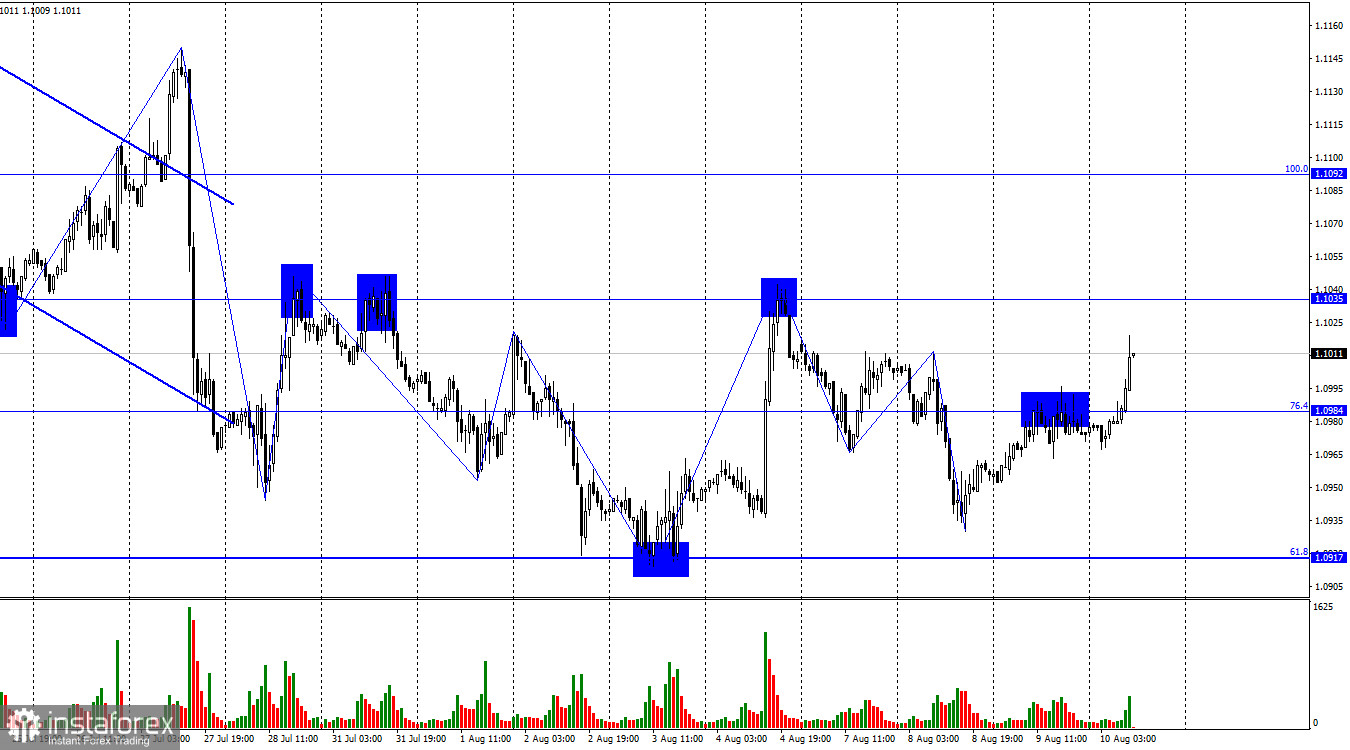

On Wednesday, the EUR/USD pair returned to the corrective level of 76.4% (1.0984). There was no rebound from this level, but the establishment above it favored continued growth, which is still ongoing on Thursday towards the 1.1035 level. A price pullback from this level will benefit the American currency and signal the start of a new decline towards the levels of 1.0984 and 1.0917. Overall, the movement in recent weeks has been horizontal. Establishing a rate above the 1.1035 level will allow the pair to break out of it.

The waves also currently indicate a horizontal movement. Peaks and lows are breached at an alarming frequency, subsequently, the emerging trend doesn't hold. Even now, the price has reached the last wave's peak upwards, but there are doubts that it can continue growing beyond the 1.1035 level. After two days of growth, we should expect an equally strong decline. However, the pair's movement today will largely depend on the US inflation report.

