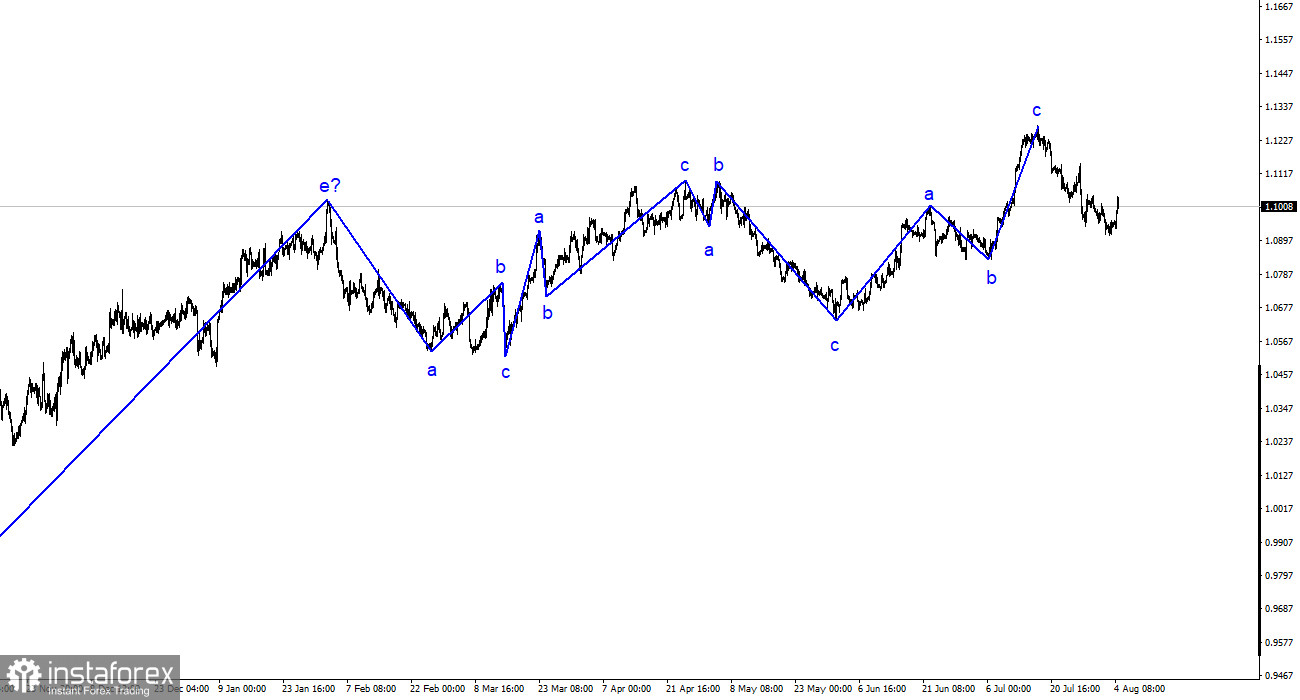

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. The entire ascending segment of the trend, which started its construction last year, took on a complex structure, and in the last six months, we have only seen three-wave structures alternating with each other. Lately, I've been consistently saying that I expect the pair around the 5-figure mark, from where the construction of the last rising three-wave began. I stand by my words. Another ascending three-wave structure has been completed, so the market has begun constructing a declining trend segment.

