The GBP/USD currency pair also traded lower on Monday, but the pound showed growth during the day. Today, it is struggling to determine its direction. The reason is that three important reports were released in the UK this morning, each showing significant value. These three reports must clearly answer whether the economic data is positive or negative for the pound. But we will discuss these reports a bit later.

In our "Weekly Preview" article, we said there would be a lot of economic data, but it would hardly provoke a strong market reaction. We can see a 50–60 point movement after each set of reports, but they are unlikely to impact market sentiment fundamentally. So far, everything is going according to plan. The pair remains below the moving average line; it tried hard to correct itself last week. The correction did not occur, as the price could not establish itself above the moving average. Therefore, we come to the unequivocal conclusion that the market is currently bearish. However, even today, when the British currency had a basis for strong growth, it did not rise.

Of course, the day is not over, but we still believe the pound's only direction is down. Even considering the recent 500-point drop, it is not enough. We switch to the 24-hour timeframe, and what do we see? Another ordinary retracement, within which the price can't even get below the Ichimoku cloud, even though it is very close. We have seen many such retracements in the last six months, and an unjustified upward trend has been restored each time. Therefore, logically, the pound should continue to fall.

Unemployment rose, and the number of unemployment claims fell.

So, the British pound rose 35 points in 5 minutes this morning, then fell by the same amount over the next hour. That's all you need to know about the strength of the market's reaction to three fairly important reports. However, we did warn traders that the response would be weak. Nevertheless, the pair's movement today could have been much stronger, as the values of all three reports were significant.

The unemployment rate rose to 4.2% compared to a forecast of 4.0%. The number of unemployment benefits claims increased by 29,000 against a forecast of -7,300. Meanwhile, wage growth accelerated to 8.2% compared to a forecast of 7.3%. What do all these numbers mean? The unemployment rate and claims increase negatively affect the pound sterling and the British economy. However, wages grew much stronger in June than expected, which means they will again fuel inflation, as the Bank of England has repeatedly warned. So, the British regulator needs to raise rates again because inflation risks rising again instead of falling. And it is already far from its target level. Andrew Bailey's forecasts of 5% in the fall look similar to his predictions of inflation halving at the beginning of the year. They may come true, but the 2% target is already a long-term prospect for the BOE.

