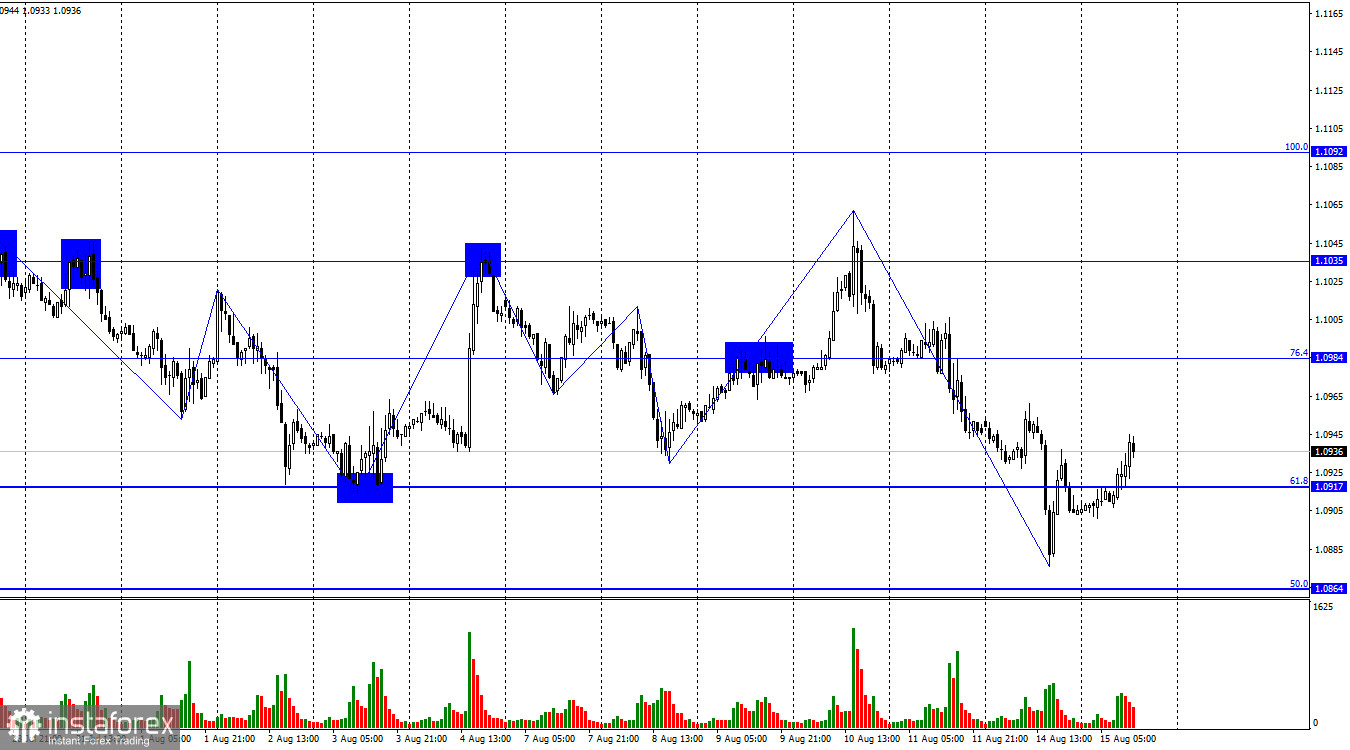

Hello, dear traders! On Tuesday, the EUR/USD pair dropped below 1.0917, the 61.8% Fibonacci retracement level, but shortly after, it resumed gains and rose above that level. Thus, the euro has every chance of extending gains to 1.0984, the 76.4% retracement level. If the price fixes below 1.0917, the euro will most likely slide to 1.0864, the 50.0% Fibonacci level.

