EUR/USD

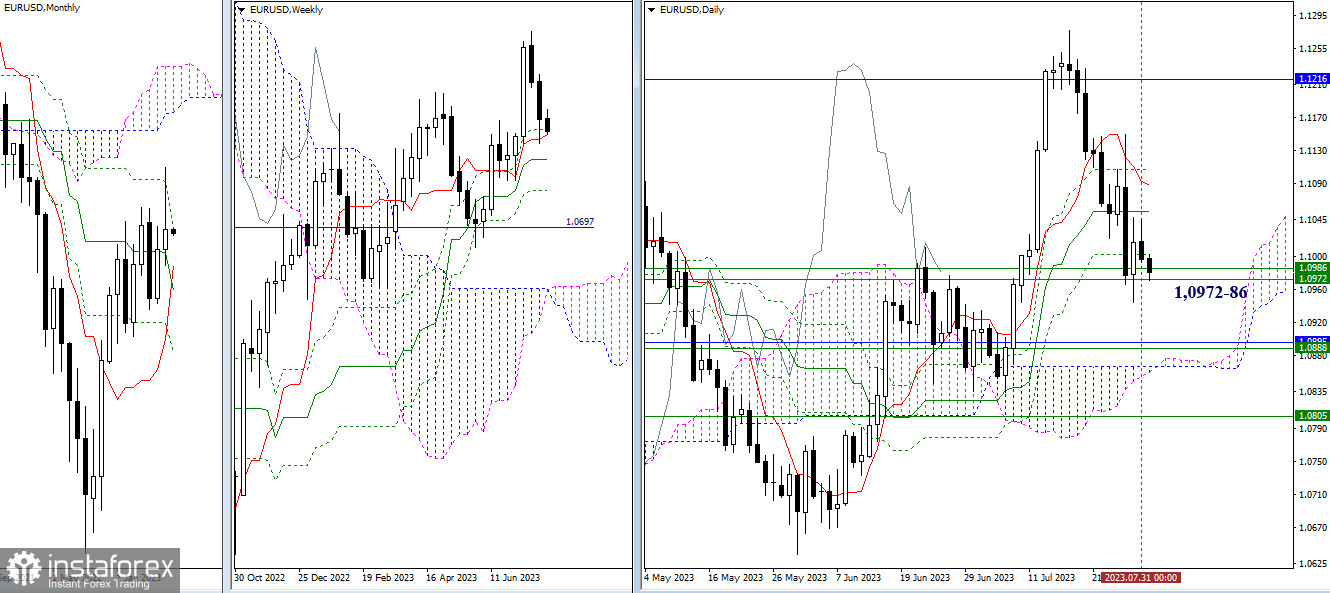

Higher timeframes

Today, the pair continues to test weekly supports (1.0972 – 1.0986). A break below these levels will pave the way towards the region of 1.0897-95 – 1.0866 (weekly and monthly medium-term trends + daily cloud). If a rebound is formed along the path of the bulls, the daily cross of Ichimoku will still present a zone of resistance (1.1055 – 1.1087 – 1.1107). The closing of July expressed doubt about a rapid and active bullish advance in the near future. Most likely, we can expect some uncertainty, consolidation, or further decline.

