GBP/USD

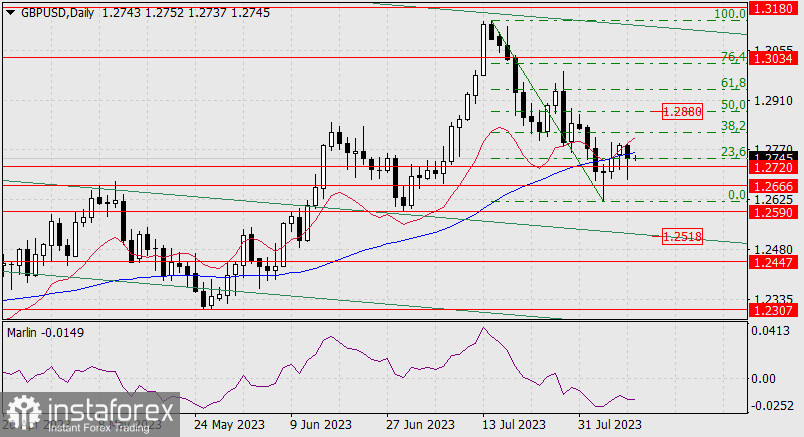

Over the past two days, we observed that the British pound falsely settled above the MACD indicator line (and above the 23.6% Fibonacci level) on Monday. Then it made a false breakout to the downside on Tuesday, narrowly missing the target support level at 1.2666.

This morning, the price is returning above the 23.6% Fibonacci level. Surpassing yesterday's peak at 1.2784 opens up the target for further corrective growth towards 1.2880 (50.0%). If the price solidifies below 1.2720, it opens up the target at 1.2666. Afterwards, it can further fall towards 1.2590.

On the four-hour chart, the price is trying to overcome the resistance of the MACD line. It's aided by the Marlin oscillator, which is already in the positive territory. The price only needs to settle above 1.2760. It has a 60% chance at growth.