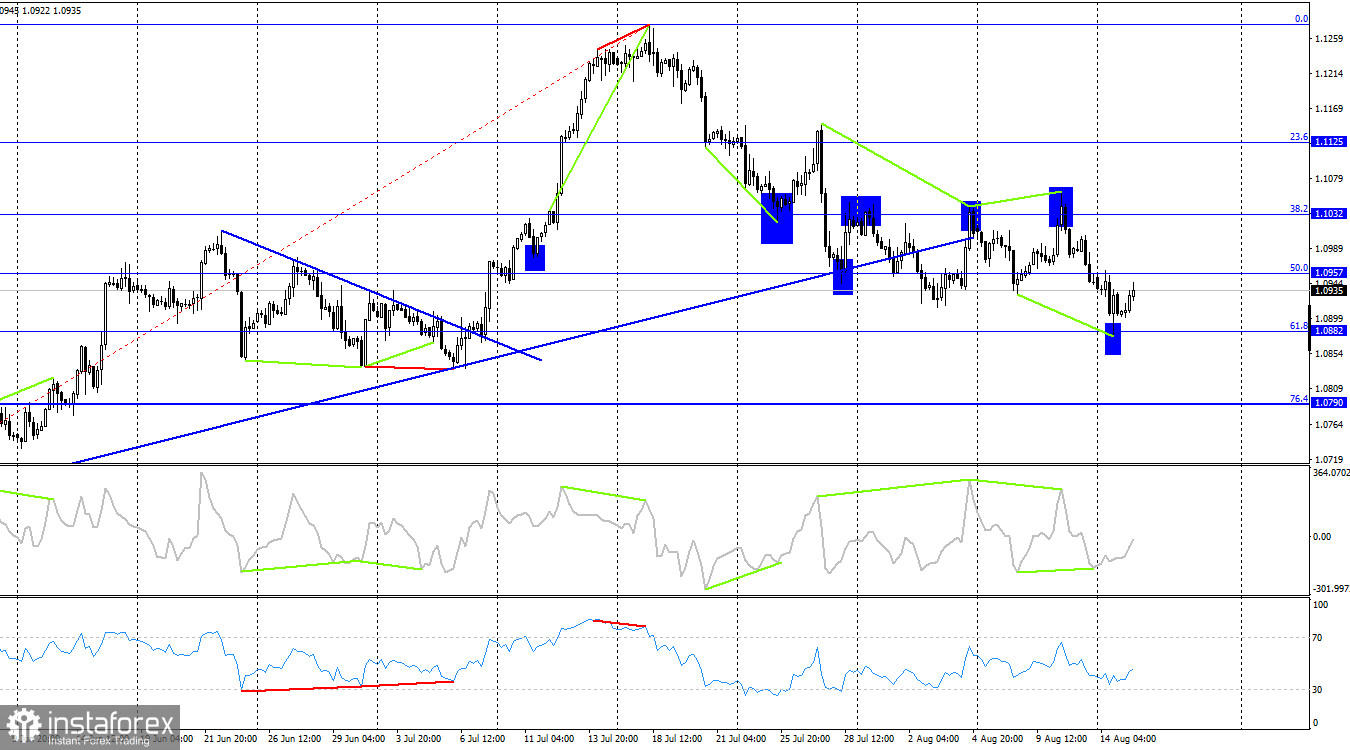

From a technical point of view, waves point to a bearish trend and a continued decline in the European currency. Given that the last wave is downward, one should expect the formation of an upward one. The market has already seen some gains, which might mark the beginning of an upward wave. However, the recent downward wave has been far greater than all waves of the past two weeks. In my view, this suggests that the market will remain under the control of bears. Therefore, after completing the ascending wave, a trend reversal is unlikely.

Today's macroeconomic calendar includes few important news releases from the euro area. Nevertheless, traders may take notice of Germany's Economic Sentiment Index, which increased to -12.3 from -14.7, and the EU Economic Sentiment Index, which rose to -5.5 from -12.2. Notably, traders expected weaker values, hence a rise in the euro in the first half of the day was logical. However, its rally is likely to be short-lived. Despite several upcoming reports from both the US and the EU that might support the euro, market sentiment remains bearish, limiting its upside potential.

On the 4-hour chart, the pair fixed below the ascending trendline and experienced two rebounds from 1.1032, the 38.2% Fibonacci level. As a result, the euro dipped to 1.0882, the 61.8% retracement level. Nevertheless, a rebound from that level brought Europe's single currency up to the level of 1.0957. In addition, a bullish divergence occurred according to the CCI indicator. if the price bounces off the 1.0957 mark, the euro will resume losses, heading back toward 1.0882 and 1.0790.

