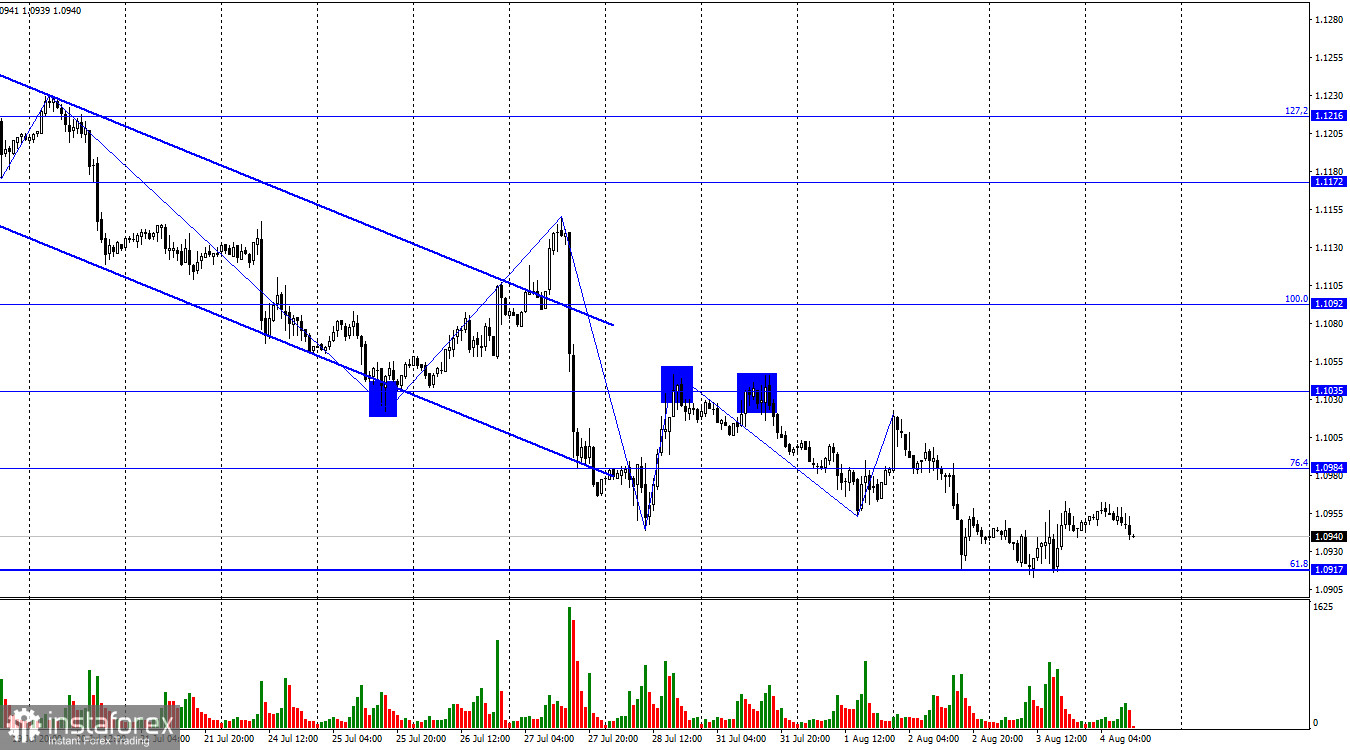

On Thursday, the EUR/USD pair experienced a new decline to the corrective level of 61.8% (1.0917). The rebound from this level worked in favor of the European currency, leading to a slight increase toward the Fibonacci level of 76.4% (1.0984). This rise may continue today. However, on Friday, important statistics will be released in the USA, so I would not be 100% confident that the rebound from the 1.0917 level will lead to stronger pair growth. Strong reports can have a reverse effect.

The waves continue to tell us the same thing day by day: the "bearish" trend persists. The new downward wave has once again broken the previous low but temporarily stalled around the 1.0917 level. I have not seen a strong upward wave, so there are still no signs of the "bearish" trend ending. And today, I don't even expect them to appear.

Yesterday, the most interesting report was the ISM index for the US services sector. It decreased from 53.9 to 52.7 compared to the previous month, which generally met traders' expectations. The dollar slightly declined on this report, but not by much. The bears cannot be swayed by one report at the moment. Today is another matter, as the Nonfarm Payrolls report and the unemployment rate cannot be ignored.

