The EUR/USD currency pair continued its downward trend on Wednesday. The only noteworthy report of the day was the ADP employment report in the USA, which could have supported the dollar. In July, the number of private sector jobs created was 324,000, surpassing the forecast of 189,000. However, it's important to note that the market rarely pays significant attention to this report, giving more preference to nonfarm payrolls. Additionally, it's worth considering that the Nonfarm Payrolls and ADP figures seldom align. It's not just about the numbers but also the nature of the values and trends. A positive ADP report doesn't necessarily mean the Nonfarm Payrolls will also please traders.

As a result, this report only partially influenced yesterday's rise in the American currency. The US currency has been continuously rising for several weeks, which is reasonable given its previous 10-month growth. The last two trading days of the week will be filled with important fundamental and macroeconomic events, indicating potential strong movements in the market. From a technical standpoint, bearish positions currently outweigh bullish positions, and this conclusion doesn't necessarily rely on fundamental reasons alone. The ECB has shown signs of readiness to pause the tightening policy, and such pauses typically signal the end of the rate-hiking cycle.

Hence, one of the few factors supporting the euro is gradually diminishing. Our targets remain the same in the medium term - a decline to the 5–6 levels.

Nonfarm Payrolls will have little impact. Let's recall how many times experts have predicted economic troubles for the American economy in the past year, claiming that unemployment would rise and the labor market would suffer significant losses. Yet, practically all Nonfarm Payroll reports in the last 12 months were better than forecast, or at least not worse. The dollar continued to weaken throughout this time, even when the Federal Reserve's interest rate was consistently rising, and the most crucial macroeconomic indicators were much stronger in the USA than in the EU or the UK. In other words, the poor macroeconomic and fundamental background did not deter the market from buying the euro currency.

Thus, if the market sentiment has turned "bearish," as we believe, the weak data from the USA will not be significant. We are still facing a situation where the market oddly interprets macroeconomic statistics. In the short term, we might witness a decline in the US dollar as occasional upward corrections are expected. However, we anticipate further strengthening the American currency in the medium term.

Therefore, Friday's statistics might create market turbulence, similar to today's Bank of England meeting. However, the fundamental factors or traders' sentiments will likely stay the same due to this data. We may see an upward correction, followed by a resumption of the pair's decline. If, by some miracle, an upward trend is restored, it will be illogical and short-lived.

