EUR/USD

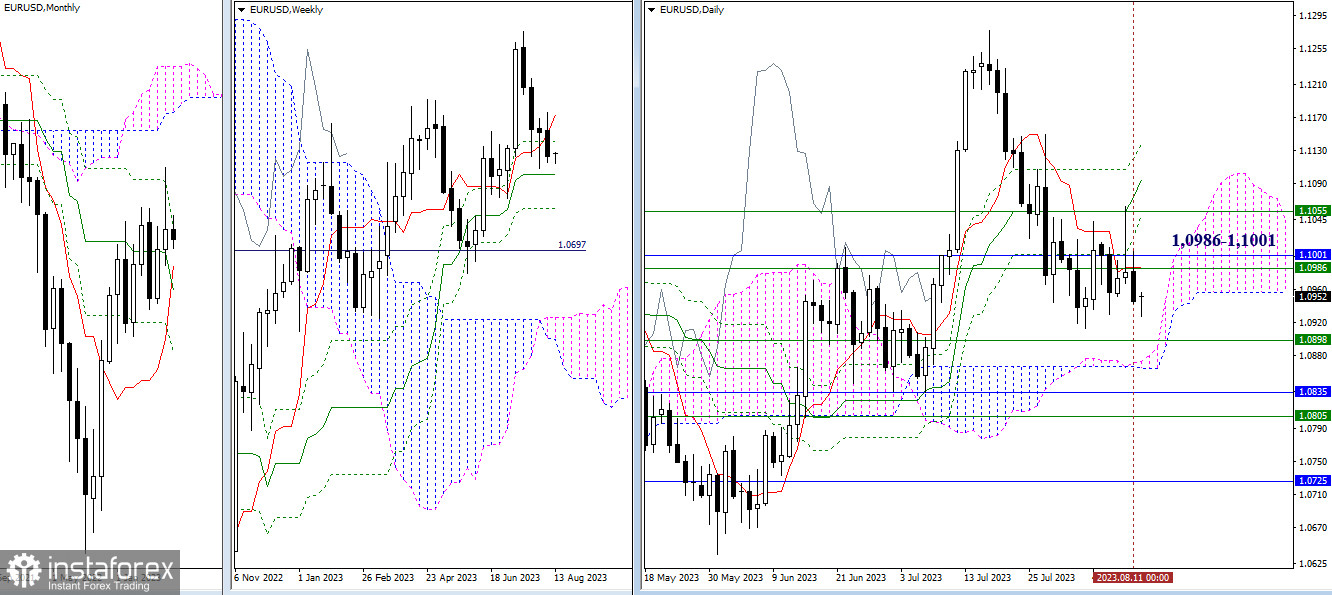

Higher Timeframes

Last week, bullish traders failed to capitalize on the apparent rebound. As a result, the market closed with a bearish sentiment below the accumulated levels in the region of 1.0986-1.1001. If the bears manage to update the low of the current slowdown (1.0913), their focus will be on testing the weekly medium-term trend (1.0898). Subsequently, their objective will be to break through the daily cloud (1.0864) and to eliminate the weekly golden cross (1.0805), reinforced by the monthly short-term trend (1.0835). If bullish activity returns, it will be important for them to break through resistances at 1.0986–1.1001–1.1055 and eliminate the daily Ichimoku cross (1.1094–1.1137).

