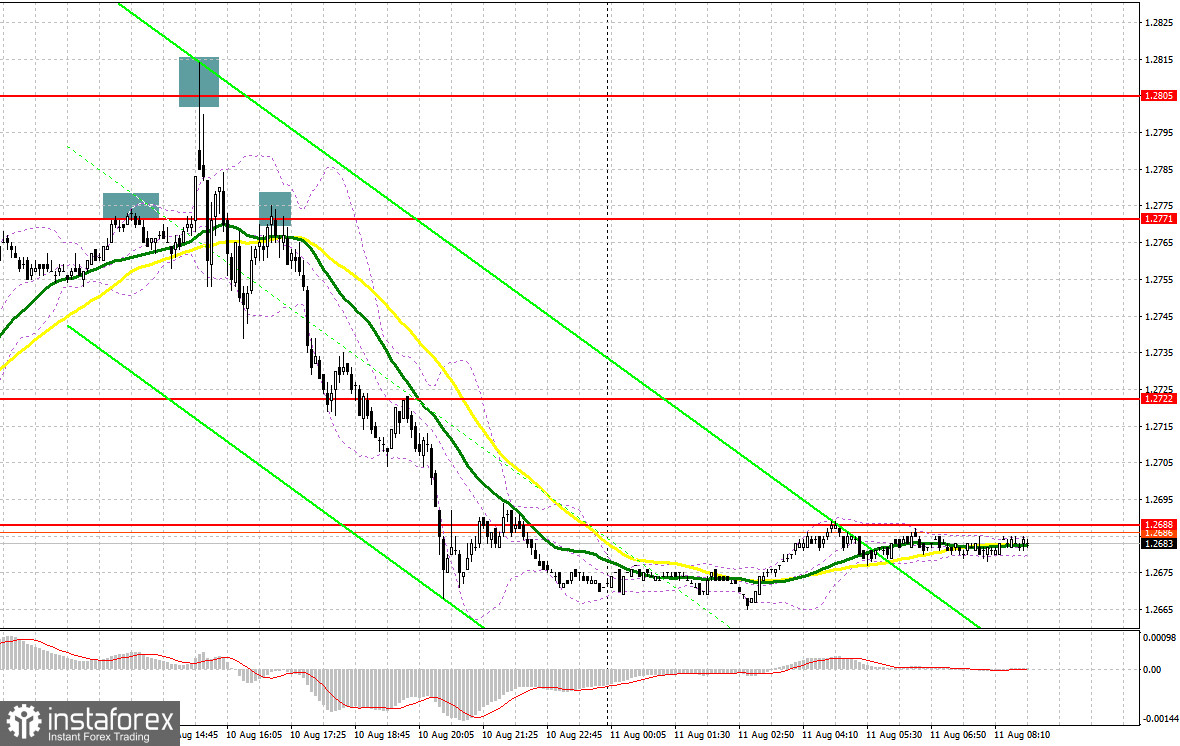

Yesterday, the pound/dollar pair formed several entry signals. Let's look at the 5-minute chart and figure out what actually happened. In my morning forecast, I turned your attention to the level of 1.2735 and recommended making decisions with this level in focus. There was growth and a false breakout at 1.2745, but there was no reverse test. Therefore, there was no buy signal. In the afternoon, after the release of US inflation data, the pound climbed to 1.2805, and produced a sell signal. Another condition for short positions was the pair returning below 1.2771 and an upward retest of this range. As a result, the pair fell by more than 50 points.

For long positions on GBP/USD:

Mixed US inflation data prevented GBP buyers from clinging to daily highs and setting up a new uptrend. Maybe the pound can receive help from today's UK reports on GDP, industrial production, and trade balance, which were better than economists' forecasts. This indicates a stable state of the British economy even amidst such high interest rates. The pound gained after the data, but we don't know whether the bull market will develop this time.

In such a case, it would be better to act on a decline from the level of 1.2666, formed at the end of yesterday. A false breakout on this mark will produce a good buy signal, which may lead to a surge towards the resistance area of 1.2705. Slightly above this level are the bearish moving averages. A breakout and consolidation above this range, which is what the buyers are trying to do now, could set the stage for a bullish market, with the next target at 1.2739. A more distant target will be 1.2774 where I will be taking profits.