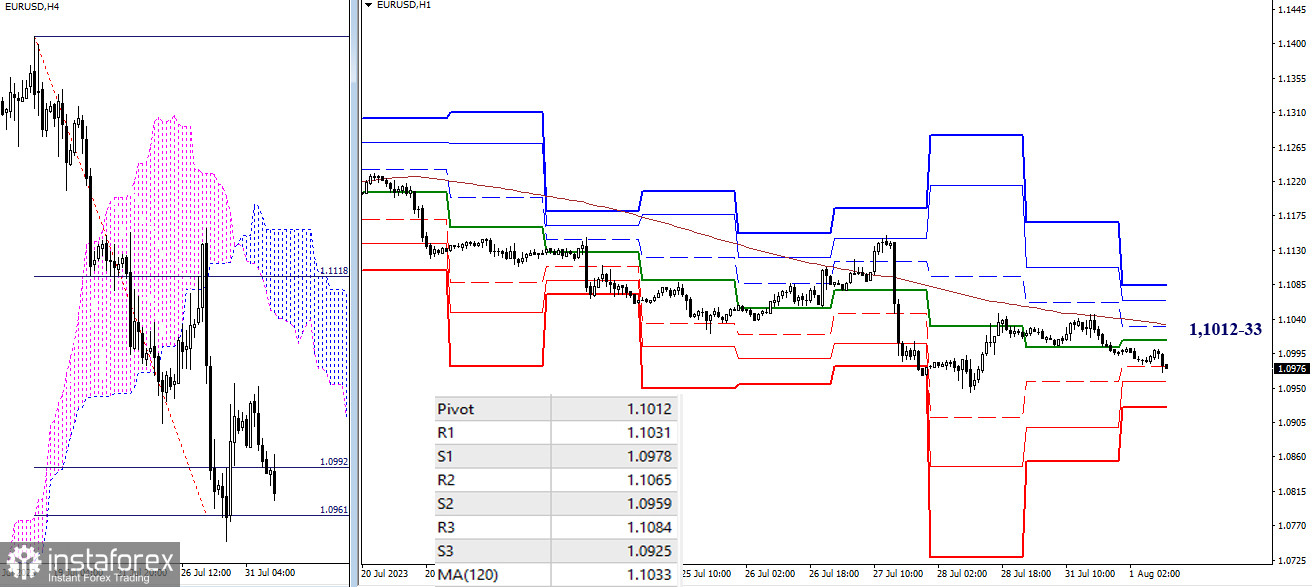

H4 – H1

At the moment, the main advantage belongs to the bears. The first support of the classic pivot points (1.0978) is being tested, then bears will be looking at 1.0959 (S2) and 1.0925 (S3). The key levels today are converging in the area of 1.1012–33 (central pivot point + weekly long-term trend). Additional bullish targets beyond that will be at 1.1065 (R2) – 1.1084 (R3).