According to economists' expectations, the Consumer Price Index in July might increase to 3.3%, while core inflation will likely remain at 4.8%. I believe such figures could lead to the movement I am anticipating – a drop in the pair. If the report shows that inflation is accelerating again, rather than declining contrary to the Fed's expectations, it will be a serious reason for an interest rate hike in September. This will be a substantial reason for traders to accumulate dollar purchases again.

If inflation is below forecast, the dollar's decline might continue, but I don't think it will be significant. I only expect the pair to exceed the 1.1035 level today if inflation falls below 3%.

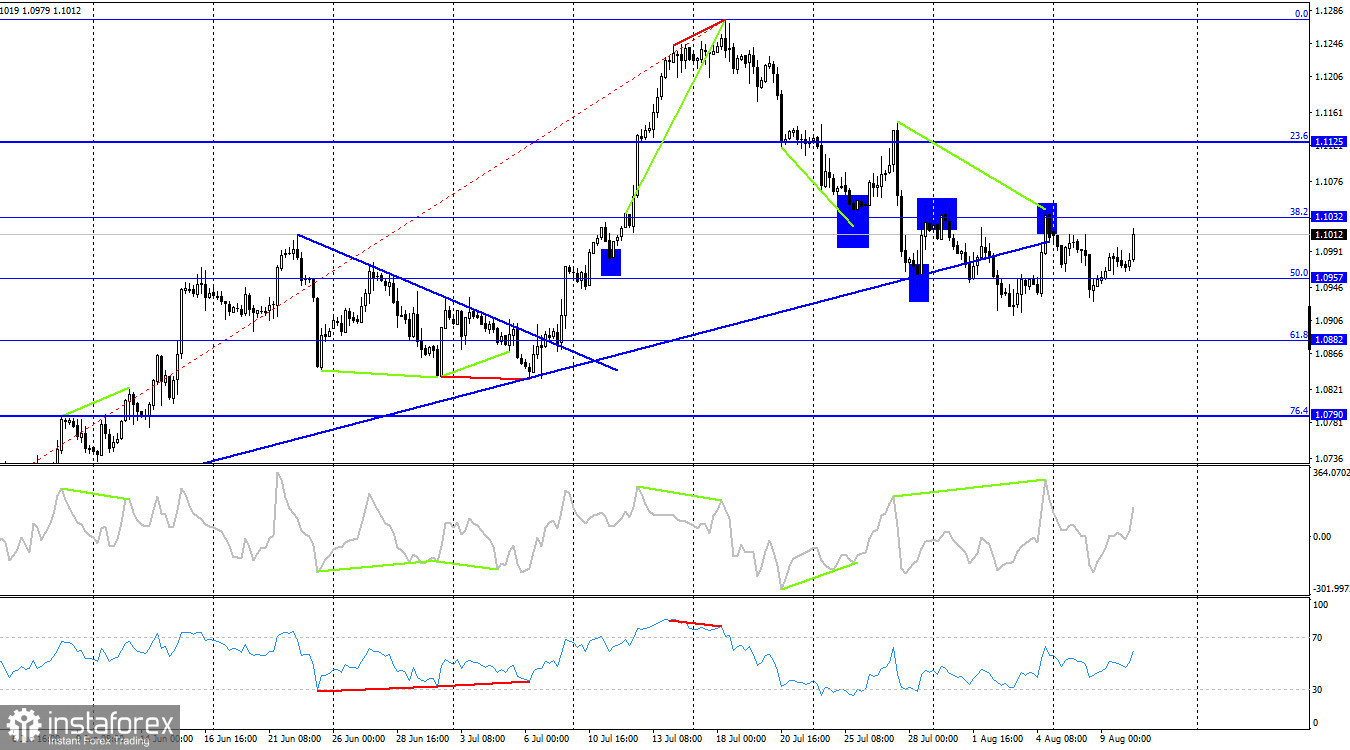

On the 4-hour chart, the pair has established itself below the ascending trend line and rebounded from the Fibo level of 38.2% (1.1032). Currently, it's approaching this level again. A new pullback from it will again benefit the US dollar and lead to a decline toward the corrective level of 61.8% (1.0882). After establishing below the trend line, the probability of the pair's decline has significantly increased.

