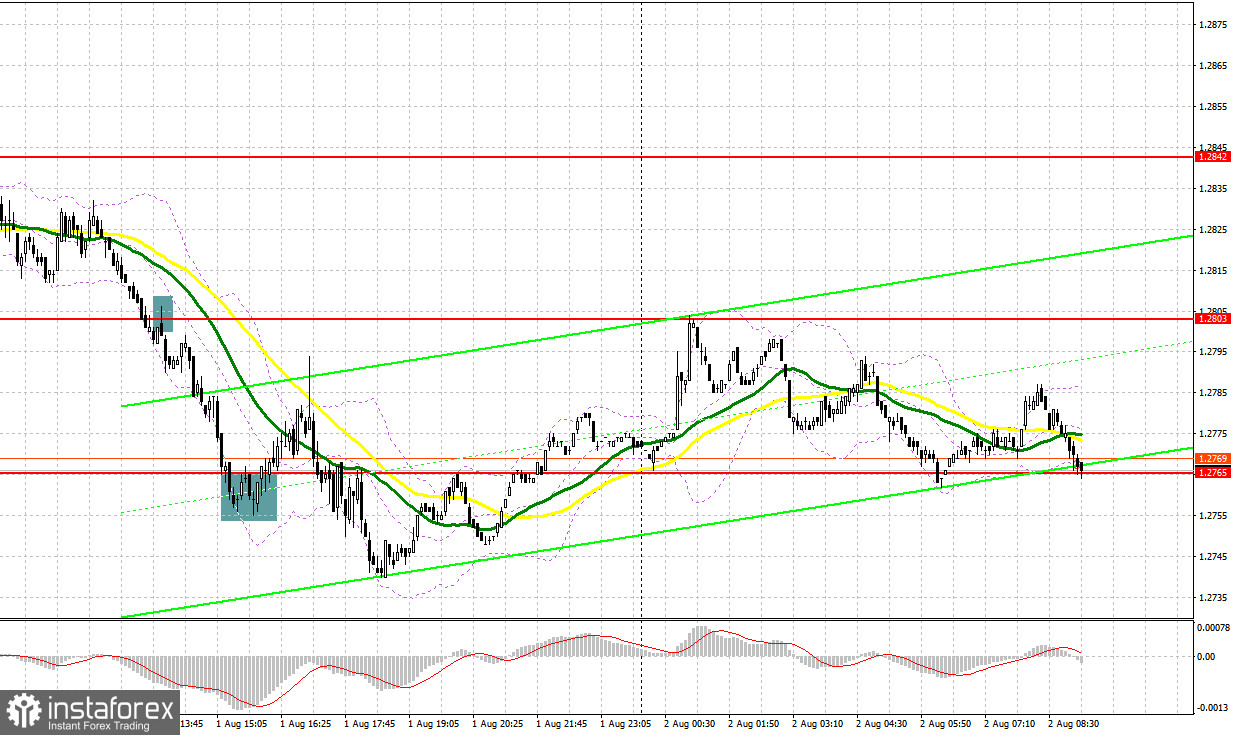

Yesterday, multiple market entry signals were generated. Let's examine the 5-minute chart and analyze the events. In my morning forecast, I highlighted the level of 1.2842 and suggested basing trading decisions on it. However, we have yet to reach that region, so we couldn't obtain favorable entry signals. In the latter part of the day, a breakthrough and a subsequent test at 1.2842 resulted in a selling signal, leading to a decline toward 1.2765. But if you missed that entry point, there was an excellent buying signal, around 1.2765. A false breakout at this level triggered a rise of over 30 points in the pound.

To open long positions on GBP/USD, the following conditions are necessary:

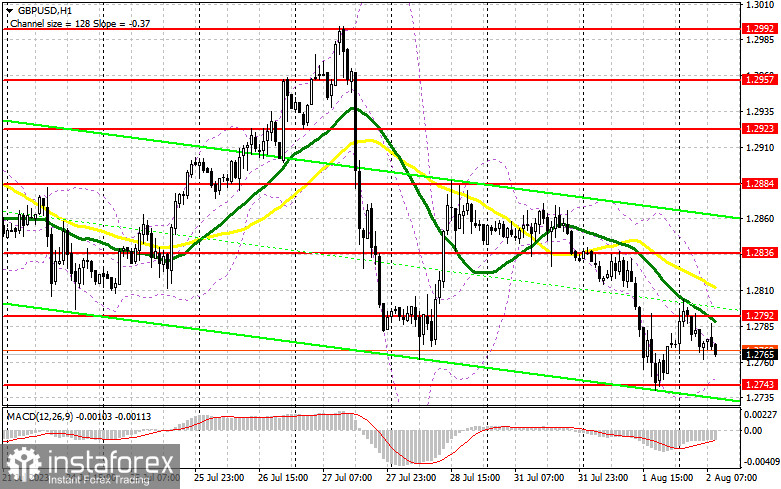

The fact that bears achieved a new low last week indicates a continuing downward trend for the pair. Today, buyers will face a challenging situation as there is no economic data from the UK, and the US labor market data scheduled for the second half of the day may increase pressure on GBP/USD. Hence, I will refrain from hasty purchases. Only after a decline and a false breakout around the weekly low at 1.2743 do I expect to find an entry point for long positions, leading to a surge toward the resistance level of 1.2792, formed from yesterday's movement. Additionally, there are moving averages that favor sellers in that area. A breakthrough and consolidation above this range will result in an ascending correction and an update of 1.2836. The ultimate target will be the resistance at 1.2884, where I recommend taking profits. If GBP/USD declines to 1.2743 and there are no buyers, pressure on the pound will persist. In that case, only the defense of the next area at 1.2711 and a false breakout at that level will signal an opportunity to open long positions. I plan to buy GBP/USD on the rebound from the last week's minimum at 1.2675, with a target of a 30-35 pip correction within the day.

To open short positions on GBP/USD, the following conditions are required:

Bears control the market, and as long as trading stays below 1.2792, further decline in the pair can be expected. It would be favorable to witness an unsuccessful consolidation above this range in the first half of the day, providing a selling signal with the prospect of returning to the weekly low at 1.2743. A breakthrough and a reverse test from the bottom to the top of this range will deal a more severe blow to buyers' positions, offering a chance for a more significant decline in GBP/USD towards 1.2711, where buyers become active. The ultimate target will be the minimum at 1.2675, where I will take profits. However, reaching this target may occur only in the second half of the day. In the scenario of GBP/USD growth and lack of activity at 1.2792, the situation in the pair will stabilize, and bulls will have a chance to build an ascending correction towards 1.2836. Only a false breakout at this level will provide an entry point for short positions. If there is no downward movement and no signal, I will sell the pound on the rebound from 1.2884, but only with the expectation of a downward correction of 30-35 pips within the day.

Indicator signals:

Moving averages.

Trading around the 30-day and 50-day moving averages indicates market uncertainty.

Note: The author considers the period and prices of the moving averages on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline, the lower boundary of the indicator, around 1.2743, will provide support.

Description of indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence) - Fast EMA period 12, Slow EMA period 26, SMA period 9.

• Bollinger Bands (Bollinger Bands). Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and subject to specific requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.