The euro fell on Friday. It is uncertain whether buyers will be active around the monthly lows. We will discuss the technical outlook in more detail below. Despite recent signs of decreasing inflationary pressure in the eurozone, economists anticipate that the European Central Bank (ECB) will raise interest rates next month.

According to the forecasts, the key rate will increase to 4% in September, up from the current 3.75%. Meanwhile, analysts believe that officials will start cutting borrowing costs only in March 2024, a month earlier than expected. This suggests a stricter approach to monetary policy.

A key focus will be on fundamental statistics, especially inflation. A rise in inflation, which has been observed since the summer, has been caused by higher energy prices. Such a situation is creating difficulties for the ECB, which is still dealing with internal inflationary pressure. Lately, there have been rumors that major central banks are considering ending their over-year-long rate hike campaigns. Recently, President Christine Lagarde mentioned a potential pause in the ECB meeting on September 13–14. However, it is not guaranteed that the regulator will make this decision.

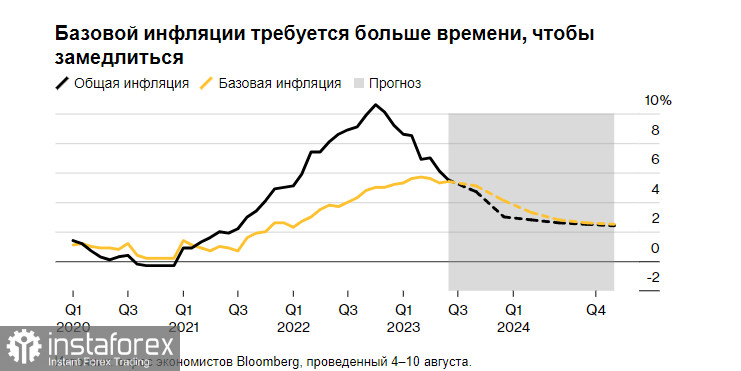

ECB research indicates that core inflation, a closely watched indicator, seems to have reached its peak. Furthermore, a separate consumer survey showed that price growth expectations in the 20 eurozone countries have decreased, still remaining above the 2% target.

Despite this, last week, many analysts increased their inflation forecasts for 2023 and adjusted their predictions for the following years. Financial markets currently estimate a 70% chance of the ECB raising rates by 25 basis points next month.

Apart from inflation, there are growing warnings about economic downturns and potential recessions. The latter half of this year might not be as positive as the first. Fabio Panetta, a member of the Executive Board, urged caution, especially if the regulator aims to meet the inflation target without harming economic activity.

Although the eurozone has avoided recession, Germany, the largest contributor to the eurozone economy, experienced a downturn last winter and stagnated in the second quarter. Economists predict zero growth for the third quarter as German production continues to decline. The forecast for 2024 was also revised to 0.8% from 1%.

The euro's reaction to the current state of affairs is not clear. Regarding today's technical picture for EUR/USD, the pressure on the euro remains the same. To regain control, buyers should keep the price above 1.0970. This would pave the way to 1.1005, a psychological level. From there, the price may climb to 1.1116. However, it would be quite difficult without support from major traders. If the pair drops, I expect significant action from major buyers only around 1.0930. If they fail to be active, it would be wise to wait for a low of 1.0900 or consider long positions from 1.0870.

Meanwhile, pressure on the pound sterling is returning. The pound sterling will rise only after bulls gain control over the 1.2705 level. Regaining this range will boost hopes for recovery to 1.2740 and 1.2780, after which we can talk about a surge to around 1.2810. If the pair falls, bears will attempt to take control over 1.2660. If they succeed, a breakout of this range will hurt bulls' positions and push GBP/USD to a low of 1.2620, with the potential to drop further to 1.2590.