With the opening of the US session, I expect a sharp increase in traders' activity. However, it remains a big question as to who will be more active. It depends precisely on the reports themselves, their values, and the degree of compliance with traders' expectations. I believe that the market is currently more inclined towards buying the US dollar, which means any report will be tried to fit their desire.

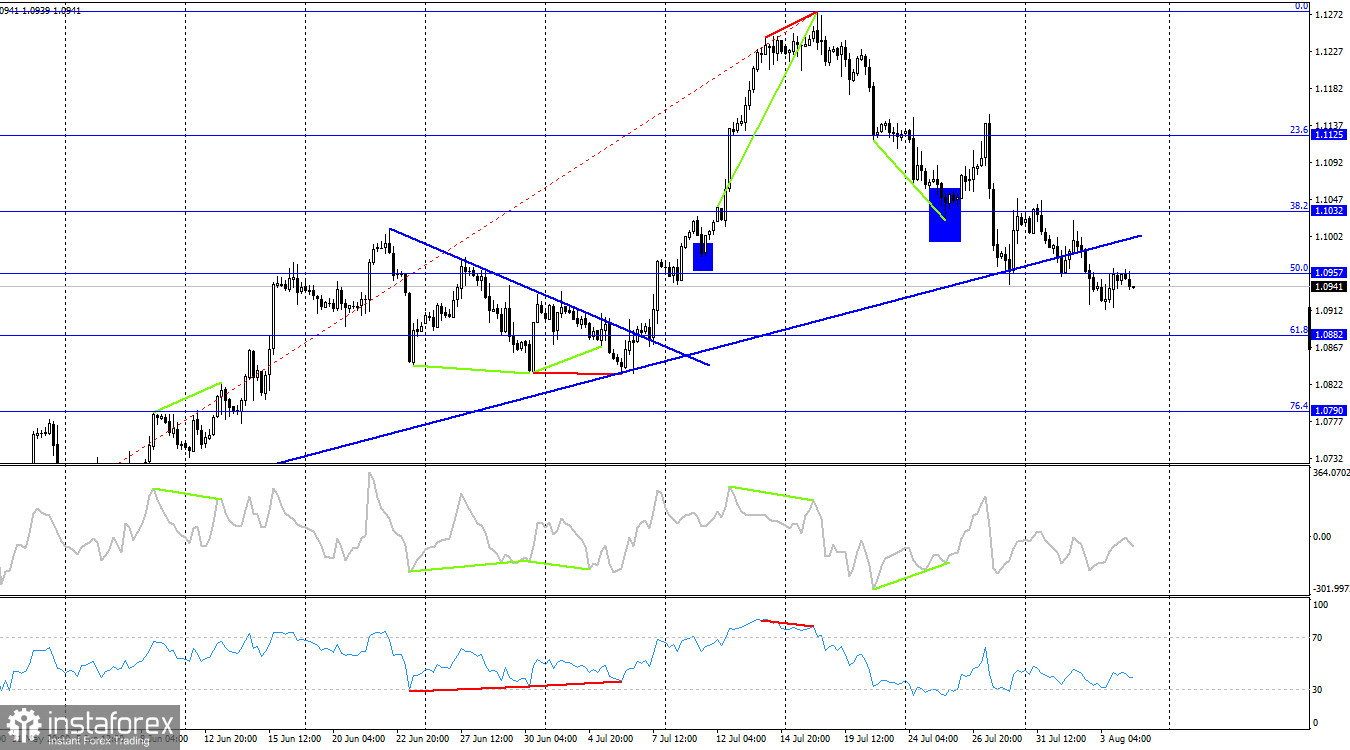

On the 4-hour chart, the pair consolidated below the ascending trendline. Thus, the decline in quotes may now continue towards the Fibonacci level of 61.8% (1.0882), and the "bullish" trend has ended on the 4-hour chart. A rebound from the 1.0957 level will allow us to expect a resumption of the decline. No emerging divergences are observed in any of the indicators.