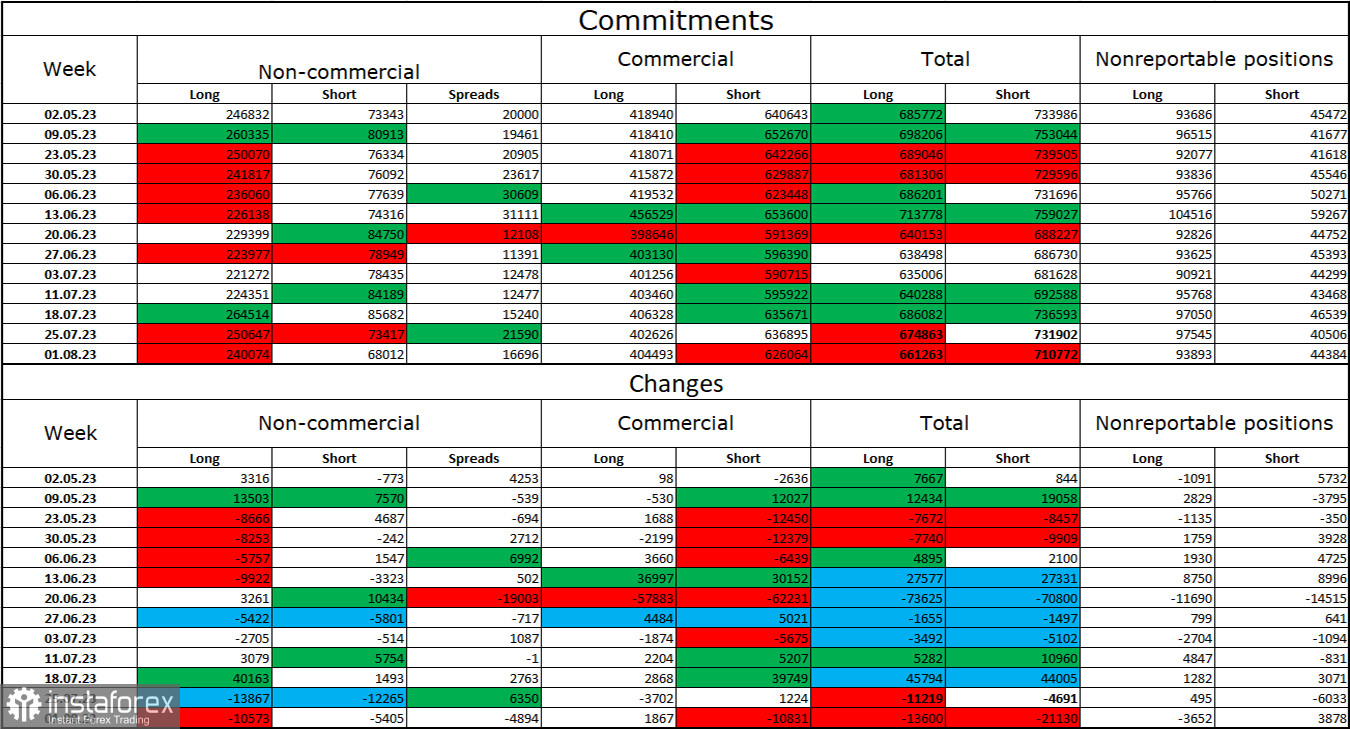

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 10,573 long contracts and 5,405 short contracts. The sentiment of major traders remains bullish and weakened slightly over the past week. The total number of long contracts speculators hold is now 240,000, and short contracts are only 68,000. The bullish sentiment persists, but the situation will likely change in the opposite direction soon. The high number of open long contracts suggests buyers may start closing them soon – there's a strong bias toward the bulls. I believe the current figures permit the continuation of the euro's decline in the coming weeks. The ECB increasingly signals the imminent end of the tightening QE procedure.

News calendar for the US and the European Union:

USA – Consumer Price Index (CPI) (12:30 UTC).

USA – Number of initial jobless claims (12:30 UTC).

On August 10, the economic events calendar features two notable entries. The influence of the news background on traders' sentiment throughout the day will be moderate in strength.

Forecast for EUR/USD and advice for traders:

Today, I recommend selling upon a rebound from the 1.1035 level on the hourly chart with targets of 1.0984 and 1.0917. Purchases were possible upon closing above 1.0984, with a target of 1.1035. Establishing above 1.1035 will allow for maintaining open purchases with a target of 1.1092.