EUR/USD

Higher Timeframes

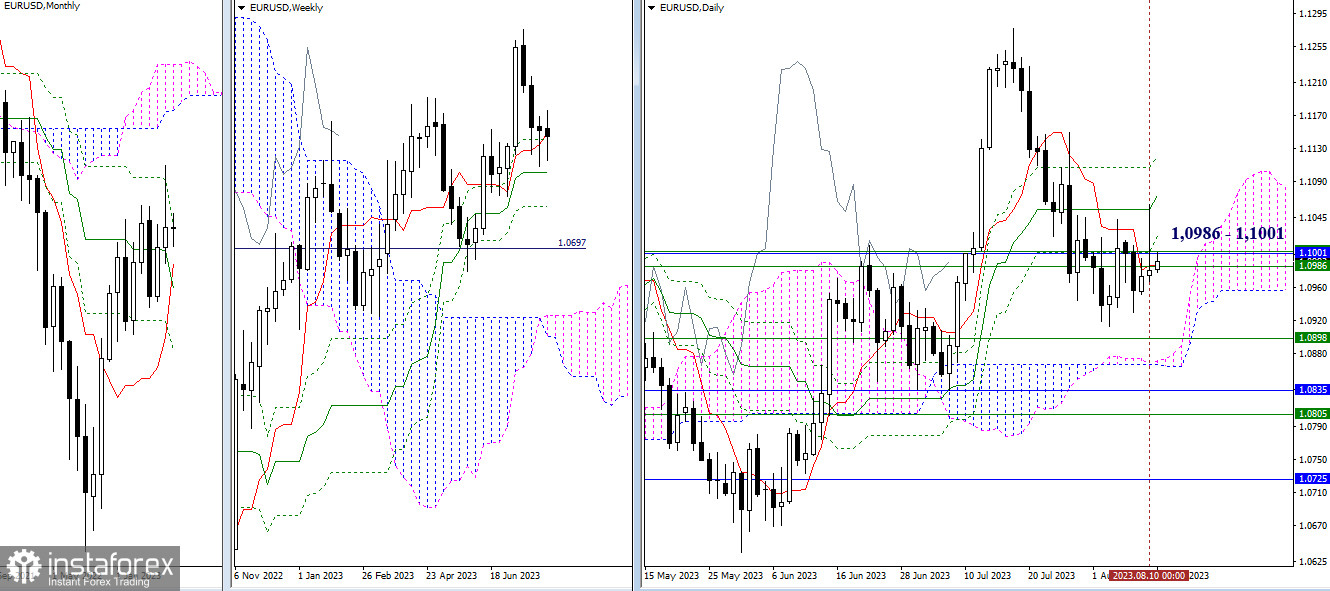

Bulls attempted to test the resistance of the daily medium-term trend (1.1055) yesterday, but couldn't sustain the momentum. As a result, the pair closed the day below a cluster of levels (1.0986 – 1.1001). Today concludes the week, and the outcome is of interest. The lack of distinct achievements increases the chances of the return of bearish activity. The broad support zone remains the focus in the current situation: 1.0898 – 1.0864 – 1.0835 – 1.0805 – 1.0725.