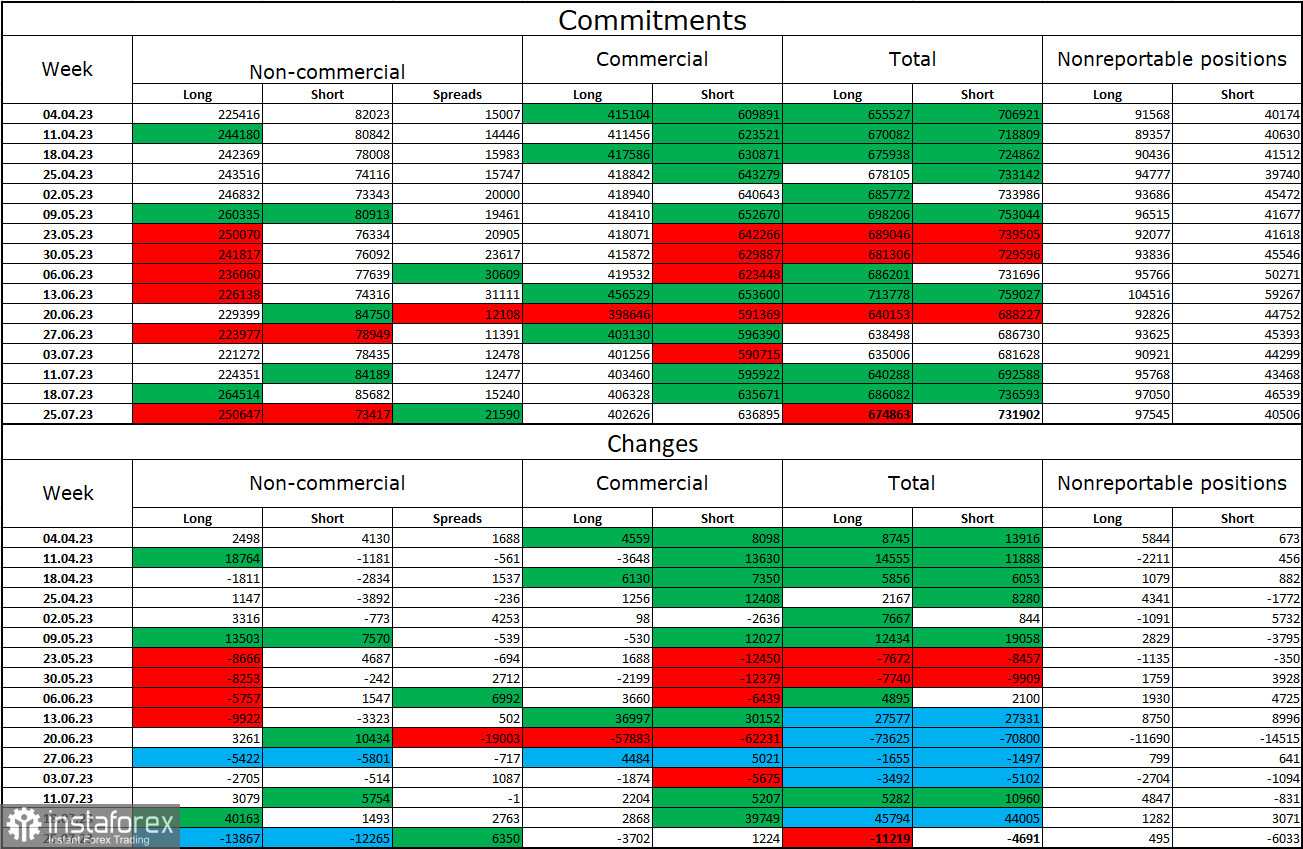

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 13,867 long contracts and 12,265 short contracts. The sentiment of major traders remains "bullish" but has slightly weakened over the past week. The total number of long contracts concentrated in the hands of speculators now stands at 250 thousand, while short contracts are only 73 thousand. The "bullish" sentiment persists, but I believe the situation will change in the opposite direction soon. The high value of open long contracts indicates that buyers may start closing them soon - the bias towards bulls is currently too strong. I believe that the current figures suggest a decline in the euro currency in the coming weeks. The ECB increasingly signals the imminent completion of the tightening procedure.

News calendar for the USA and the European Union:

EU - Retail Sales Volume (09:00 UTC).

USA - Average Hourly Earnings (12:30 UTC).

USA - Nonfarm Payrolls (12:30 UTC).

USA - Unemployment Rate (12:30 UTC).

On August 4th, the economic events calendar includes several interesting entries, with Nonfarm Payrolls standing out. The impact of the information background on traders' sentiment today can be significant.

Forecast for EUR/USD and trader advice:

I recommended selling on the rebound from the 1.1035 level on the hourly chart with targets at 1.0984 and 1.0917. Both targets have been reached. New sales are possible if the pair closes below the 1.0917 level with a target of 1.0864. Buying opportunities for the pair are present now on the rebound from the 1.0917 level on the hourly chart with targets at 1.0984 and 1.1035.