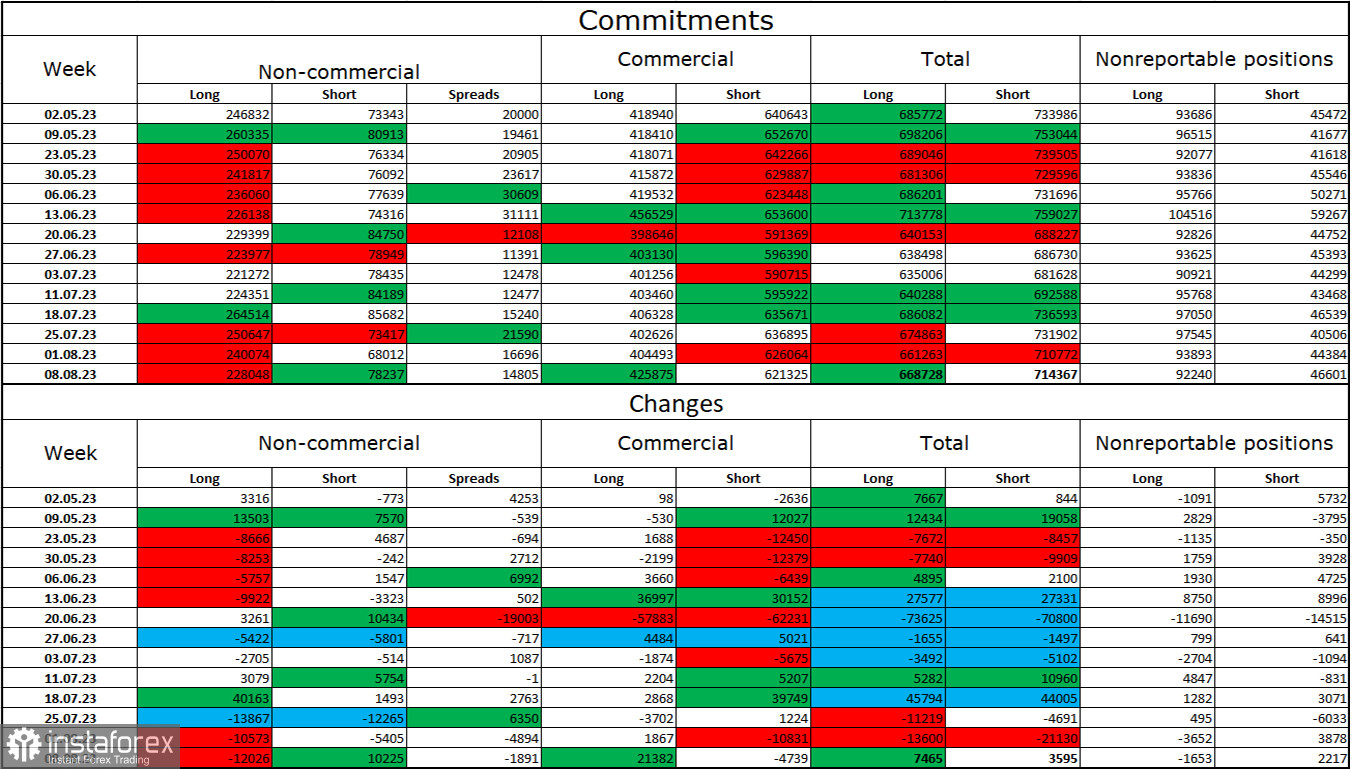

Commitments of Traders (COT):

In the latest reporting week, speculators closed 12,026 long contracts and opened 10,225 short contracts. The sentiment of major traders remains bullish but still has slumped over the past week. The total number of long contracts now stands at 228,000, while short contracts amount to 78,000. Bullish sentiment persists, but the balance of power is expected to continue shifting in the near future. The high volume of long positions suggests that buyers may keep closing them. In my view, the euro is likely to extend weakness in the coming weeks. Moreover, the ECB increasingly signals an imminent end to monetary policy tightening.

Economic calendar for US and EU:

EU - ZEW Economic Sentiment Index

US - Retail Sales

On August 15, the macroeconomic calendar contains two news releases that are worth the attention of traders. The impact of fundamental factors on market sentiment throughout the day is expected to be weak.

EUR/USD forecast and trading tips:

Earlier, I recommended going short at 1.1035 on the 1-hour chart, counting on a decline to the levels of 1.0984 and 1.0917. Both targets have been achieved. New short positions can be opened if the price bounces off 1.0984 or closes below 1.0917. Going long will be relevant in case the price closes above 1.0917. However, the scenario suggesting a strong rally in the euro is unlikely.