Tips for trading BTC

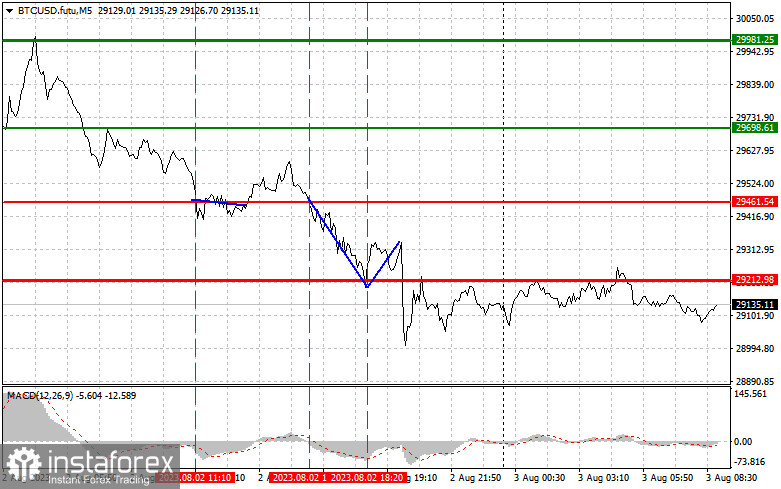

The price tested $29,461 while the MACD indicator was in the negative zone, confirming the selling point for Bitcoin. However, the significant drop did not happen immediately. Only the second similar test at $29,461 in the afternoon resulted in another selling point, leading to a downward movement to $29,212. Buying during the bounce from this price also proved successful.

The fact that Bitcoin is once again trading below $29,500 indicates a high likelihood of further decline. All of this occurs within a downward correction, making it more appealing to investors as the cryptocurrency's value decreases. As for interesting news, the SEC's attempts to regulate the crypto industry continue. It was recently announced that the US government initiated an investigation into the investment company BlackRock, which recently filed an application to launch a Bitcoin ETF. The company's management is suspected of excessive investment in the Chinese economy, which undermines the American economy.

Considering the limited chances of further growth for Bitcoin buyers, today's actions will mostly rely on scenario 1 for selling, but buying should not be overlooked either.

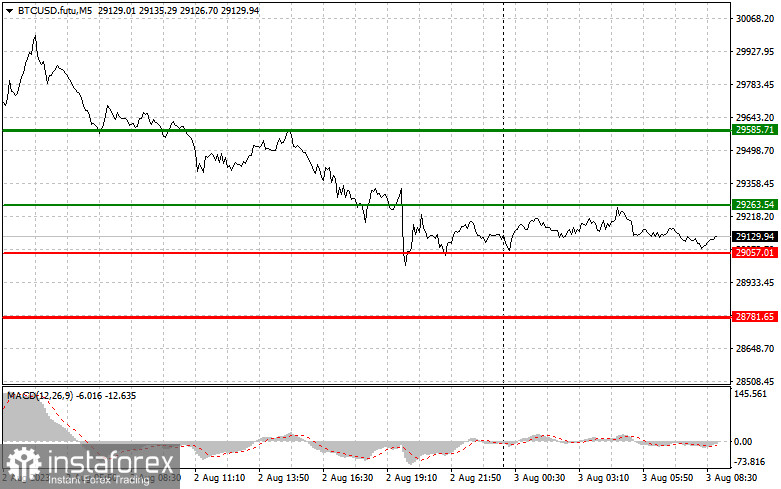

Buy signal:

Scenario 1: You can buy Bitcoin when it reaches the entry point near $29,263 (green line on the chart) with the target of reaching $29,585 (thicker green line on the chart). Once it reaches $29,585, it is better to close long positions and open short positions. We may expect strong Bitcoin growth after regaining control over $29,500. Important! Before buying, make sure the MACD indicator is above zero.

Scenario 2: Today, you can also buy Bitcoin in case of two consecutive price tests at $29,050. This will limit the downward potential of the trading instrument and lead to a reverse market turnaround upwards. One can also expect a rise towards the opposite levels of $29,260 and $29,585.

Sell signal:

Scenario 1: Selling Bitcoin is possible today only after the price level drops below $29,057 (red line on the chart), resulting in a rapid decline of the trading instrument. The key target for sellers will be $28,780, where one can close short positions and open long ones. Pressure on Bitcoin could return at any moment, so it is better to stick to selling BTC. Important! Before selling, make sure the MACD indicator is below zero.

Scenario 2: Today, you can also sell Bitcoin in case of two consecutive price tests at $29,263. This will limit the upward potential of the trading instrument and lead to a reverse market turnaround downwards. We can also expect a drop towards the opposite levels of $29,057 and $28,780.

On the chart:

Thin green line - entry price for buying the trading instrument.

Thicker green line - estimated price for setting take profit orders or independently fixing profits, as further growth above this level is unlikely.

Thin red line - entry price for selling the trading instrument.

Thicker red line - estimated price for setting take profit orders or independently fixing profits, as further decline below this level is unlikely.

MACD Indicator. When entering the market, pay attention to overbought and oversold zones.

Important! Beginner traders in the cryptocurrency market should be extremely cautious when making entry decisions. Before important fundamental reports are released, it is better to stay out of the market to avoid sudden price fluctuations. If you decide to trade during news releases, always use stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you don't use proper money management and trade with large volumes.

Remember that you need a clear trading plan, similar to the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for day traders.