purchasing Managers' Index (PMI) at 08:00 UTC.

- Eurozone - Unemployment Rate at 09:00 UTC.

- United States - Institute for Supply Management (ISM) Manufacturing Purchasing Managers' Index (PMI) at 14:00 UTC.

- United States - Job Openings and Labor Turnover Survey (JOLTS) at 14:00 UTC.

On August 1st, the economic events calendar features several significant entries, with two American reports being particularly noteworthy. The impact of the information background on traders' sentiment today may be of moderate strength.

Forecast for EUR/USD and trader recommendations:

I previously advised selling on a rebound from the 1.1035 level on the hourly chart, targeting 1.0984 and 1.0917. The first target has been reached, and the second can be expected if the price closes below 1.0984. Buying the pair is now possible on a rebound from the 1.0984 level on the hourly chart, with targets at 1.1035 and 1.1092.