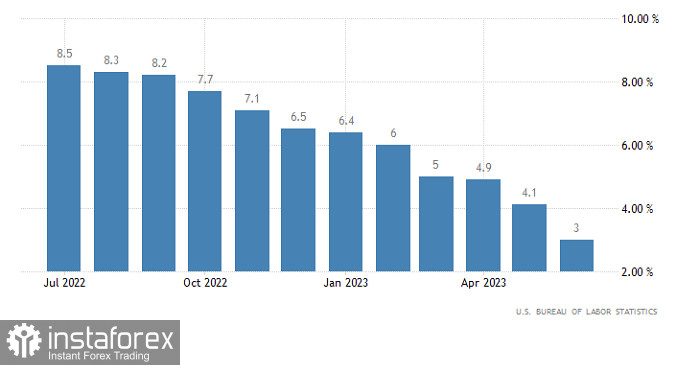

Although the pound edged up on Wednesday, and it was quite noticeable, the level of volatility was still significantly lower than the day before. Overall, the market is still stagnant. No significant changes have occurred, which is not surprising in the absence of influential economic releases. However, the main reason for this behavior is today's US inflation data. No one is willing to take risks, considering the forecasts. The fact is that the growth rate of consumer prices in the United States could accelerate. According to the most conservative estimates, from 3.0% to 3.1%. However, there are those who predict that it would increase to 3.3%. In any case, an increase in inflation will erase doubts regarding the Federal Reserve's future course of actions. The US central bank will at least raise the interest rate once again. And if inflation rises quite significantly, this could happen at the next Federal Open Market Committee meeting. The main thing is that if inflation does rise, the dollar could significantly strengthen. The extent of the acceleration in the growth rate of consumer prices will determine how critical this movement is.

US inflation

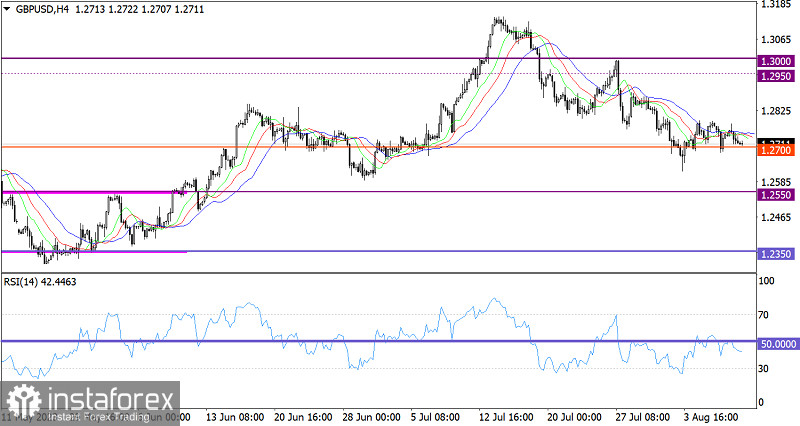

Despite the ongoing corrective trend from the peak of the medium-term trend, the GBP/USD pair remains stagnant. The 1.2700 level acts as support, around which the 1.2700/1.2780 range has formed.

On the four-hour chart, the RSI indicator is moving in the lower area, thus reflecting bearish sentiment among traders.

On the same time frame, the Alligator's MAs have crossed over each other. This signal appeared due to the stagnant phase.

Outlook

To continue the corrective trend, the quote needs to consistently stay below the 1.2700 level. In this case, the price can move towards the price range of 1.2550/1.2600. However, a good signal of an increase in the volume of long positions may appear if the price stays above the 1.2800 mark. This may indicate the end of the corrective cycle.

The complex indicator analysis unveiled that in the short-term and intraday periods, indicators are providing a mixed signal. In the medium-term period, indicators are pointing to the ongoing corrective trend.