Subdued Euro Post-CPI Data

Morning Brief: ECB Statements and CPI Implications

In early 2024, EUR/USD shows consolidation, struggling to surpass the 1.09 or 1.10 mark. Recent ECB statements suggest no imminent rate cuts, impacting market expectations. The ECB's Philip Lane indicates a mid-year review for potential rate adjustments, while others like Nagel and Villeroy suggest later cuts. Holzmann voices uncertainty, hinting at stable rates through the year. German CPI data, rising from 3.2% to 3.7% y/y in December, reflects persisting inflation in the Eurozone, challenging the ECB's stance.

The US Factor and EUR/USD Movements

Comparatively, the US economic landscape presents stronger data, hinting at a potentially stronger dollar in the short term, especially with no ECB rate cuts expected in the first half of 2024. This scenario could shift with any weak US economic data releases.

Technical Market Outlook: Bearish Trend and Resistance Zones

EUR/USD broke below the 1.0928 support level post-German CPI announcement. Bears now eye 1.0877, with a potential dip to December 2023 lows at 1.0723. For bulls, overcoming the 1.1011 - 1.1018 resistance is crucial for a trend reversal.

Indicator Insights: Understanding Market Sentiments

- Trend Analysis:

- The downtrend is evident with the price below the 100-period EMA and 50-period DEMA, indicating these as dynamic resistance levels.

- Candlestick Patterns:

- A Bearish Engulfing pattern signals a potential downtrend continuation, while a Hammer pattern suggests a possible bullish reversal attempt.

- Support and Resistance Levels:

- Marked support and resistance levels provide key trading zones.

- Technical Indicators:

- RSI near 35.42 implies potential for further decline before considering oversold conditions.

- Market Sentiment:

- Bearish Engulfing near resistance levels indicates bearish sentiment, countered by the Hammer pattern's bullish reversal potential.

Key Points to Watch: Trading Insights for Different Scenarios

- Bullish Scenario:

- Confirmation of the Hammer pattern and a break above resistance and moving averages could signal a bullish trend.

- Bearish Scenario:

- A break below the Hammer's low might indicate a downtrend continuation.

EUR/USD H1 Intraday Indicator Analysis:

- Most technical indicators and moving averages signal a sell, reflecting a predominant bearish sentiment.

Sentiment Scoreboard:

- The general sentiment leans bullish, though recent days show a more balanced outlook.

Weekly Pivot Points:

WR3 - 1.10093

WR2 - 1.09826

WR1 - 1.09714

Weekly Pivot - 1.09559

WS1 - 1.09447

WS2 - 1.09292

WS3 - 1.09025

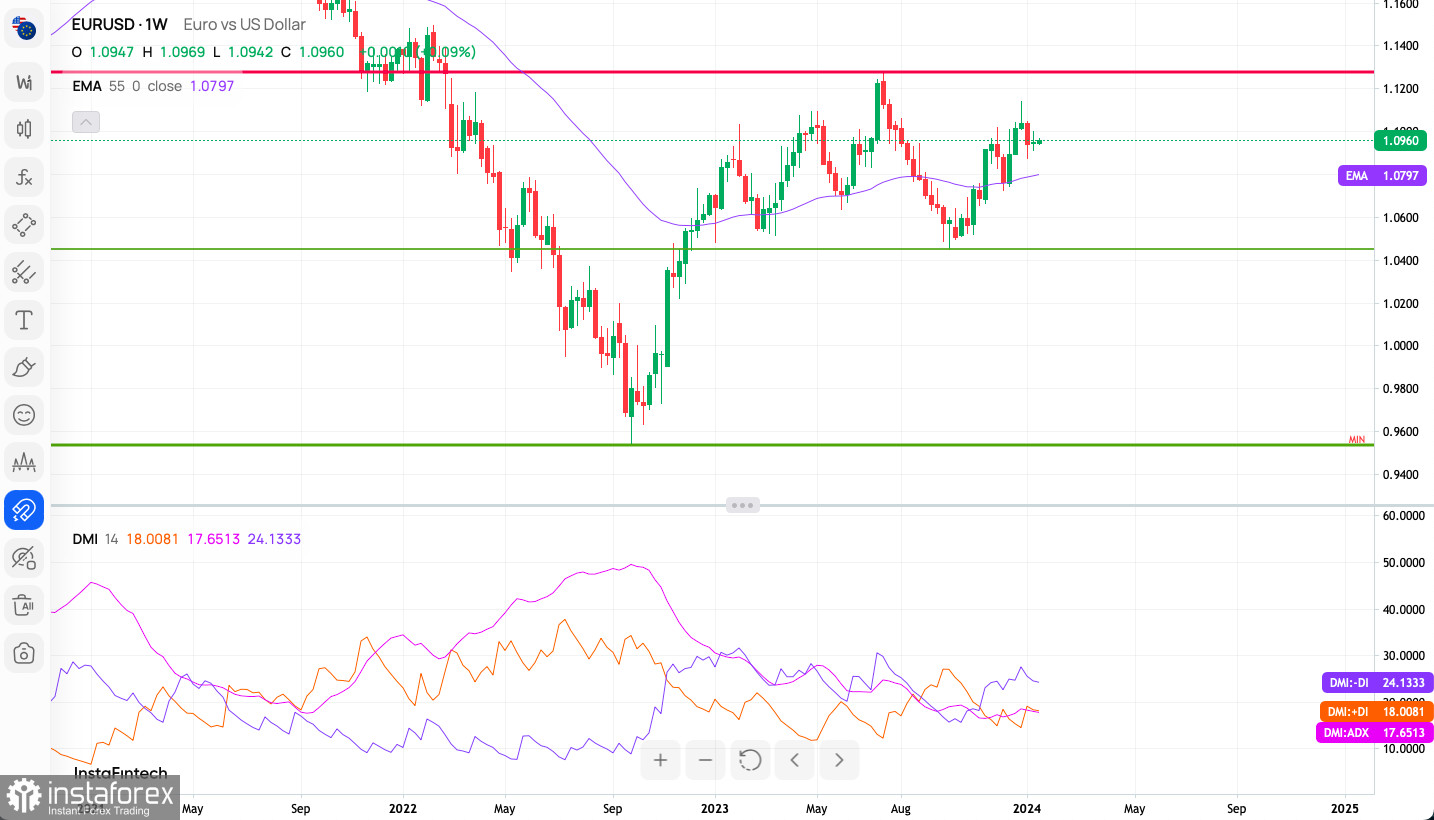

Weekly Time Frame Trading Outlook:

- The 55-period EMA suggests resistance above market price, indicating a bearish sentiment.

- DMI shows stronger downtrend signals, but the ADX indicates a weak trend strength.

- Current price action near resistance level requires close monitoring for potential break or reversal.

Conclusion:

For traders, staying vigilant for market signals is crucial. In a bullish scenario, look for entry points above resistance, while in a bearish scenario, consider the potential continuation of the downtrend, especially near oversold RSI levels. The mixed signals from ECB statements, coupled with CPI data and US economic strength, make the EUR/USD pair an interesting focal point for forex traders.

Useful Links

Important Notice

The begginers in forex trading need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp market fluctuations due to increased volatility. If you decide to trade during the news release, then always place stop orders to minimize losses.

Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. For successful trading, you need to have a clear trading plan and stay focues and disciplined. Spontaneous trading decision based on the current market situation is an inherently losing strategy for a scalper or daytrader.