Over the past month and a half, Bitcoin has been within a downward corrective movement in the $28.5k–$30.5k range. This downward movement is part of a larger upward trend that began to form from January to June. The last two months have been bearish for BTC and the crypto market, resulting in a local downward trend.

However, this tendency is gradually waning, with various fundamental and market factors emerging as evidence. It's premature to declare the correction period completely over, but the initial signals are already hitting the market, vividly reflected in the BTC/USD price.

No rate hike on the horizon?

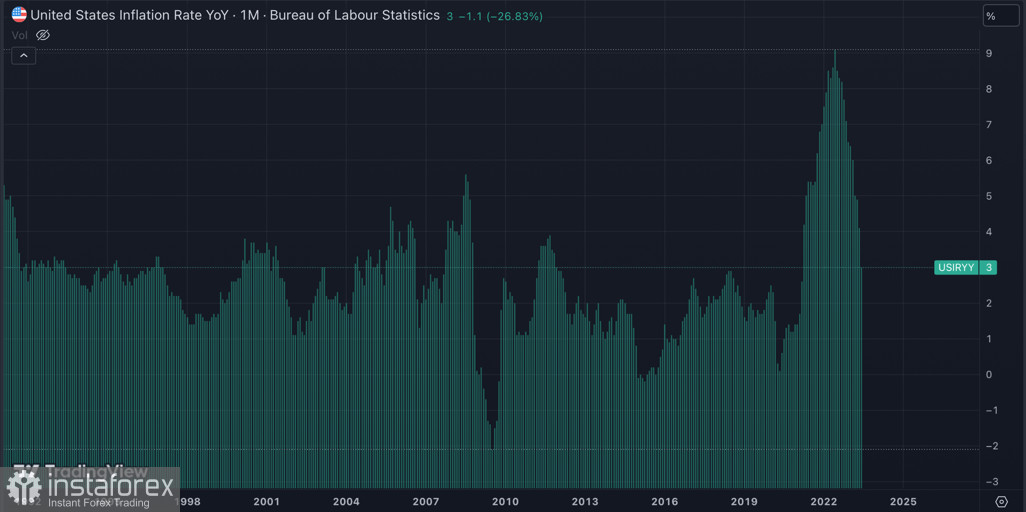

The most significant event at the moment was a radio address by the President of the Federal Reserve Bank of Philadelphia, Patrick Harker, who has a voting right in the Federal Open Market Committee (FOMC). The official stated he sees no apparent reasons to raise the rate in the September 20 meeting, even if inflation predictions for the end of July are confirmed.

Harker believes the institution should wait for data, at least for August, before deciding on any further rate hikes. This statement had a positive impact on Bitcoin and other high-risk assets. Concurrently, the U.S. dollar index predictably started to decline. While Harker's statement provided a boost to financial instruments, the effect is likely to be short-term.

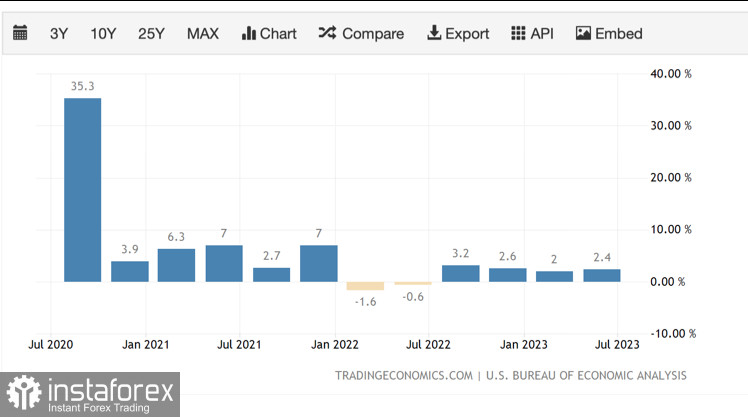

Despite the Fed official's statement, the record low unemployment rate in the U.S. and the country's robust GDP growth indicate the strength and resilience of the American economy. The consumer activity index also remains high, reinforcing potential inflation growth and further rate hikes by the Fed.

Stablecoin stir

Leading payment system PayPal announced the launch of its own stablecoin, PYUSD. The asset will soon undergo the listing procedure on several cryptocurrency platforms once the issuer provides the necessary liquidity level. Paxos claims that the launch of PayPal's stablecoin marks a pivotal moment in the regulation of this type of crypto assets.

Concurrently, Forbes published an article noting that Tether's reported operational profit is significantly lower than the net profit from the previous quarter. Moreover, the USDT issuer company can't declare a net profit for the second quarter of 2023, which might be a concerning signal for USDT stablecoin holders.

BTC/USD Analysis

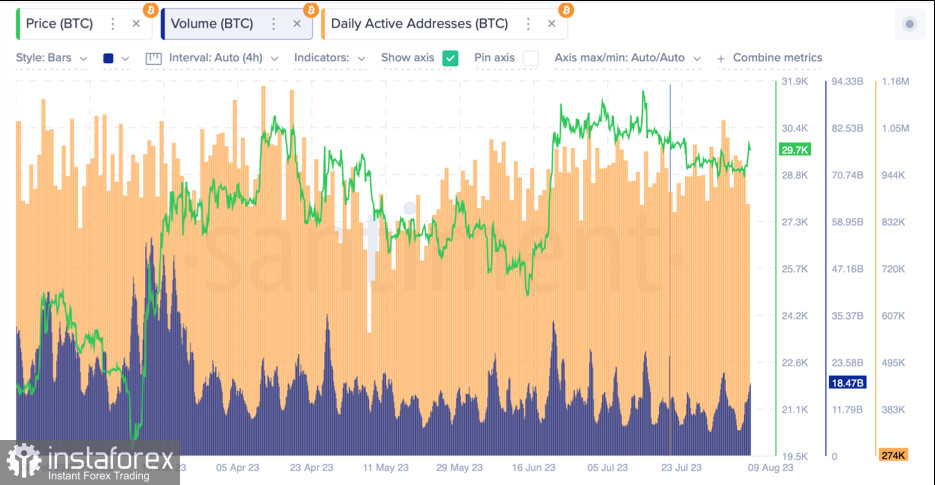

Amidst the whirlwind of events in recent days, Bitcoin managed to find a loophole for a local bullish impulse beyond the $28.5k–$30k range. As of August 8th, the BTC price made an upward surge to the $30.2k level and subsequently stabilized above $29.5k, which is a positive sign. There's also a noticeable increase in the activity of unique addresses within the BTC network, and trade volumes jumped to $19 billion.

The impression is that the asset is gradually concluding its correction within the upward trend. Over the past month, the asset tested the $30k level three times on the daily timeframe, which might eventually lead to its breakout. Within the current bullish trend, Bitcoin has room to drop to the $28k level, setting up another rising low.

Technical metrics suggest the completion of the bullish impulse. RSI and stochastic have peaked and are gradually transitioning to a consolidation phase. At the same time, a bullish crossover has formed on the 1D MACD chart, indicating a potential inception of another bullish surge with an attempt to breach the $30k level. The asset appears ripe for the conclusion of its corrective motion, but the likelihood of a continued decline remains.

Conclusion

Bitcoin executed a strong upward impulse, trying to break through the $30k mark. There's an evident bullish momentum, which might lead to a retest of this level. Meanwhile, Santiment reports an absence of stablecoin inflow, possibly suggesting a pause in active trading activity. One should not overlook the inflation rate, the data for which will be published tomorrow, August 10th, and will have a crucial impact on BTC's price movement.