If GBP/USD falls and there are no bulls at 1.2666, the pressure will increase. In this case, only the protection of 1.2623, which is the month's low, as well as a false breakout on this mark, will create new entry points into long positions. You could buy GBP/USD at a bounce from 1.2592, keeping in mind an upward intraday correction of 30-35 pips.

For short positions on GBP/USD:

As for the bears, they also have ample opportunities today. Their strategy should be to defend the 1.2705 level and reclaim control over 1.2666. Failure to settle above 1.2705, which is in line with the moving averages, and even after such good UK GDP data, will generate a sell signal with a prospect of falling to 1.2666 - the buyers' last hope. A breakout of this level and its upward retest would significantly dent the buyers' positions, offering a chance for a more substantial decline towards the monthly low of 1.2623. A more distant target will be the 1.2592 low where I will be taking profits.

If GBP/USD grows and there is no activity at 1.2705, which we should still consider in case we get good UK reports, bulls will regain full control of the pair and may start an upward correction towards 1.2739. Only a false breakout at this level would provide an entry point for going short. If there is no downward movement there, I would sell the pound right on a rebound from 1.2774, hoping for an intraday correction of 30-35 pips.

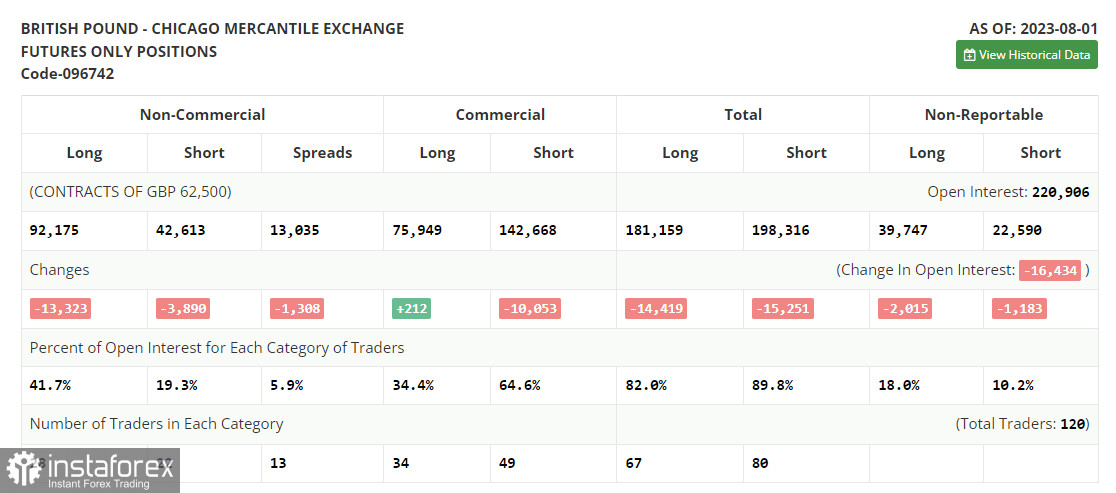

COT report:

The Commitments of Traders (COT) report for August 1st recorded a decline in both long and short positions. Traders have been closing their positions in anticipation of a crucial meeting of the Bank of England. Interestingly, despite recent decisions by the US Federal Reserve and the European Central Bank, the Bank of England signaled its intention to maintain an aggressive stance in an attempt to combat rising inflation. Notably, the recent COT report does not take into account the changes after the regulator's meeting. Therefore, we can downplay the results of this report. Looking ahead, markets anticipate an important GDP report from the UK which the Bank of England relies on when making decisions. However, the optimal strategy remains to buy the pound on dips. The divergent policies of central banks will continue to influence the prospects of the US dollar, asserting downward pressure on it. The latest COT report indicates that long positions of the non-commercial group of traders have decreased by 13,323 to 92,175, while short positions dipped by 3,890 to 42,613. Consequently, the spread between long and short positions narrowed by 1,308. The weekly closing price dropped to 1.2775 compared to the prior value of 1.2837.

Indicator signals:

Moving Averages

Trading is taking place below the 30-day and 50-day moving averages, indicating that the bears are trying to extend the decline.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If GBP/USD declines, the indicator's lower border near 1.2640 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.