The market often mistakes the desirable for the real. When the EUR/USD soared to the region of 18-month highs in mid-July, investors spoke of the end of the federal funds rate hike cycle, about the divergence in the ECB and FOMC monetary policy, the resilience of the Eurozone economy, and the imminent acceleration of China's own economic recovery. Nearly a month was needed to realize that these advantages didn't play out for the euro.

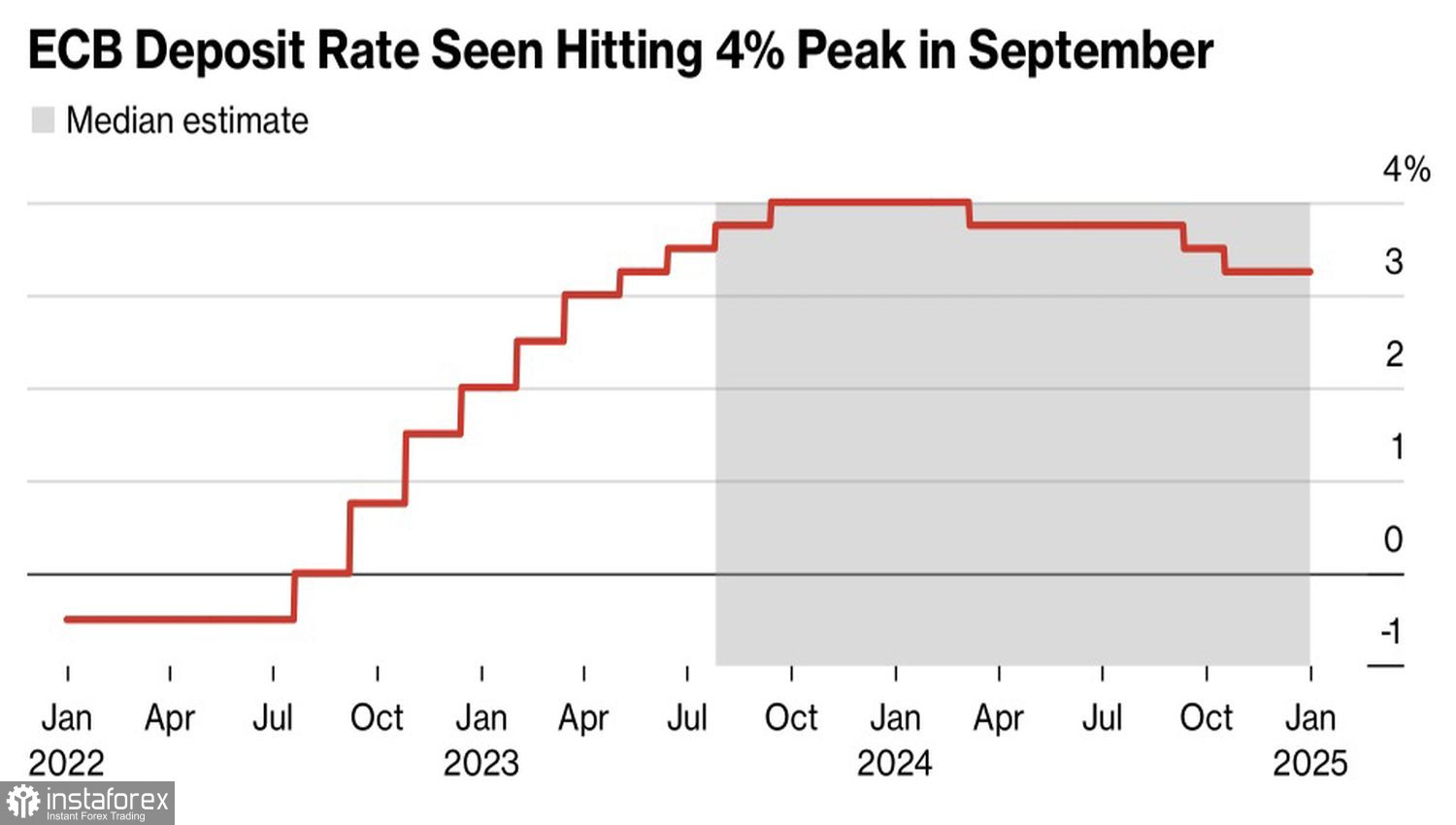

Judging by the disinflation in the U.S., the FOMC's forecast of a 5.75% rate hike will likely not materialize. However, to sink the U.S. dollar, this proved insufficient. As long as borrowing costs remain at a plateau of 5.5%, the USD index will maintain stability. Moreover, there are serious doubts in the market that the ECB's deposit rate will continue to rise. Yes, the latest Bloomberg expert survey suggests its cap is at 4%, but forecasts for reducing borrowing costs have been shifted from April to March 2024. Additionally, specialists polled by Reuters believe that the European Central Bank will miss a step in September.