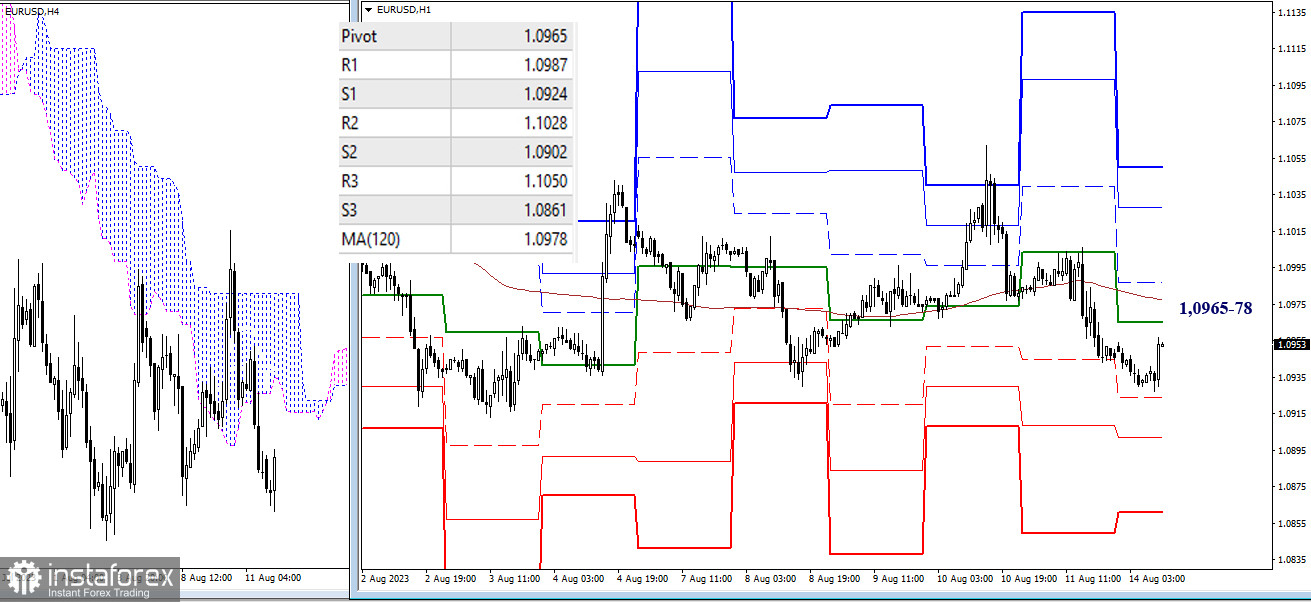

H4 – H1

Currently, the advantage lies with the bears. Targets for the development of bearish sentiment today are located at 1.0924–1.0902–1.0861 (supports of classic pivot points). The key levels of lower timeframes currently serve as resistances at 1.0965-78 (central pivot point + weekly long-term trend). Breaking through which will affect the prevailing balance of power. Further recovery of bullish positions during the day is possible after surpassing resistances of classic pivot points (1.0987–1.1028–1.1050).

