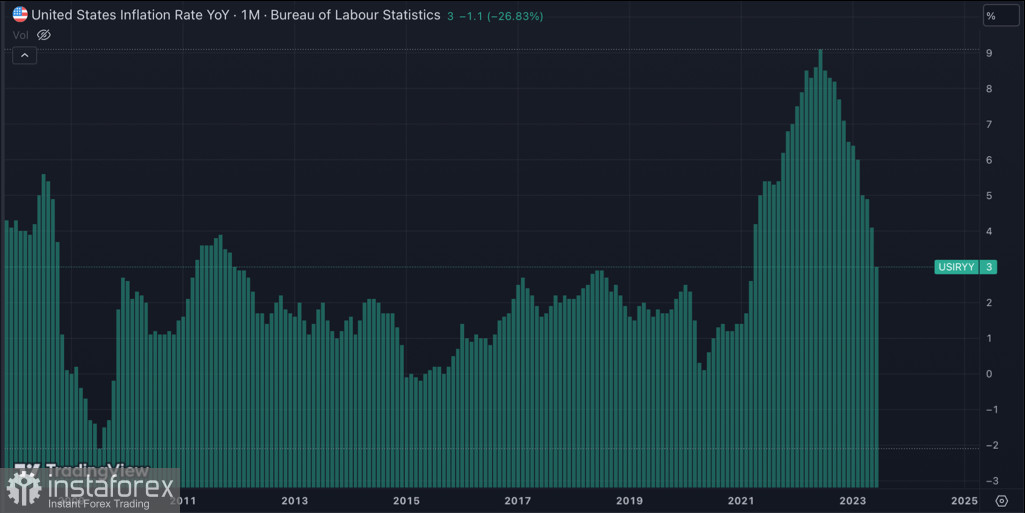

Over the past two months, a clear pattern has emerged in the cryptocurrency and Bitcoin market, where significant price movements only occur upon the release of macroeconomic news. The last time Bitcoin made a significant price surge was in anticipation of the Federal Reserve meeting, where the key rate was raised once again. Now, we're observing increased investor activity ahead of the CPI data publication on Thursday, August 10th.

Market participants are gearing up for potential inflation outcomes and are closing their positions. This process begins to pressure the price as additional volumes of BTC enter the market. So far, there hasn't been a significant change in Bitcoin's price dynamics, but the probability of intensifying bearish trends is increasing.

Who is selling and who is buying BTC?

Despite long-term confidence in BTC, the market anticipates negative inflation data. Analysts and traders see the potential for CPI to rise above 3%, which would automatically trigger an extension of the Federal Reserve's monetary policy for at least another month. Given this, investors will be closing their positions and moving their capital to safer assets in anticipation of volatility.

This process primarily concerns short-term investors who don't want to ride the waves of volatility before August 10th. It's also reported that miners have been selling their BTC reserves more frequently over the last three months to settle their 2022 debts. However, local BTC sell-offs have not been particularly successful so far.

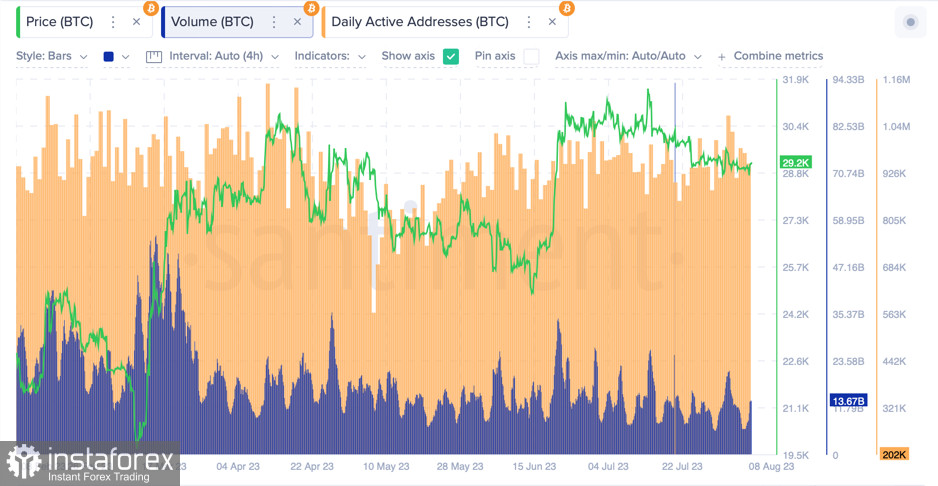

This has been made possible due to the activity of large investors who resumed buying BTC once the price began to slowly slide in the $28.5k–$29.7k range. Santiment reports that the BTC buying phase was preceded by a stablecoin accumulation phase, which large players are now converting into BTC. Long-term investors also remain loyal to Bitcoin – over 14.59 million BTC are held by those who haven't moved their coins.

BTC/USD Analysis

Bitcoin continues to move in a downward channel with minimal price corrections, and as of August 7th, the asset attempted to break the $29k level. At one point, the price reached $28.6k, but buyers subsequently managed to push it back above $29k. On the 4H timeframe, a "bullish engulfing" pattern formed, followed by a recovery above $29k.

Subsequently, the asset continued its upward movement towards the $29.2k–$29.4k levels, where it encountered increased volumes of sellers. Overall, the situation remains bearish, but the BTC price is actively testing the local resistance level. Meanwhile, trading volumes remain at $12 billion, and the volatility level has reached a historical low of 0.78%.

The local surge of buyers has led to the BTC price attempting to break through the downward trend line around $29.4k. Technical metrics are gradually taking on a bullish direction, but it would be premature to suggest the development of a strong corrective upward movement. It's likely that we will see a local correction/consolidation, after which the bearish trend will continue with a target around $28.5k.

The situation that unfolded on August 7th confirms the increased activity of buyers in the BTC market. At the same time, the decline of Bitcoin's price below $29k occurred with falling volumes, indicating a weakening of the local downward trend. It can also be surmised that this was due to a lull ahead of the inflation data release, making it risky to open long positions at this time.

Conclusion

The Bitcoin market is beginning to come alive due to the activity of traders pursuing their goals. In the coming days, we will likely witness the primary stage of the market's preparation for disheartening CPI data around 3.2%. Therefore, the prevailing sentiment towards BTC remains bearish, with the $28.5k target potentially attainable in the short-term. This sentiment would be invalidated if BTC manages to consolidate above $30.2k on a momentum swing, but the current situation nearly rules out such a possibility.