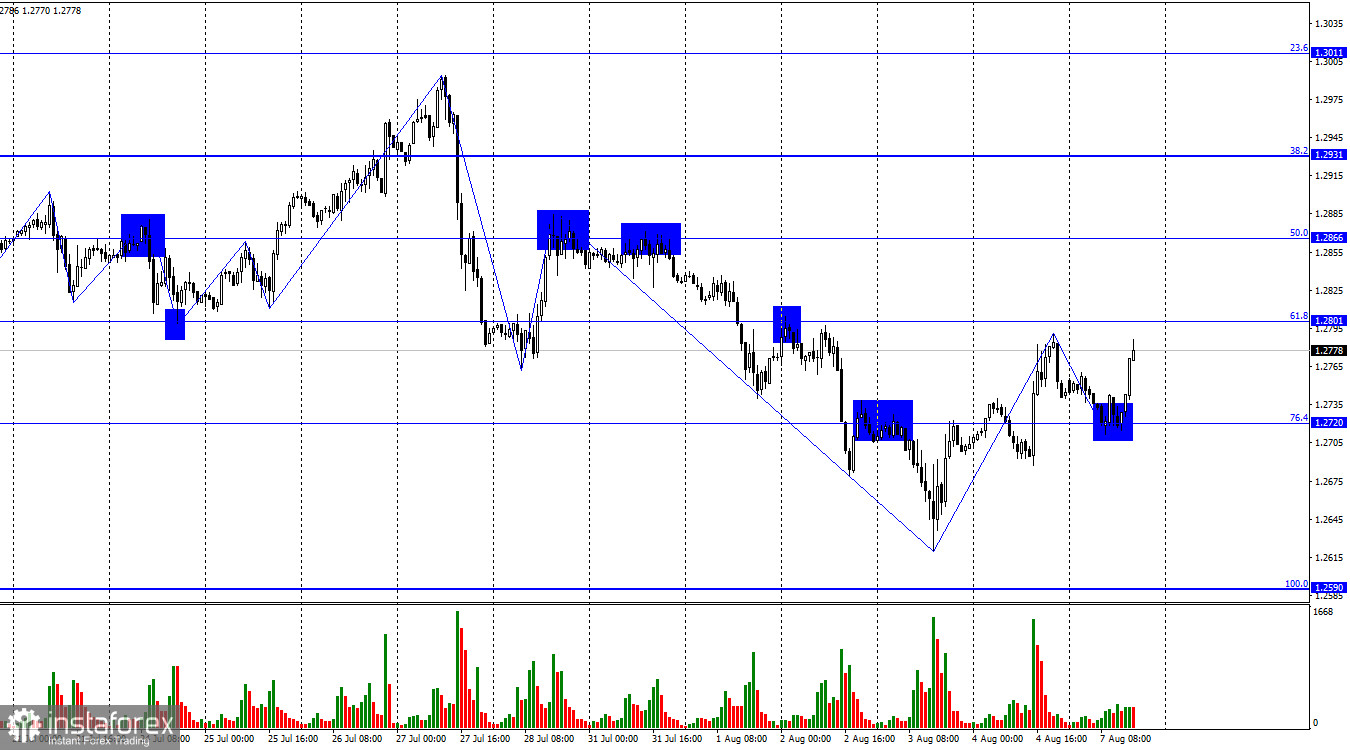

On the hourly chart, the GBP/USD pair experienced a rise on Friday, almost up to the corrective level of 61.8% (1.2801), but then it turned in favor of the dollar and retraced back to the Fibo level of 76.4% (1.2720). The price rebound from this level once again worked in favor of the pound and the pair's rise, but at the moment, the previous peak has not been breached, meaning the bullish market sentiment could quickly revert to bearish. A rebound from the 1.2801 level will allow traders to anticipate a renewed pound decline toward the Fibo level of 100.0% (1.2590).

The waves still indicate only a bearish trend. Despite a relatively strong bullish wave on Friday, the previous bearish wave was even stronger. The last wave peak has yet to be breached, but a downward wave hasn't broken the last low. I would say the following: some signs of the end of the bearish trend are present, but they are still very few. I would not bet on a strong rise of the pound now.

