The British pound reacted positively to the UK GDP data, keeping its chances of recovering after yesterday's sell-off triggered by US inflation figures. It was revealed that the UK economy showed its strongest quarterly growth in over a year. This indicates resilience despite a sharp rise in borrowing costs.

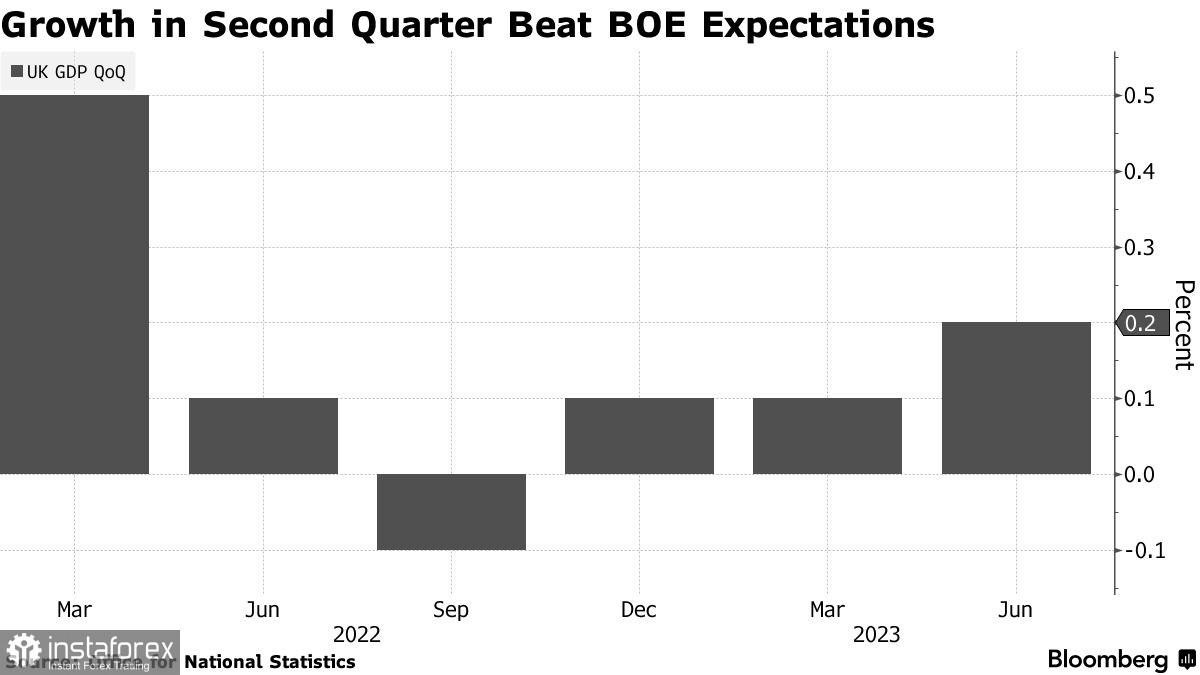

The UK Office for National Statistics stated that the gross domestic product (GDP) increased by 0.2% compared to the first quarter. This is the largest growth since early 2022. Economists had expected a rise of 0.1%. Meanwhile, in June, industrial production jumped by 0.7% on an annual basis, surpassing economists' expectations of a 0.2% rise.

Consumer spending rose by 0.7% for the quarter, marking the highest increase in over a year. Business investments surged by 3.4%, like in the previous quarter. Government spending also saw a sharp rise.

Economic growth, amid rising interest rates and high prices, has strengthened the assumptions of many traders. They think the Bank of England will continue to tighten its policy and raise interest rates further to combat inflation. This is also supporting the growth of the pound sterling, which currently looks attractive, especially after a significant correction earlier this month.

Although economic growth rates are slow compared to history, they continue to exert upward pressure on wages and prices. Although inflation has decreased from last year's peak, it remains more than three times higher than the Bank of England's target of 2%. For this reason, there is no chance of a pause in September. Better-than-expected GDP figures are likely to fuel the Bank of England's desire to continue raising interest rates.

Notably, the UK is the only G7 country that has not yet fully recovered after the pandemic. In the last quarter, production volume increased by just 0.2%, which is below the levels recorded at the end of 2019.

Meanwhile, the Bank of England expects more significant economic growth in the third quarter. Economists, however, are more pessimistic, pointing to a sharp decline in momentum unveiled by recent purchasing manager surveys. It is clear that the UK economy remains fragile. Companies are grappling with high inflation, rising interest rates, and a tight labor market. Against this backdrop, some economists even predict a recession starting at the end of 2023.

Regarding today's technical picture for GBP/USD, demand for the pound sterling is mounting. The pound sterling will rise only after bulls gain control over the 1.2705 level. Regaining this range will boost hopes for recovery to 1.2740 and 1.2780, after which we can talk about a surge to around 1.2810. If the pair falls, bears will attempt to take control over 1.2660. If they succeed, a breakout of this range will hurt bulls' positions and push GBP/USD to a low of 1.2620, with the potential to drop further to 1.2590.

Meanwhile, pressure on the euro remains the same. To regain control, buyers should keep the price above 1.1010. This would pave the way to 1.1060. From there, the price may climb to 1.1110. However, it would be quite difficult without support from major traders. If the pair drops, I expect significant action from major buyers only around 1.0970. If they fail to be active, it would be wise to wait for a low of 1.0930 or consider long positions from 1.0900.