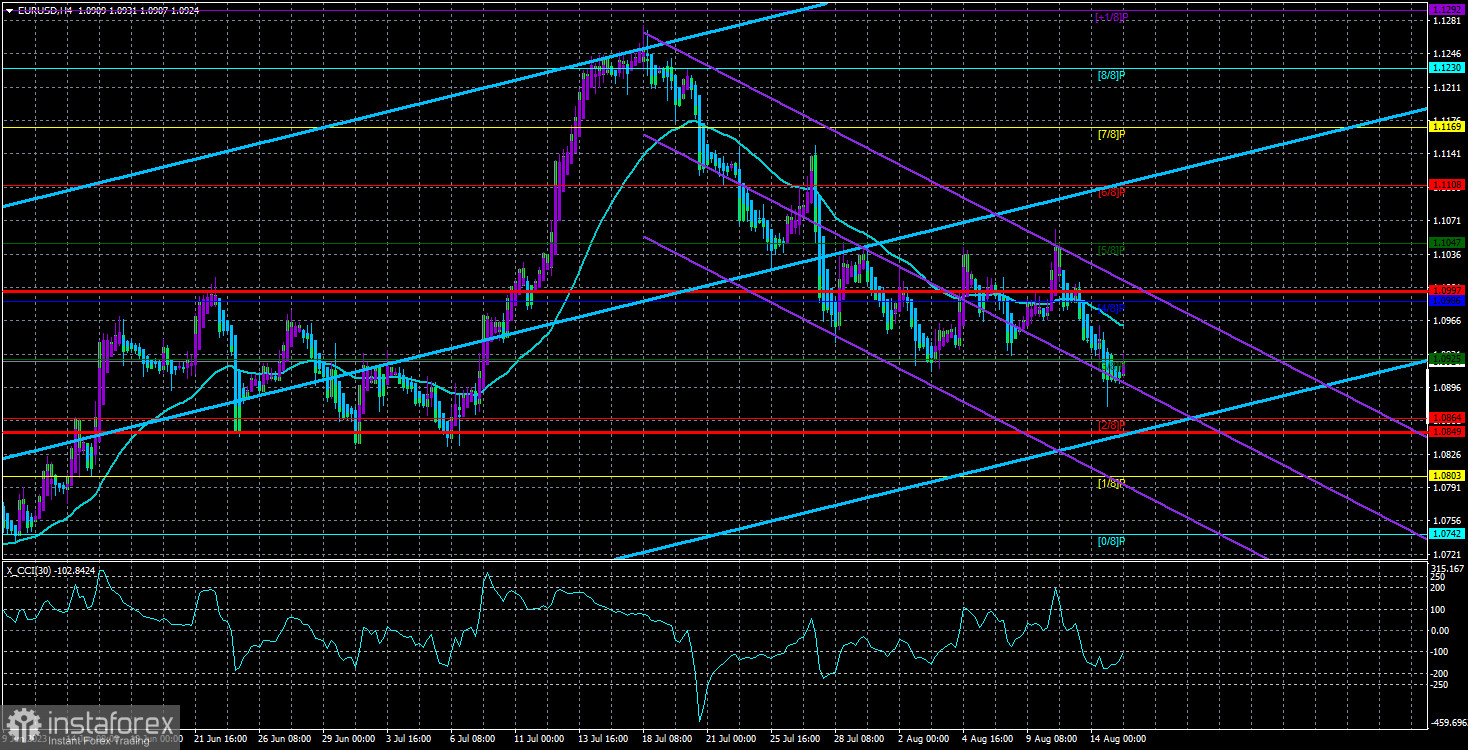

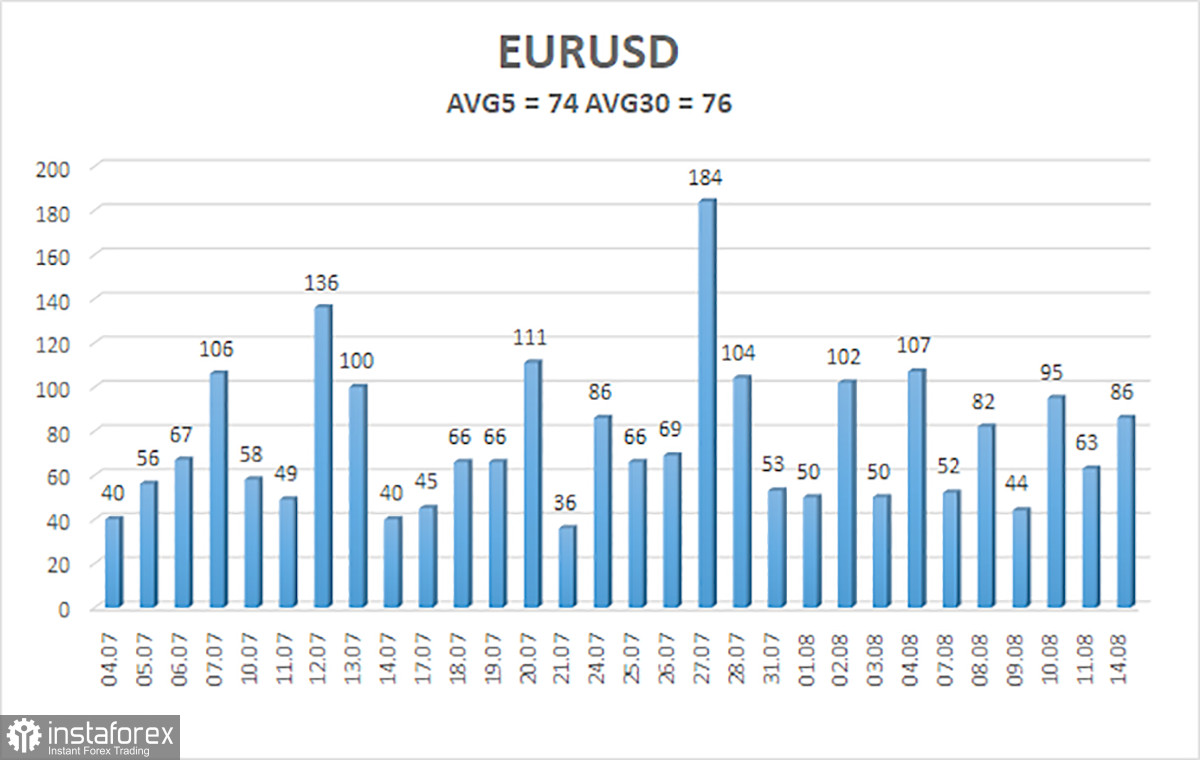

The average volatility of the GBP/USD pair over the last five trading days is 98 points. For the pound/dollar pair, this value is considered "medium." Therefore, on Tuesday, August 15, we expect movement within the range limited by levels 1.2606 and 1.2802. A reversal of the Heiken Ashi indicator back down will signal a resumption of the downward movement.

The nearest support levels:

S1 – 1.2634

S2 – 1.2573

The nearest resistance levels:

R1 – 1.2695

R2 – 1.2756

R3 – 1.2817

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe continues to be below the moving average. At this time, short positions with targets of 1.2634 and 1.2581 remain relevant, which should be opened in the event of a reversal of the Heiken Ashi indicator downwards. Long positions can be considered if the price is fixed above the moving average with targets of 1.2756 and 1.2802.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is now strong.

Moving Average Line (settings 20,0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI Indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.