Tips for trading ETH

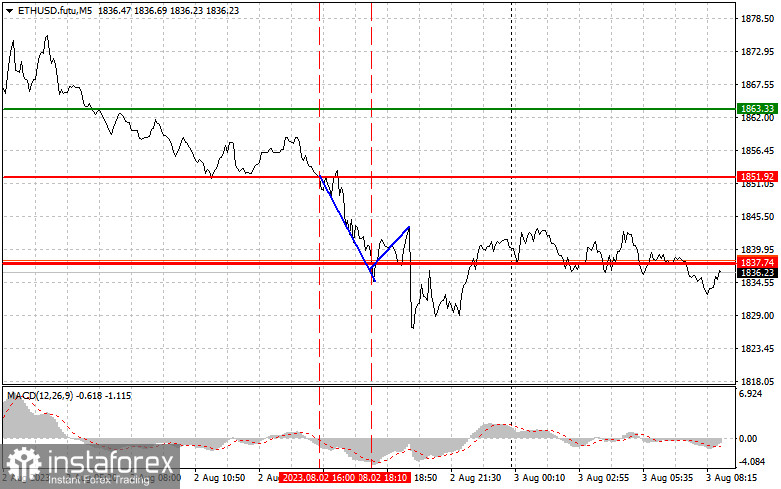

A test of 1,851 occurred at a time when the MACD indicator was in the negative zone, which was a confirmation of the correct entry point into short positions. As a result, ETH reached the support level of 1,837 where I recommended opening long positions on the decline. A fall in Ether will hardly undermine a bullish bias. The return to 1,815, the support level located at the lower border of the sideways channel from June 27 is not a good sign. A breakout of this range will force bulls to close Stop Loss orders. This is the main goal of sellers now. Be careful at this level. The lower Ether declines, the more attractive it becomes, especially at the lower border of the sideways channel. For this reason, I am going to trade today according to scenario No. 1.

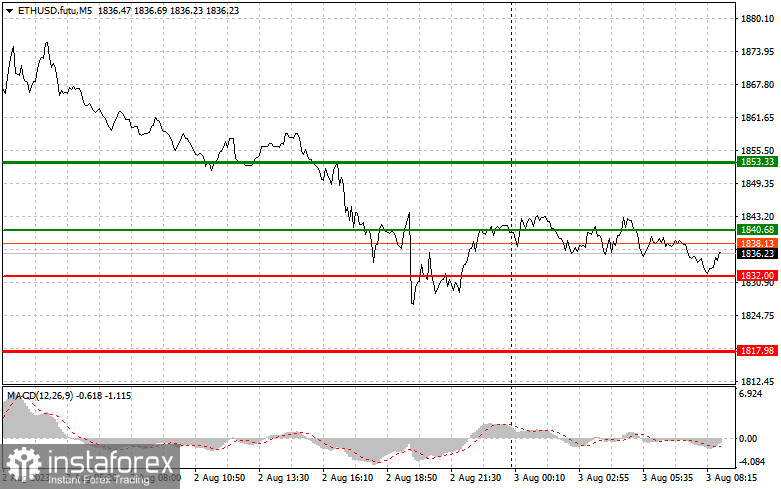

A fall in Ether will hardly undermine a bullish bias. The return to 1,815, the support level located at the lower border of the sideways channel from June 27 is not a good sign. A breakout of this range will force bulls to close Stop Loss orders. This is the main goal of sellers now. Be careful at this level. The lower Ether declines, the more attractive it becomes, especially at the lower border of the sideways channel. For this reason, I am going to trade today according to scenario No. 1.

Buy signal

Scenario No.1: you can buy ETH today when the price reaches $1,840 (the green line on the chart) with the prospect of a rise to $1,853 (thicker green line on the chart). At $1,853, I recommend closing long positions and opening short ones in the opposite direction. Ether is likely to advance if it grows above intraday highs.

amid the start of a bull market. Important! Before buying, make sure that the MACD indicator is above the zero mark and it has just started to climb from it.

Scenario No.2: you can also go long today in the case of two consecutive tests of $1,832 at a time when the MACD indicator will be in the oversold area. This will limit the downward potential of the trading instrument and could lead to a market reversal. It may advance to the levels of $1,840 and $1,853.

Sell signal

Scenario No. 1: it is possible to sell Ether today only if the price touches $1,832 (the red line on the chart), which may lead to a rapid decline. The key level is located at $1,817 where I recommend exiting sales as well as opening long positions in the opposite direction. The pressure on Ether will increase after if it beaks through $1,815 - the lower border of the sideways channel. Important! Before selling, make sure that the MACD indicator is below the zero mark and it has just started to dip from it.

Scenario No. 2: you can also sell ETH today in the case of two consecutive tests of $1,840 at a time when the MACD indicator will be in the overbought area. This will limit the upward potential of the trading instrument and lead to a market reversal. The instrument is projected to slide to the levels of $1,832 and $1,817. What's on chart:

What's on chart:

The thin green line is the entry point where you can buy a trading instrument;

The thick green line is the estimated price where you can place a Take Profit order or lock in profits manually as ETH is unlikely to rise above this level;

The thin red line is the entry point where you can sell the trading instrument ;

The thick red line is the estimated price where you can place a Take Profit order or lock in profits manually as the price is unlikely to decline below this level;

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions when entering the market. Before the release of important fundamental reports, it is better to stay out of the market to avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place Stop Loss orders to minimize losses. Without placing Stop Loss orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes. Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Relying on spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.