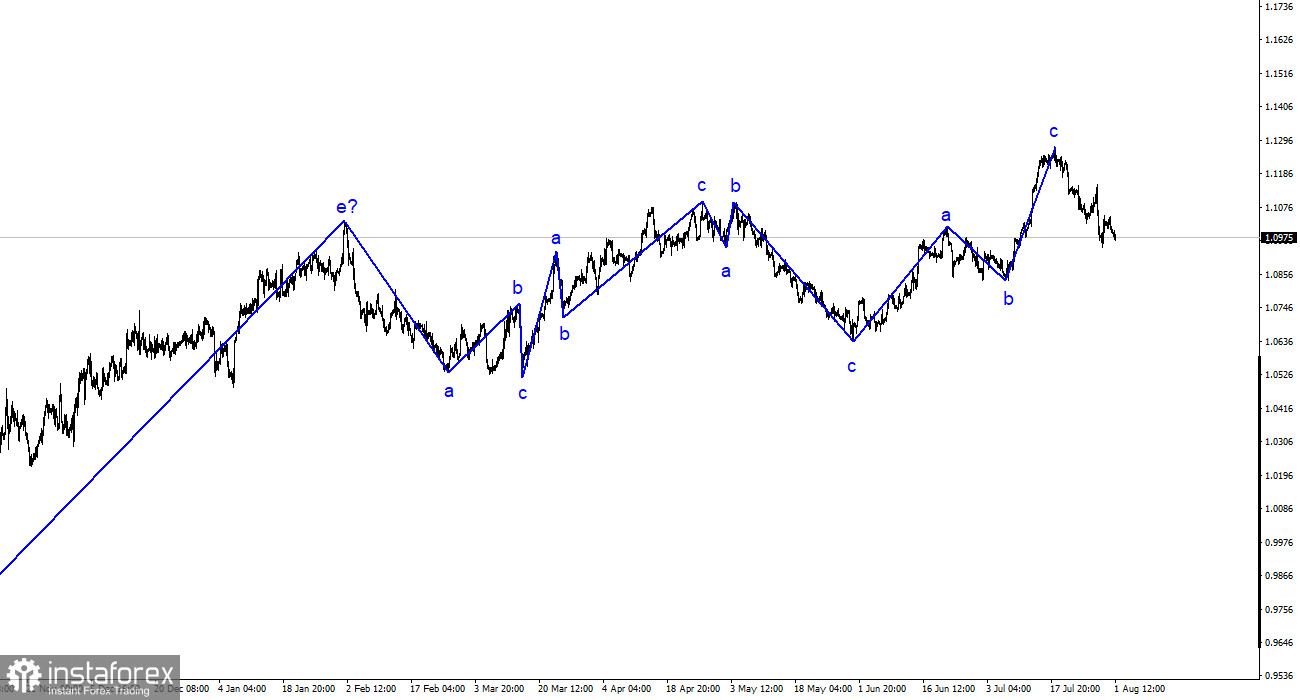

The wave analysis of the 4-hour chart for EUR/USD remains clear. The ascending trend, which began building last year, has become more complex, and over the last six months, we have observed three-wave structures alternating with each other. I have consistently mentioned my expectation of the pair being around the 1.5 figure, where the construction of the last ascending three-wave structure started. I stand by this analysis, believing another ascending three-wave structure has been completed, leading the market into a descending trend phase.

