What does the future of Bitcoin depend on? Is it influenced by the macroeconomic background or the return of major players to the crypto market? A series of scandals in 2022-2023 has dampened the enthusiasm of institutional investors to put money into tokens, leading to a decrease in volatility and trading volumes. Digital assets have become unappealing, and the decline in BTC/USD quotes seems inevitable. However, the correlation between Bitcoin and American stock indices suggests that the cryptocurrency sector leader has stopped reacting to global economic events. Is this really the case?

Currently, the volatility of Bitcoin quotes is only about half of that of the Nasdaq 100. Volatility is the lifeblood of traders, and its decrease prompts players to exit the market and seek opportunities elsewhere. Indeed, monthly spot trading volumes of BTC/USD have dropped to the lowest levels since November 2020, and the volatility of the cryptocurrency sector leader is lower than that of the S&P 500, gold, not to mention technology company stocks. This is a rare occurrence.

Bitcoin Trading Volumes Dynamics

One of the main reasons for the decline in trading volumes and volatility is the exodus of major players from the crypto market due to bankruptcies, scandals, and tightening regulations by the Securities and Exchange Commission (SEC). Approval from the SEC for specialized exchange-traded funds with Bitcoin as the underlying asset could change the situation, but the regulator has plenty of time to make a decision. This circumstance allows crypto assets to remain in a dormant state.

Awakening it will be extremely difficult, especially in the face of events affecting U.S. stocks and bonds. The U.S. debt market is experiencing a rapid rise in yields amid Fitch's decision to downgrade the credit rating of the United States, the Treasury Department's announcement of issuing $103 billion in long-term bonds per week, and positive macroeconomic statistics. Bitcoin has been sensitive to the dynamics of Treasury bond yields before, which allowed speculation about its status as a risky asset.

Bitcoin and U.S. Bond Yields Dynamics

If the crypto market's connections to the global economy are restored, the future of BTC/USD will be in the hands of the Federal Reserve. Continuation of the monetary tightening cycle will lead the United States into a recession, which is highly undesirable for risky assets. Conversely, the end of the rate hike process for federal funds, a soft landing, and a Goldilocks regime where stable GDP growth accompanies a slowdown in inflation will allow the S&P 500 to quickly recover lost positions and create a tailwind for Bitcoin and its peers.

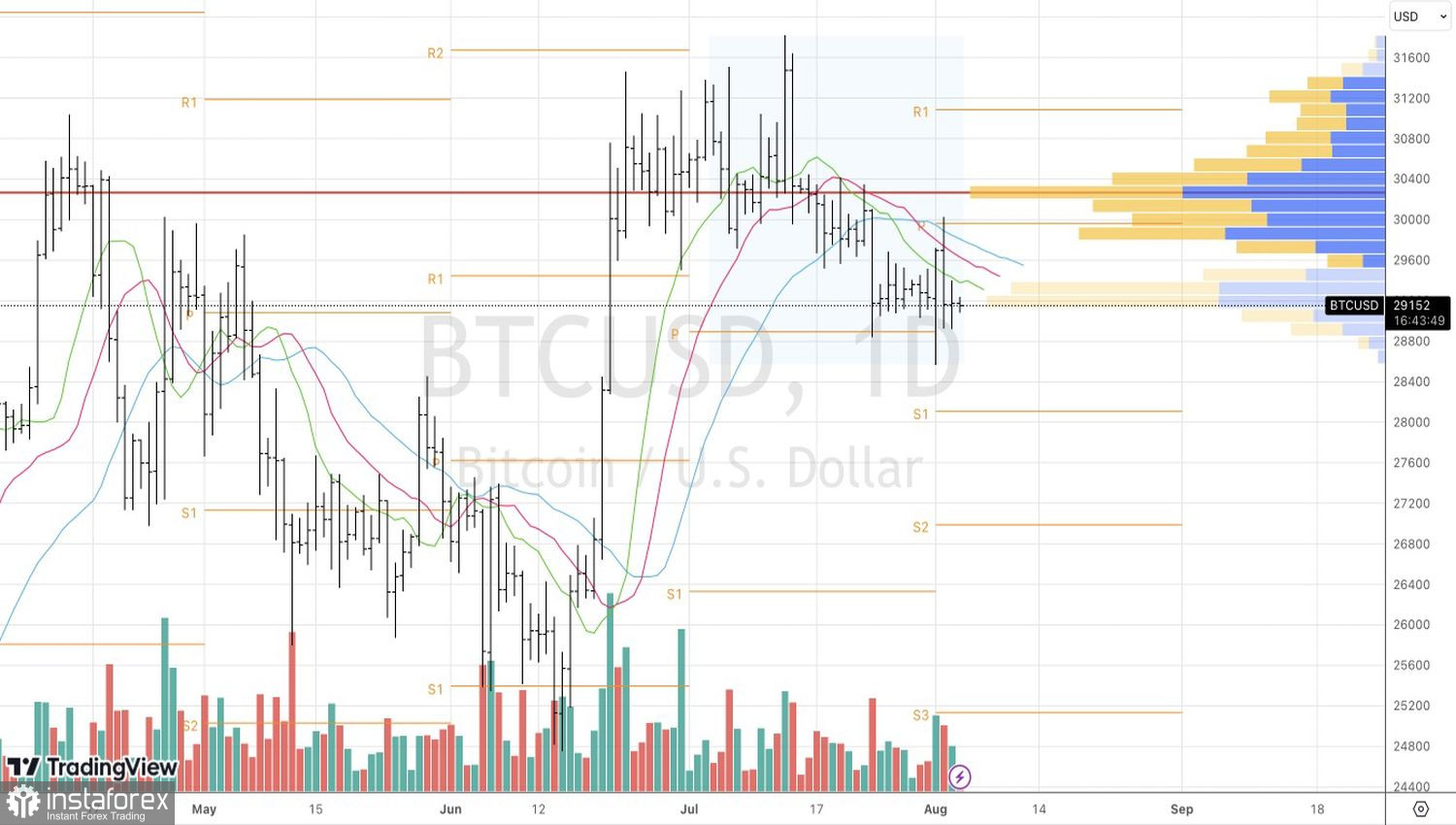

Technically, on the daily chart of BTC/USD, the cryptocurrency is below the fair value at 30,300, moving averages, and the important pivot level at 29,450. Bears clearly dominate the market, and a decline in Bitcoin quotes below the support level at 28,900 will increase the risk of further decline and provide a basis for increasing previously formed shorts.