Dynamics of expectations on the ECB deposit rate

Thus, the EUR/USD bulls cannot benefit either from the end of the federal funds rate hike cycle or from the divergence in the ECB and FOMC monetary policy. At the same time, the alarming dynamics of European Purchasing Managers' Index signals the incorrectness of judgments about the resilience of the currency bloc's economy.

The euro has almost its only trump card left – China. But it's not playing out either. The yuan's drop to its lowest mark since the beginning of the year indicates that instead of gaining momentum, China's economic recovery has lost it. Disappointing data on foreign trade, business activity, lending, and other indicators do not allow the EUR/USD bulls to counterattack.

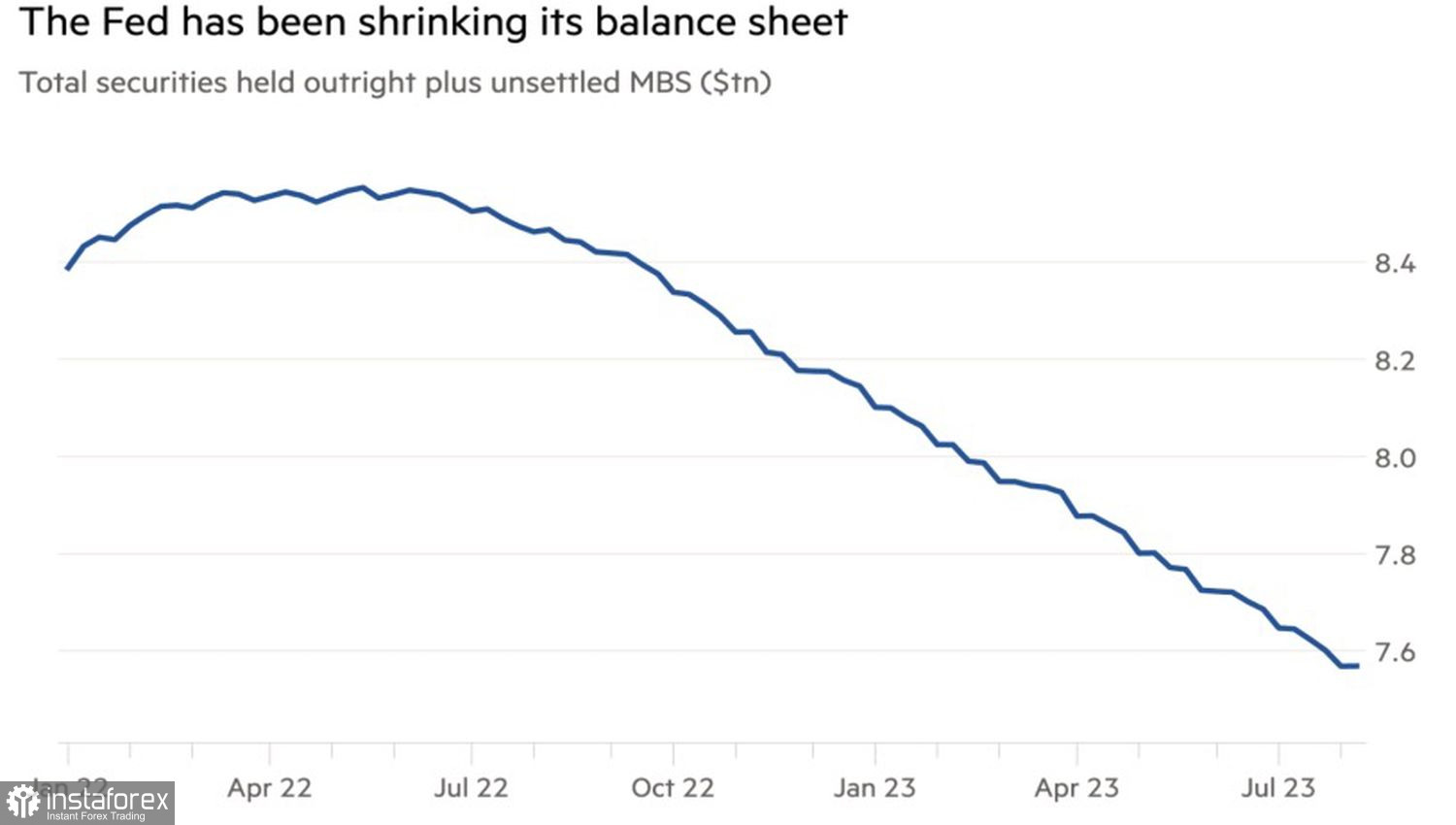

On the other hand, the U.S. dollar has found a new growth driver. It is the rally in Treasury bond yields that enhances the attractiveness of American assets and contributes to capital inflow to the States. The rise in debt obligations rates is due to both the strength of the economy, large-scale Treasury emissions, and the lowering of the credit rating, as well as the acceleration of the FOMC's quantitative tightening program. It's one thing when the central bank gets rid of securities amidst rate hikes, another when the Treasury throws bonds worth trillions of dollars at auctions.

