Many economists believe that the Bank of England might raise the interest rate to 5.50% or even 6.00% if inflation remains high. For now, pound buyers can rely on support from the Bank of England, but only until the economy starts showing clearer signs of slowdown, prompting the Bank of England to pause its interest rate hike cycle.

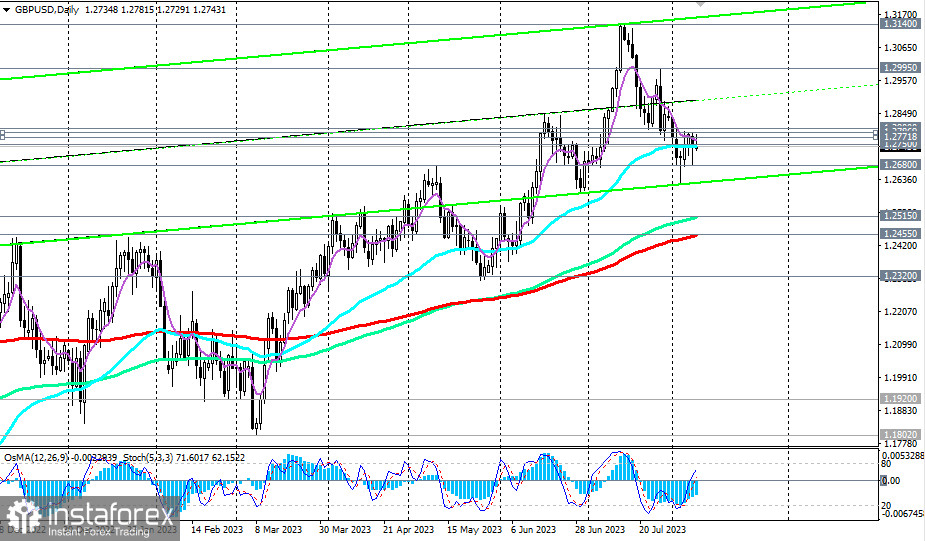

After reaching a peak since May 2022 at 1.3142 in the middle of the previous month, the GBP/USD began to decline, influenced by a weakening pound and a strengthening dollar.

As of writing, GBP/USD was trading close to the 1.2745 mark, through which an important medium-term support level passes (50 EMA on the daily chart).

As long as the medium-term bullish momentum persists above the key support levels of 1.2515 (144 EMA on the daily chart) and 1.2455 (200 EMA on the daily chart), the current decline can still be seen as a correction, especially as the price found support near the 1.2745 level.

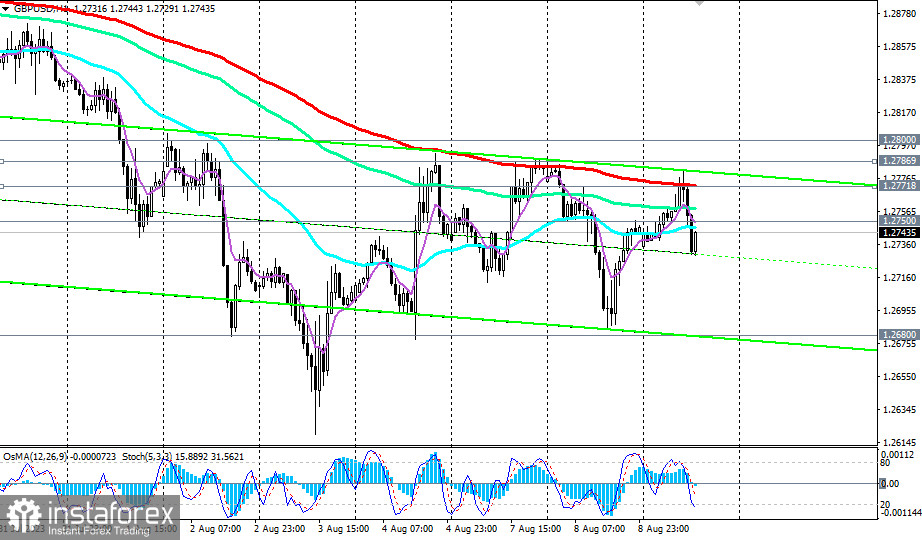

Therefore, breaking through significant short-term resistance levels at 1.2772 (200 EMA on the 1-hour chart) and 1.2787 (200 EMA on the 4-hour chart) can be seen as an initial signal to resume long positions.

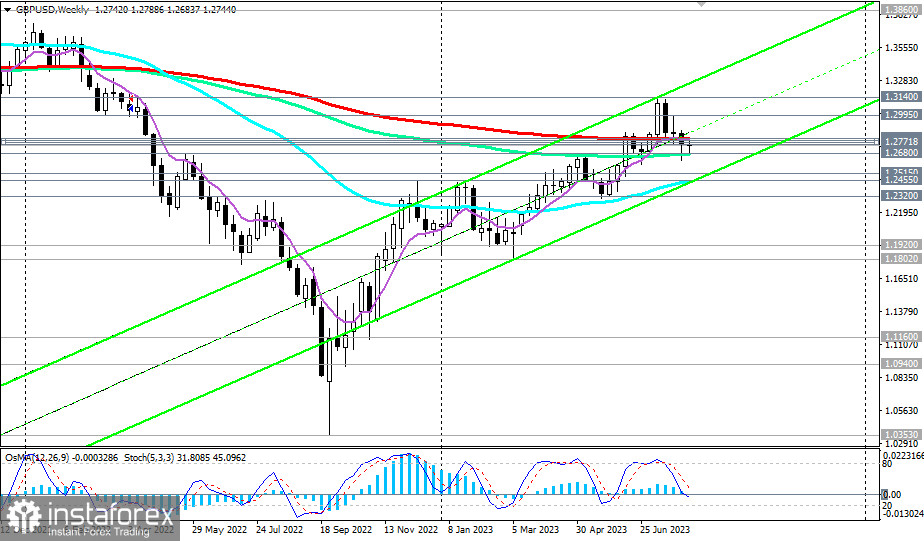

A break of the key resistance level at 1.2800 (200 EMA on the weekly chart) would push GBP/USD into the long-term bullish zone, making long positions favorable again. Further growth of GBP/USD within the upward channel on the weekly chart towards its upper boundary and the 1.3250 and 1.3300 marks would become highly likely. This would steer the pair towards key strategic resistance levels at 1.3860 and 1.4300 (200 EMA on the monthly chart). Breaking these would usher the pair into the global bullish market zone.

In an alternative scenario, a breakdown of the crucial long-term support level at 1.2680 (144 EMA on the weekly chart) would be a sell signal. The most immediate signal for implementing this scenario would be breaking today's low at 1.2730, followed by the "round" support level of 1.2700. Downside targets would be the support levels of 1.2515, 1.2500, and 1.2455. Breaking the vital medium-term support level at 1.2455 (200 EMA on the daily chart, 50 EMA and the lower boundary of the upward channel on the weekly chart) would confirm GBP/USD's return to the long-term bearish zone.

Support levels: 1.2750, 1.2700, 1.2680, 1.2600, 1.2515, 1.2500, 1.2455, 1.2400, 1.2320

Resistance levels: 1.2772, 1.2787, 1.2800, 1.2900, 1.3000, 1.3100, 1.3140, 1.3250, 1.3300, 1.3860, 1.3900, 1.4300