***

GBP/USD

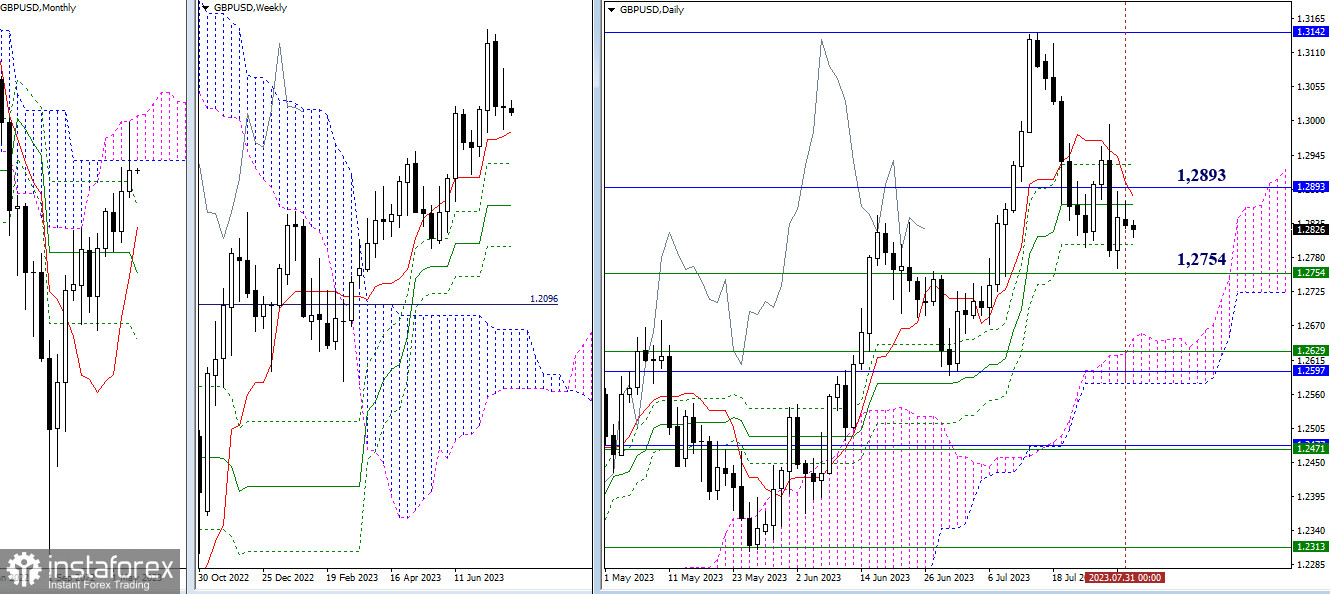

Higher timeframes

Yesterday's actions were not significant in scale, so there were no substantial changes. The upper monthly shadow at the closing of July signaled a rebound from the tested monthly cloud (1.2893 – 1.3142). This month, if bulls fail to reclaim the lower boundary of the monthly cloud (1.2893), which is currently strengthening daily levels (1.2866 – 1.2878 – 1.2931), and continue the ascent, then priorities may shift towards a downward development and strengthening of bearish sentiments. The crucial level for bears in this area is 1.2754 (weekly short-term trend), and the support zone is 1.2657 – 1.2629 – 1.2597 – 1.2577.

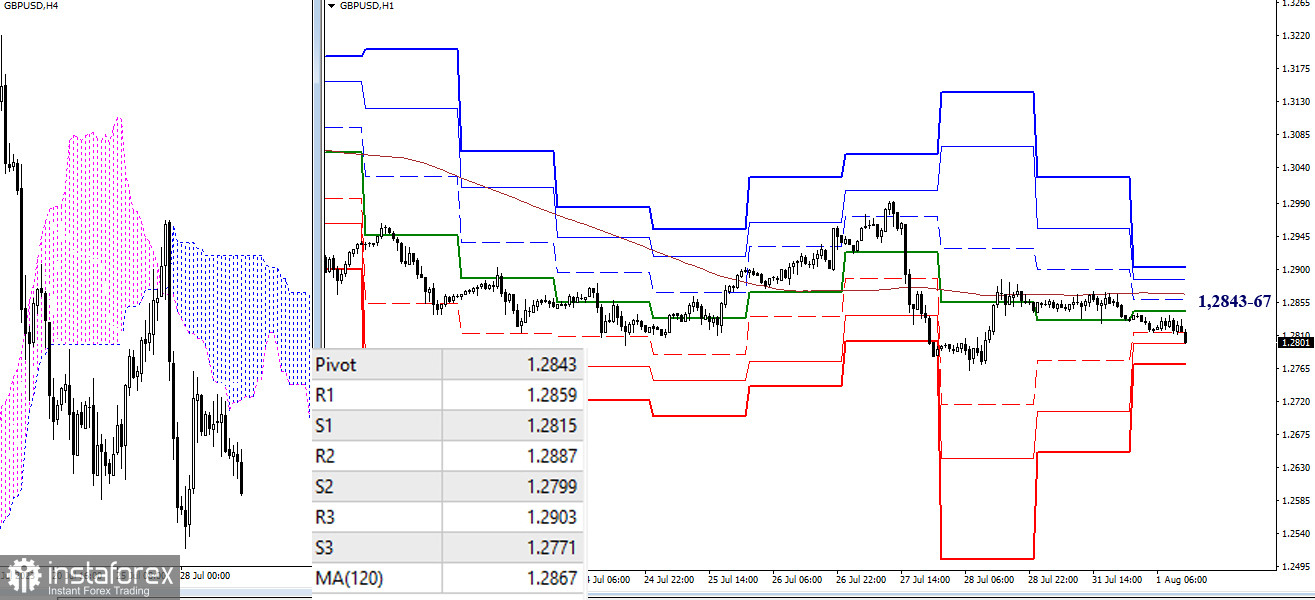

H4 – H1

The main advantage on lower timeframes is currently on the bears' side. In the case of further decline, the support levels of the classic pivot points (1.2799 – 1.2771) may come into play. The key levels today are converging in the area of 1.2843 – 1.2867 (central pivot point + weekly long-term trend). Consolidation above and a reversal of moving average can change the current balance of power.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)