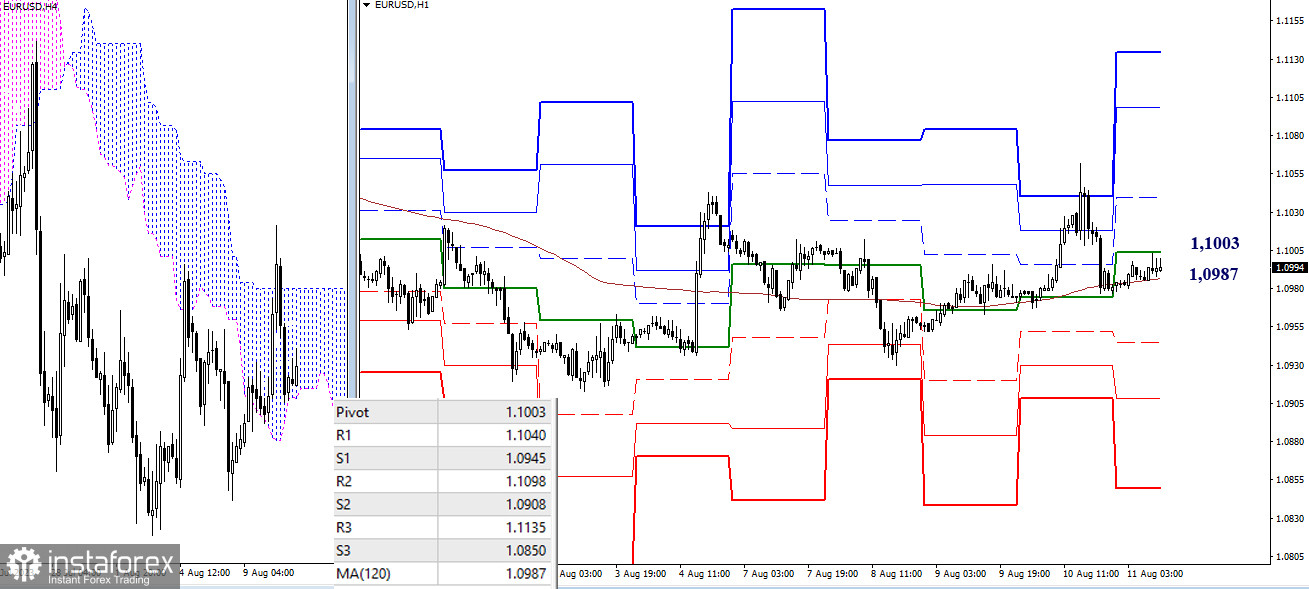

H4 - H1

The key levels of the lower timeframes, 1.0987 – 1.1003 (central pivot point + weekly long-term trend), today align with the attraction and influence levels of the higher timeframes (1.0986 – 1.1001). Thus, this interaction may assist in achieving a more reliable outcome. If a directional movement develops, the intraday targets are the classic pivot points. For bulls, the resistance levels are (1.1040 – 1.1098 – 1.1135), and for bears, the support levels are (1.0945 – 1.0908 – 1.0850).