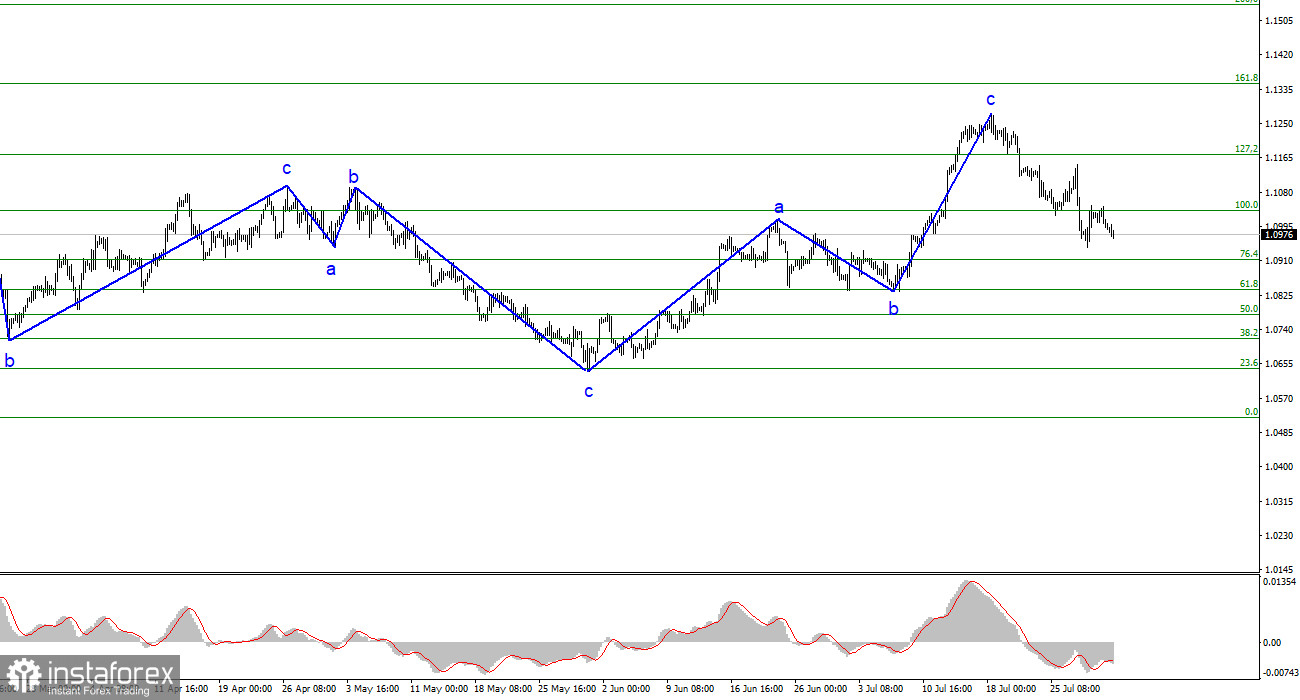

The trend section that started on May 31 could take a five-wave form with the structure a-b-c-d-e, but it is currently difficult to state this with certainty. The news background needs more strength to sustain stable demand for the euro, sometimes being outright weak, while the economic statistics from the European Union still need to be better. A successful attempt to break through the level of 1.1172, which corresponds to 127.2% on the Fibonacci, indicates the market's readiness to sell.

The unemployment rate in the EU has remained unchanged.

On Tuesday, the EUR/USD exchange rate declined by 30 basis points, and the movements were once again relatively low, with the news background having no significant impact on market sentiment. Reports released today have been limited to the European Union. The final estimate of the business activity index in the manufacturing sector for July was 42.7 points, decreasing by 0.7 points from the previous month. However, the June unemployment report brought positive news, as it did not increase even by a tenth of a percent, contrary to market expectations of a rise to 6.5-6.6%. Nonetheless, the absence of an increase in unemployment provides weak support for the euro. More importantly, business activity in the manufacturing sector continues to move away from the crucial 50.0 level. Hence, today's news background can be negative rather than positive. Nevertheless, it was not disastrous, justifying the euro's gradual decline.

The European currency will likely continue losing market support, not solely due to wave-related factors. The ECB may pause in September, signaling a softened monetary approach. The market is highly sensitive to such changes. The expectation of a much stronger interest rate increase by the ECB, given the significant gap between its rate, the Fed's rate, and the Bank of England's rate, paired with inflation far from the target mark, has caused disappointment. Consequently, the ECB's decision to slow the pace of rate hikes is a significant reason for reduced demand for the euro. This situation aligns with the necessity of building a descending wave structure.

In conclusion, based on the conducted analysis, the construction of the ascending wave structure is complete. I still consider the targets around 1.0500-1.0600 quite realistic and recommend selling the pair with these targets in mind. The a-b-c structure appears complete and convincing, and the close below the 1.1172 level indirectly confirms the construction of the descending trend section. Therefore, I recommend selling the instrument with targets around the 1.0836 level and below. I believe that the construction of the descending trend section will continue.

On a larger wave scale, the ascending trend's wave analysis has taken an extended form but is likely to be completed. We have observed five upward waves, likely constituting the structure a-b-c-d-e. Subsequently, the instrument has formed four three-wave structures: two downward and two upward. It is likely in the stage of constructing another descending three-wave structure.