Dynamics of the FOMC balance

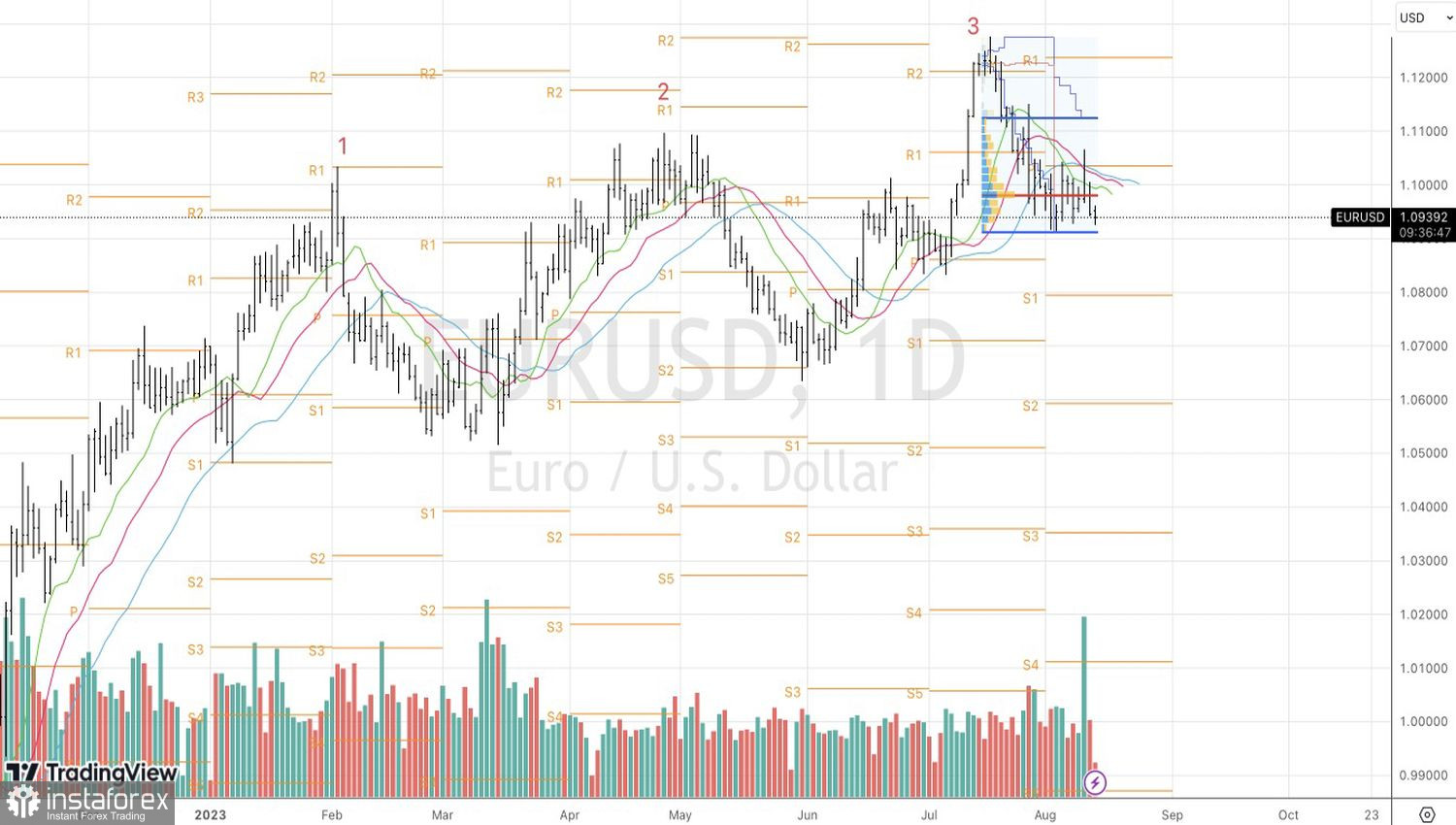

Thus, the weakness of the euro's advantages combined with the favorable external background for the U.S. dollar provides a solid foundation for the continuation of the main currency pair's correction. Nordea expects to see it at 1.07 by the end of the year, and such a forecast has a good chance of materializing.

Technically, on the daily chart, the EUR/USD continues to realize the patterns "Three Crows" and "1-2-3." Breaking the fair value at 1.091 will allow increasing the shorts formed from 1.1065 and 1.0965.