The last two days of the past week were quite interesting for the pound. First, the Bank of England raised its rate by 0.25%, but Andrew Bailey's rhetoric wasn't overly hawkish, greatly disappointing traders. Then there were the US labor market and unemployment reports, which contradicted each other, as unemployment turned out to be better than market expectations, but the payrolls were worse. Thus, the pound did not have strong reasons to form a new bullish trend at the end of last week. Its maximum, for now, is a correction.

On Monday, there's no significant news. Trader activity is quite high for an empty event calendar.

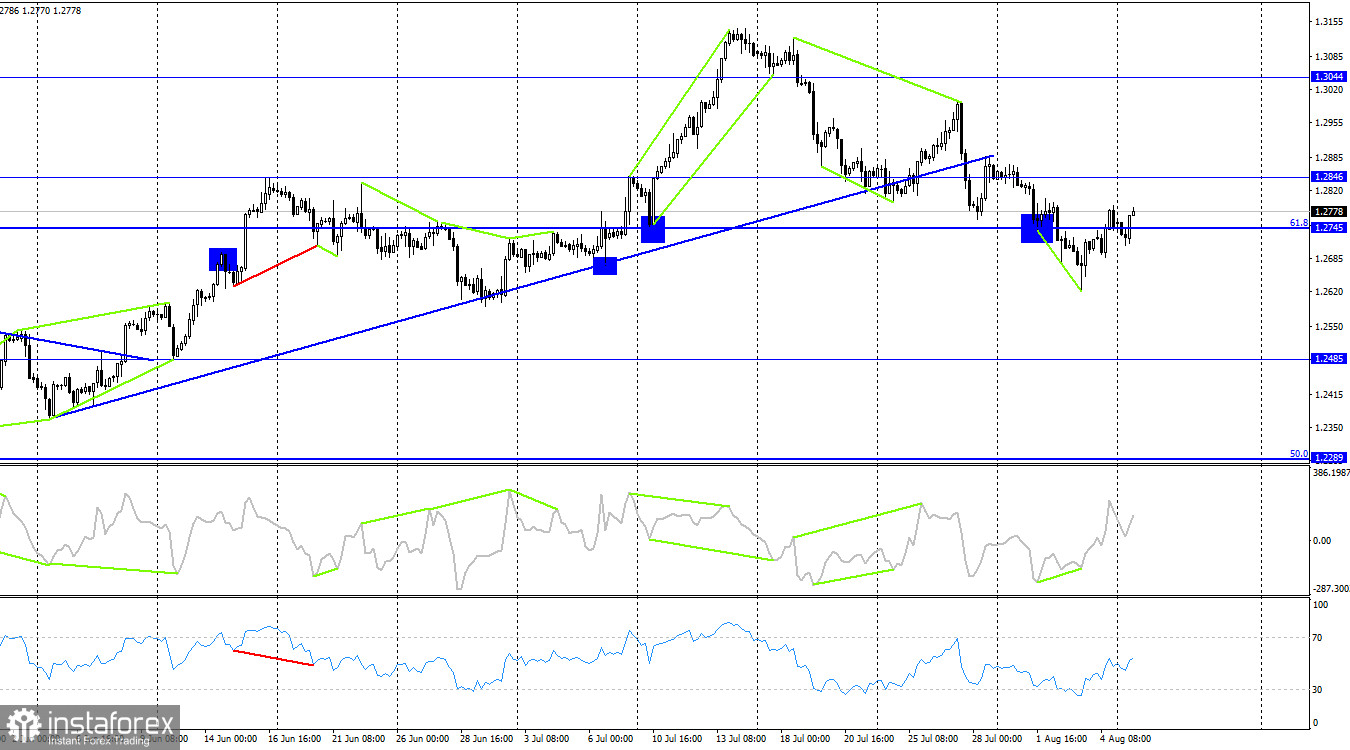

On the 4-hour chart, the pair reversed in favor of the pound after forming a bullish divergence at the CCI indicator. There was also a consolidation above the Fibo level of 61.8% (1.2745), which allows expecting continued growth towards the level of 1.2846. No impending divergences are observed currently with any of the indicators. I don't believe in a strong pound rise under the current conditions.