***

GBP/USD

Higher Timeframes

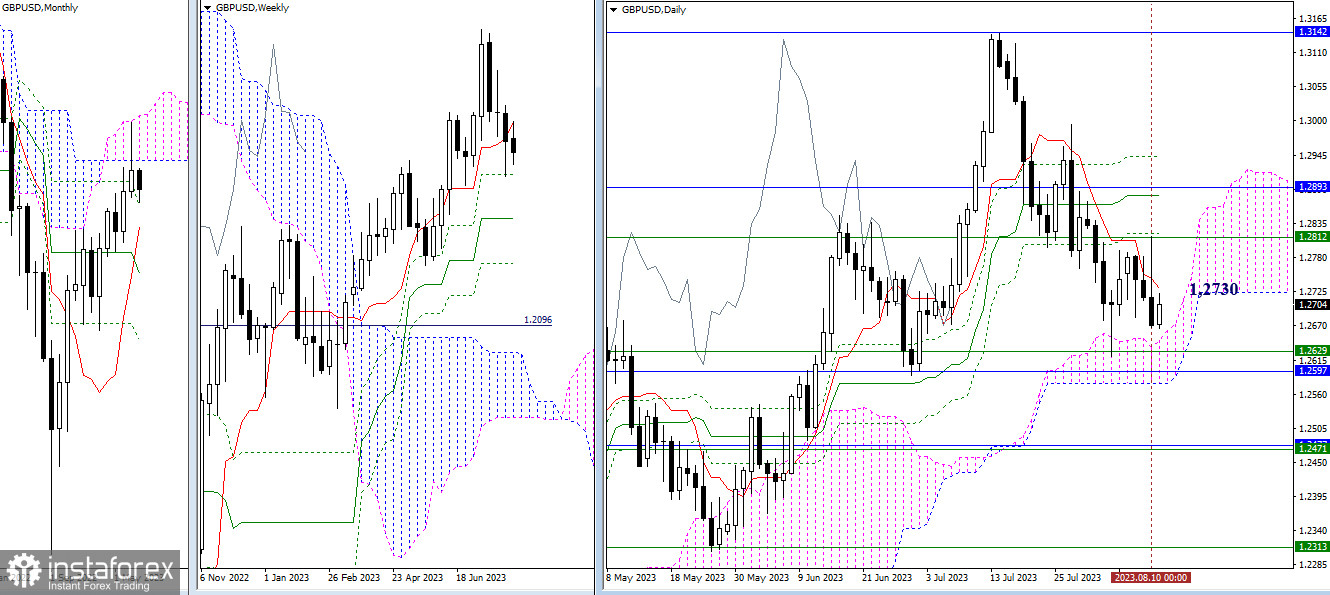

Bulls failed to change the game yesterday. After testing the weekly short-term trend (1.2812), they lost momentum. Conversely, the bears managed to close the day near the support zone that merges levels from various timeframes: 1.2646 – 1.2629 – 1.2597 – 1.2577. The nearest resistance today can be pinpointed at 1.2730 (daily short-term trend), and the path is still obstructed by 1.2812 (weekly short-term trend).

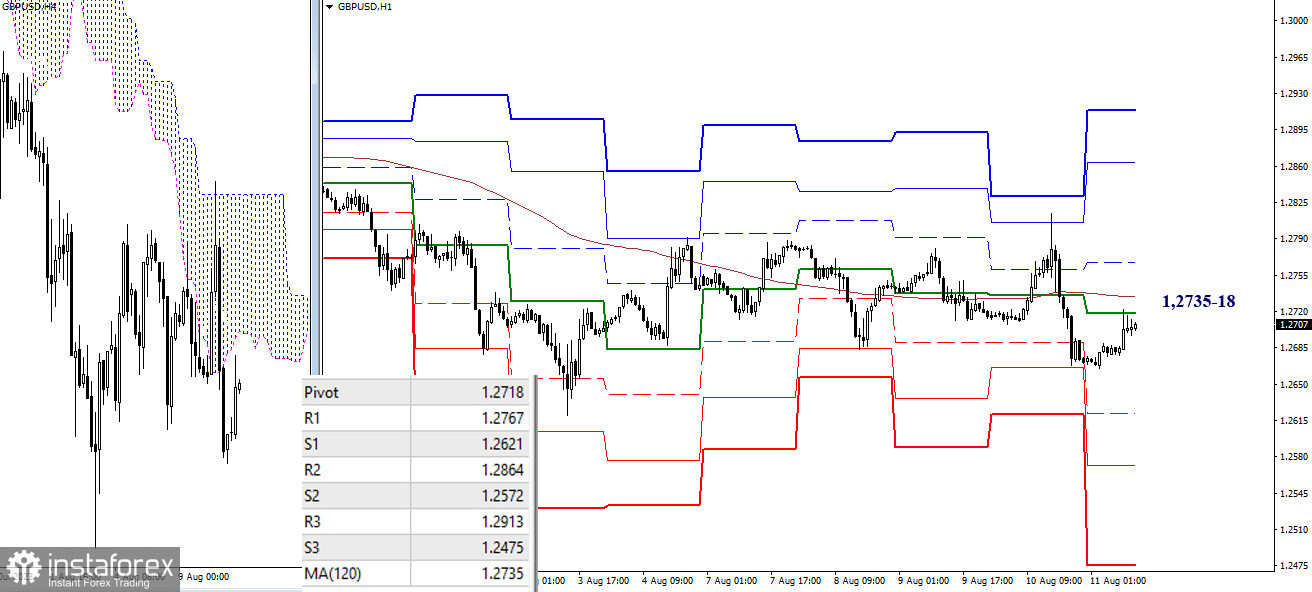

H4 - H1

On the lower timeframes, the pair continues to revolve around key levels, which today are situated around 1.2735-18 (central pivot point + weekly long-term trend). At the moment, these levels are being tested from below. Possessing these key benchmarks determines the advantage. So if the pair operates below these key levels, the advantage lies with the bears, with intraday targets at 1.2621 – 1.2572 – 1.2475 (support levels of classic pivot points). However, if the pair manages to secure above 1.2735-18, the focus with a bullish development will be directed to 1.2767 – 1.2864 – 1.2913 (resistance levels of classic pivot points).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)