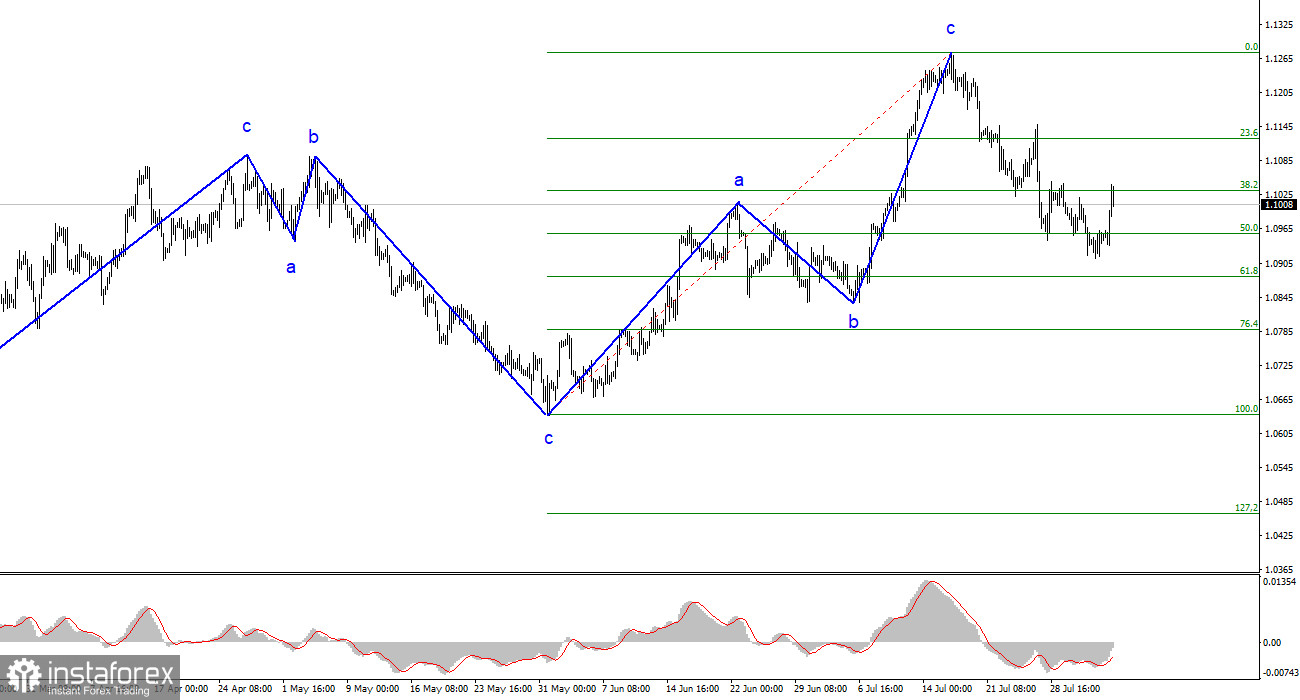

Theoretically, the trend segment that began on May 31st could take a five-wave form with an a-b-c-d-e structure, but asserting this confidently right now is rather complex. The news background could be stronger for the euro currency (and sometimes even outright weak) for there to be a consistently high demand for it. At the same time, the economic statistics from the European Union remain mediocre. An unsuccessful attempt to break through the 1.1032 mark, corresponding to 38.2% Fibonacci, will indicate the market's readiness to sell again.

The Nonfarm Payrolls did not meet the forecast.

The euro/dollar rate increased by 60 basis points on Friday. This isn't a significant amount, and this increase doesn't conclusively indicate the completion of the first wave of the new declining trend segment (presumably). Wave 1 or a could be longer than it appears now, and even if it is complete, I expect the construction of a rising correction wave, after which the decline will resume.

On Friday, the market only focused on one report. Nonfarm Payrolls for July amounted to 187,000, against market expectations of 200,000, which triggered a mass exodus from the US currency. However, this will not continue for long, and Friday's increase will be the starting point for growth above the 13-figure mark. The market paid no attention to the unemployment rate, which decreased to 3.5%, or the wage levels, which increased by 4.4%. Thus, economic statistics from the US were pretty decent. We are also currently receiving some positive news from the European Union.

Given this, the market has no basis for constructing a new strong ascending wave. If this is true, the quote decline might resume early next week. The market has had time to analyze the outcomes of the ECB and FOMC meetings, so now it will closely monitor inflation reports and statements from members of these central banks. ECB's Board of Directors will have to try hard for the market to believe in maintaining a "hawkish" approach to the rate. A strong increase in demand for the euro is possible only if the ECB signals readiness to raise the rate to 5% and above.

General conclusions.

Based on the analysis, the construction of the ascending wave set is complete. Targets in the range of 1.0500-1.0600 are quite realistic, and with these goals in mind, I recommend selling the pair. The a-b-c structure appears well-formed and convincing, and closing below the 1.1172 mark indirectly confirms the construction of a downward trend segment. Therefore, I recommend selling the pair with targets around the 1.0836 mark and below. The construction of the downward trend segment will continue.

On a larger wave scale, the wave markup of the ascending trend segment took an extended form, but it is likely completed. We saw five waves upward, which most likely represent the a-b-c-d-e structure. The pair then constructed four three-wave patterns: two downward and two upward. Now, it has likely moved into the phase of constructing another descending three-wave structure.