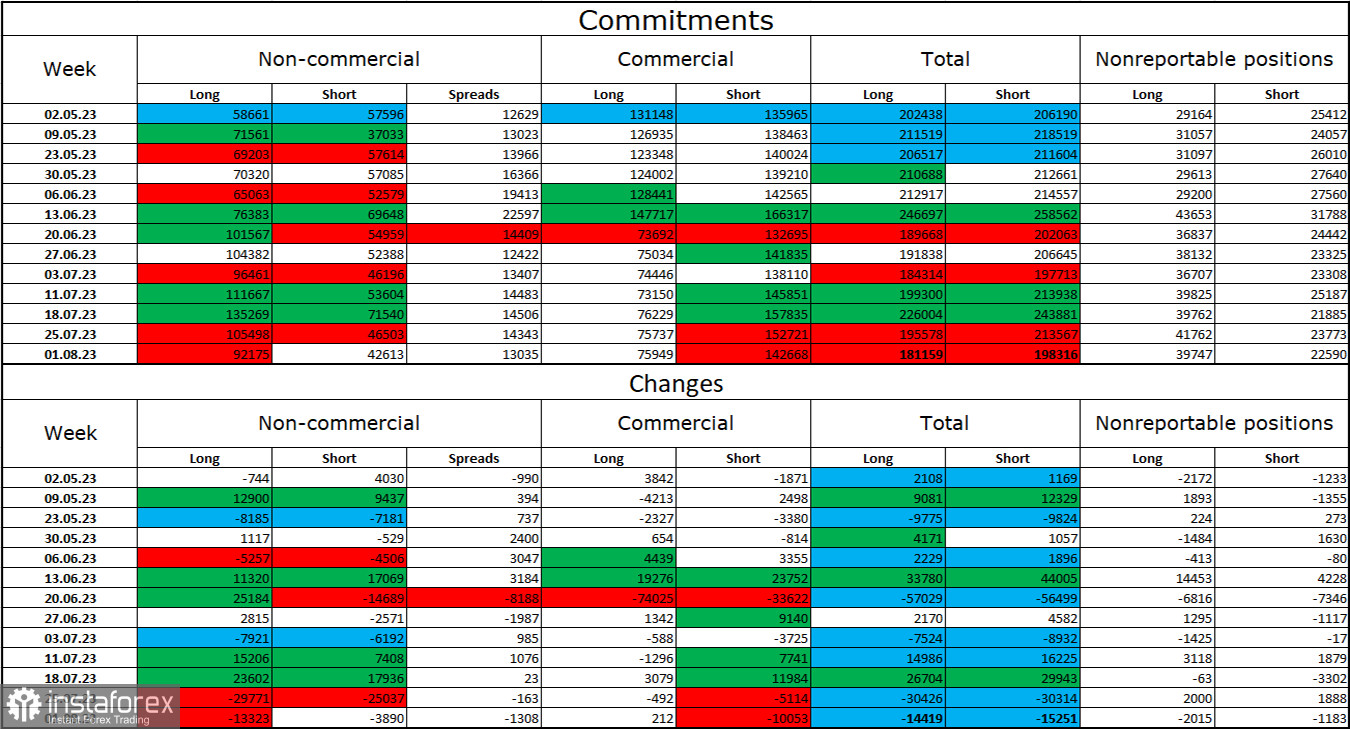

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category has become less bullish over the last reporting week. The number of long contracts held by speculators decreased by 13,323 units, while the number of short contracts decreased by 3,890. The overall sentiment of major players remains bullish, with a two-fold gap forming between the number of long and short contracts: 92,000 versus 42,000. The pound had good prospects for continued growth recently, but many factors now favor the US dollar. Betting on a new strong rise of the pound is becoming increasingly difficult. The market doesn't always consider all the supporting factors for the dollar, and the pound has recently risen solely on expectations of further rate hikes by the Bank of England.

News calendar for the USA and the UK:

On Monday, the economic event calendar has no noteworthy entry. For the rest of the day, the influence of the news backdrop will be absent.

Forecast for GBP/USD and advice for traders:

I suggest new pound sales on a rebound from the 1.2801 level on the hourly chart with targets at 1.2720 and 1.2620. Purchases of the pound were possible on a rebound from the 1.2720 level on the hourly chart, with targets at 1.2801 and 1.2866. They can be held until sell signals appear.