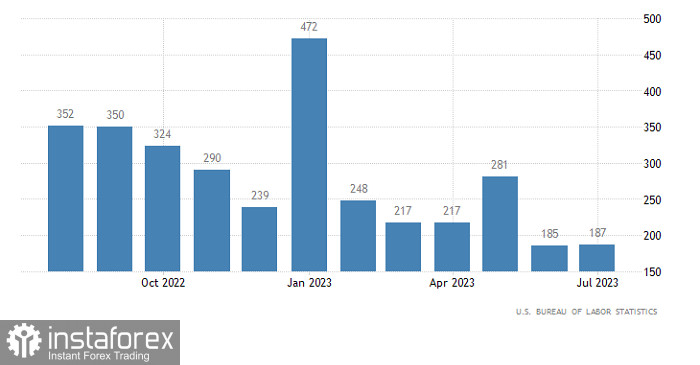

According to the report from the United States Department of Labor, the unemployment rate declined from 3.6% to 3.5%, which, logically, should have pushed the dollar higher. But on the contrary, the US dollar dipped. This is due to the fact that the non-farm payroll rose by only 187,000. Not only was this lower compared to forecasts of 190,000, but the previous figure was also revised downward from 209,000 to 185,000 jobs. In other words, over the past two months, far fewer jobs were created than needed to maintain labor market stability. Considering the population growth rate and the level of economic activity, approximately 250,000 new jobs need to be created monthly. Of course, these numbers will vary significantly from month to month, but if two consecutive months have significantly fewer jobs than this average, how can the unemployment rate decrease at all? This is why the dollar became weaker, as it creates distrust in the official data. And this can trigger a real panic. So, the fact that the dollar became weaker on Friday is nothing but a flight from the risks of uncertainty.

Number of new jobs created outside of agriculture in the United States

There is no economic data scheduled in the calendar on Monday. Emotions will settle down a bit, and the market will recover slightly. The main result will be a small retracement.

During a partial recovery, the EUR/USD pair temporarily rose above the 1.1000 level. However, it failed to stay above this value, and as a result, the price returned below the psychological level. This indicates that the corrective move will continue from the high of the mid-term trend.

On the four-hour chart, the RSI technical indicator is moving around the 50 middle line, which may signal an increase in the volume of short positions.

On the same time frame, the Alligator's MAs are intersecting each other, which points to a slowdown in the corrective move.

Outlook

In this case, if the price stays below the 1.1000 level, it may lead to an increase in selling volumes. To continue the corrective move, the quote needs to stay below the 1.0900 level. As for the alternative scenario, traders may consider an upward move in the recovery process if the price remains above the 1.1050 level.

The complex indicator analysis unveiled that in the short-term period, indicators suggest a downward cycle since the price fell below the 1.1000 mark. In the intraday period, indicators point to the recovery process in the euro. In the medium-term period, indicators signal a slowdown in the uptrend.