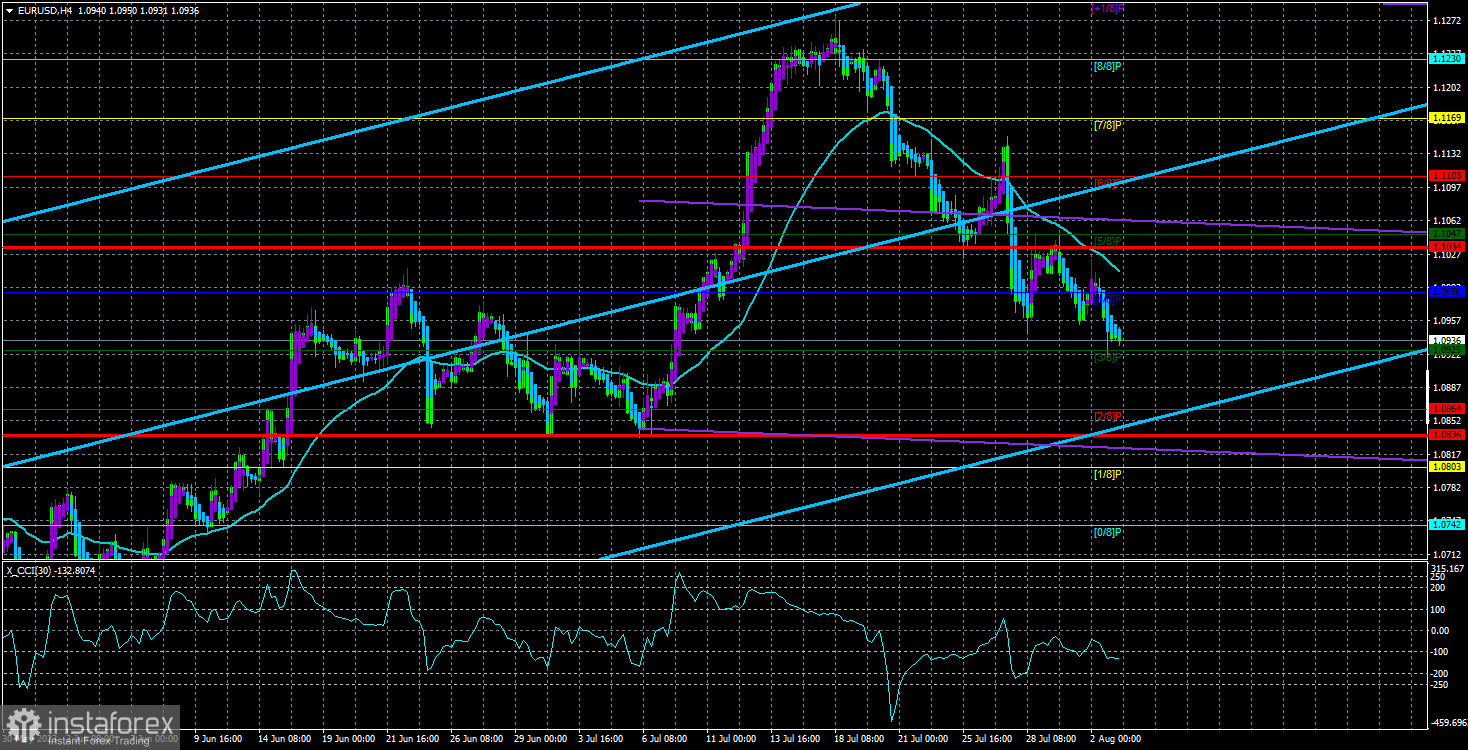

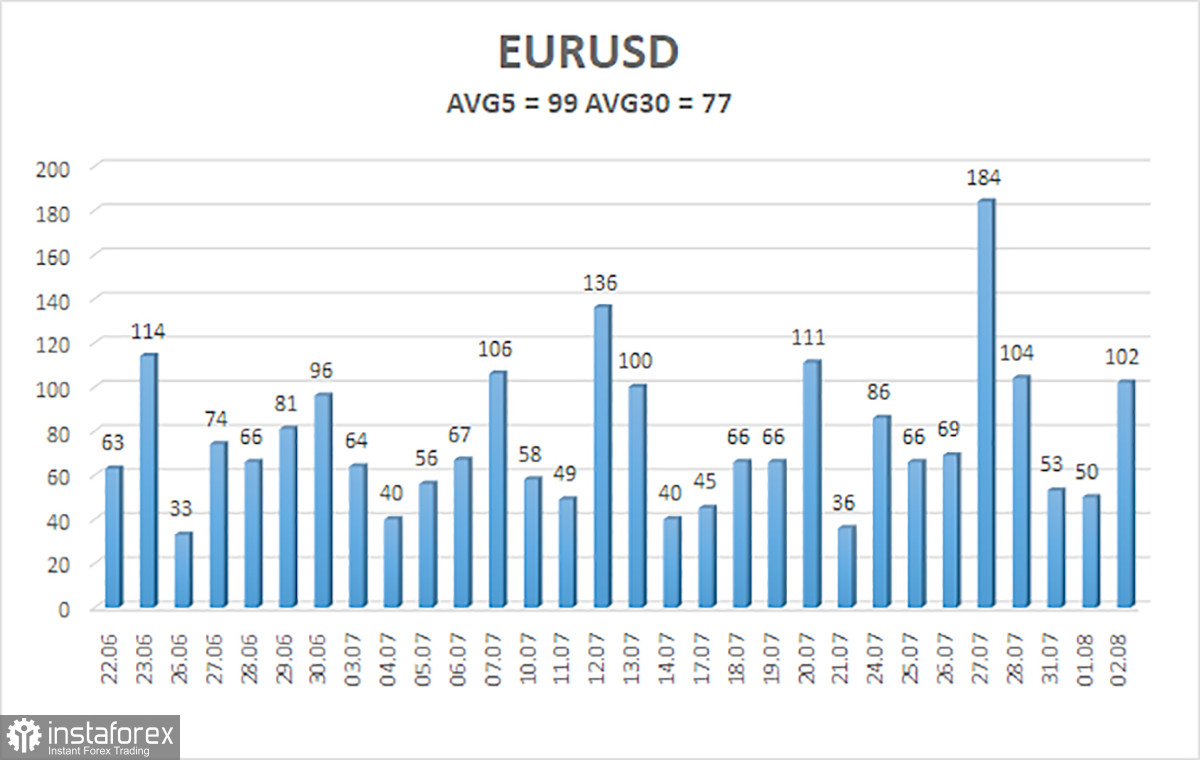

As of August 3rd, the average volatility of the euro/dollar currency pair over the last five trading days stood at 99 points, categorized as "average." However, this level of volatility is still influenced by the trading that occurred on the previous Thursday (184 points). As a result, we expect the pair to move between the levels of 1.0836 and 1.1034 on Thursday. A reversal of the Heiken Ashi indicator upwards will indicate a new phase of the corrective movement.

Nearest support levels:

S1 - 1.0925

S2 - 1.0864

S3 - 1.0803

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1047

R3 - 1.1108

Trading recommendations:

The EUR/USD pair remains below the moving average. It is recommended to maintain short positions, targeting 1.0864 and 1.0836, until the Heiken Ashi indicator reverses its upward trend. Long positions will only be appropriate if the price establishes itself above the moving average, aiming for 1.1047 and 1.1108.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel in which the pair will trade in the next 24 hours, based on current volatility indicators.

CCI Indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an upcoming trend reversal in the opposite direction.