***

GBP/USD

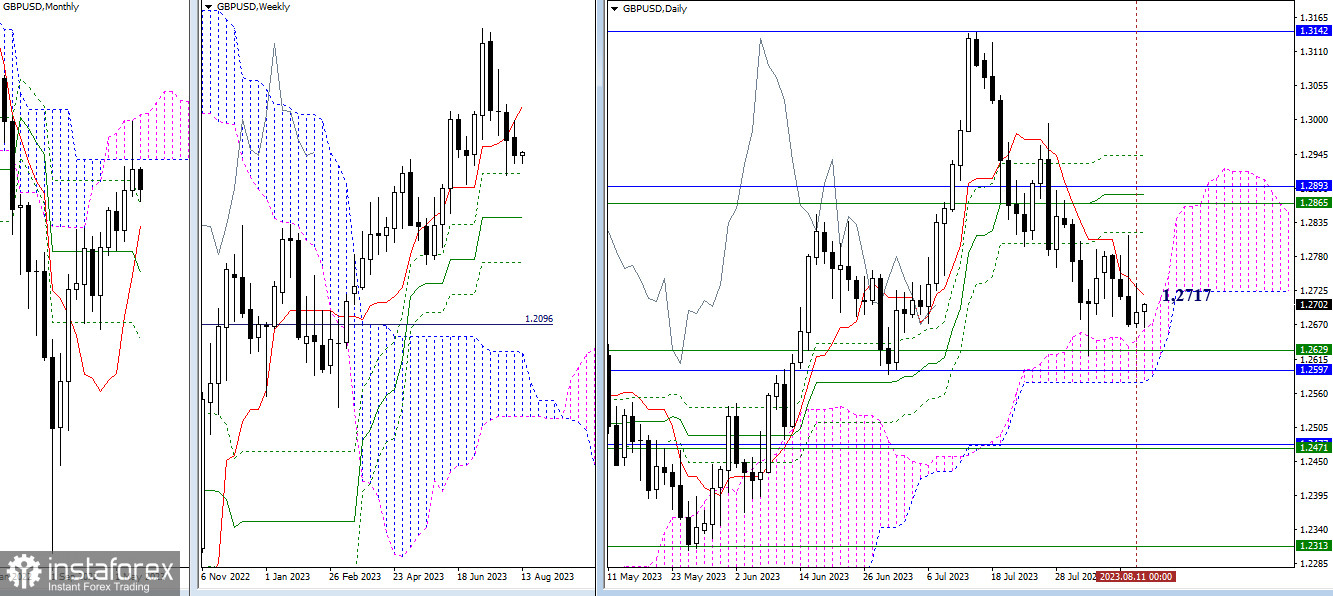

Higher Timeframes

Last week, the market did not manage to exceed the range of the previous week's candle, as the trading range was insubstantial. Consequently, the main tasks facing the market retained their significance. For new bearish prospects, the market needs to overcome the supports of the daily cloud (1.2663–1.2577), strengthened by levels of higher timeframes (1.2597 – 1.2629). For the bullish scenario to unfold, the bulls need to establish themselves above the daily short-term trend (1.2717) and continue rising towards other resistances of the daily Ichimoku cross (1.2819–1.2881–1.2942), which are currently reinforced by the weekly short-term trend (1.2865) and the lower border of the monthly cloud (1.2893). Liquidating the daily cross and securing firmly above the supports of higher timeframes will open up other bullish targets.

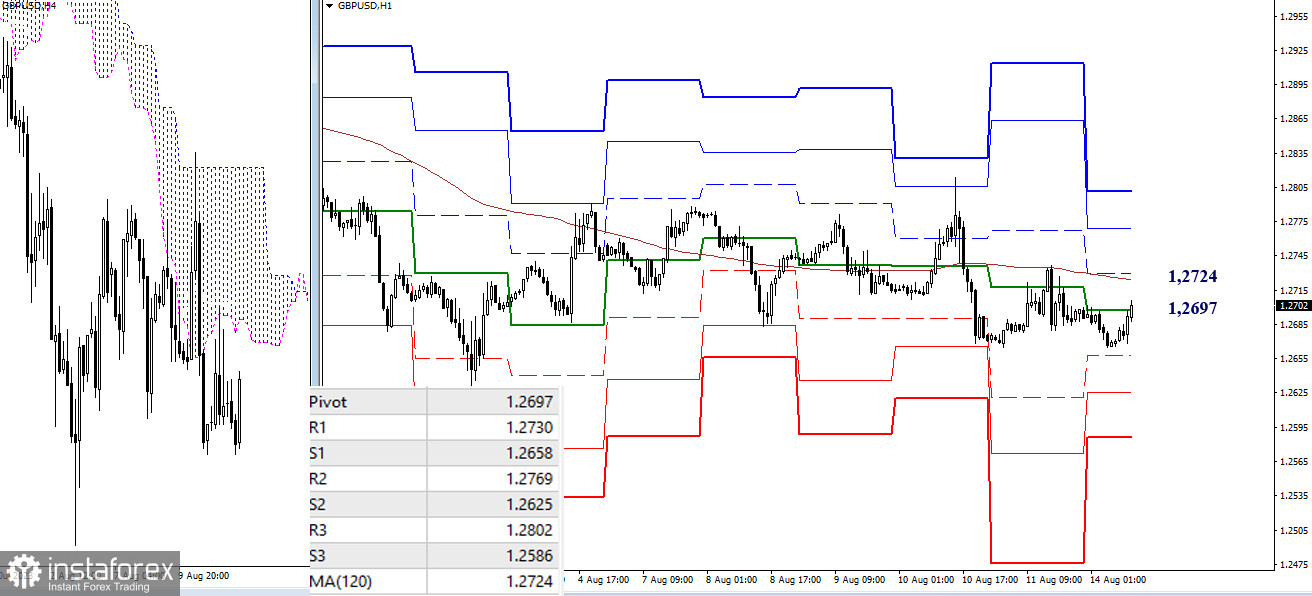

H4 – H1

Bears currently have the advantage on the lower timeframes, but the market has been lingering near key levels for a long time, interacting with them. Right now, it is testing the resistance of the day's central pivot point (1.2697), followed by the weekly long-term trend (1.2724). Establishing above the moving average and its reversal can alter the current balance of power. Additional intraday reference points today are resistances (1.2730–1.2769–1.2802) and supports (1.2658–1.2625–1.2586) of the classic pivot points.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)