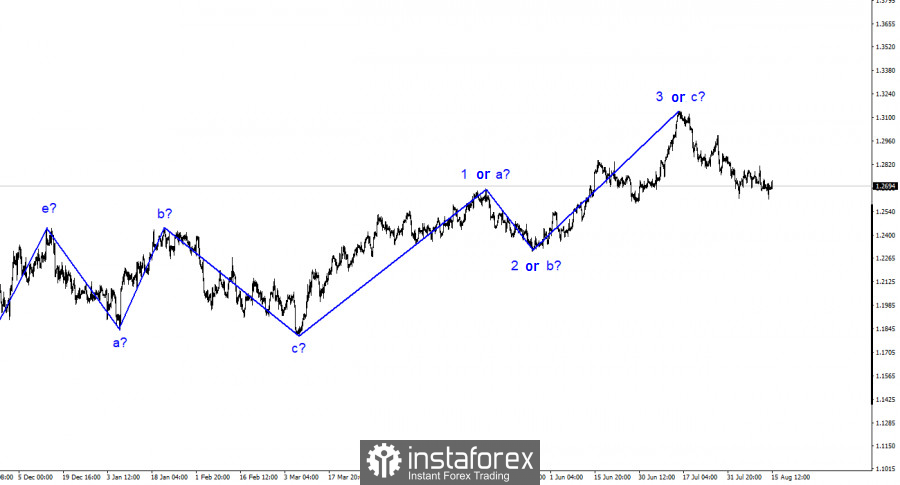

The wave analysis for the GBP/USD pair remains relatively simple and clear. The construction of an upward wave 3 or C is complete, and the presumed new downward trend segment has begun, which could theoretically still be a fourth wave. In my opinion, the British currency has no reason to resume the upward trend (and many reports and events confirm my view). However, the wave pattern has transformed into a more complex form, and wave 3 or C has taken on a more extended shape than many analysts expected several months ago. The entire upward trend segment may still take on a five-wave form if the market finds new reasons for long-term purchases.

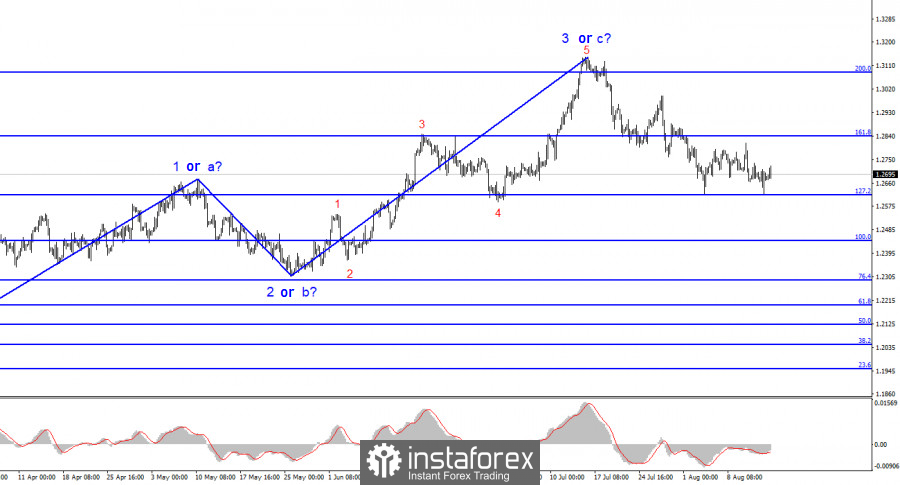

In any case, I expect the continuation of the downward wave, which began almost exactly on schedule. If the current wave has a five-wave internal structure, it can be considered the first impulse wave and we can expect further decline of the pound (after the construction of a corrective wave 2 or B). However, today, there was a second unsuccessful attempt to break through the Fibonacci level of 127.2%, and the recent decline in quotes may be both a fifth wave and a correction within a new ascending wave of a larger scale.

The market has given a mixed assessment of British statistics.

The GBP/USD exchange rate increased by 50 basis points on Tuesday. Throughout the day, we observed an increase in demand for the pound, as I warned yesterday. British statistics were not unambiguous, but two unsuccessful attempts to break through the 1.2620 mark indicated the market's readiness to build a corrective wave. Now the increase can continue to the 1.2840 mark.

Returning to British statistics, I can note that the unemployment rate has risen to 4.2%, and the number of claims for unemployment benefits was higher than market expectations. It may seem that the demand for the pound should decrease today, but the wave picture did not allow this to happen, and the wage report supported it. What does stronger wage growth mean? Only British citizens will spend more money. And if they spend more, prices will also rise. Certainly, not quickly, but they will. After all, it is with this process that the Bank of England is struggling, trying to "quench" inflation by regularly raising interest rates. Consequently, wage growth increases inflation and intensifies the need to continue tightening monetary policy. The connection between the exchange rate of the pound and the central bank's policy is obvious.

I don't think that the current growth of the pound will be long and strong, but the market had and has reasons for buying today. Therefore, we can reasonably expect a 100-point rise.

General conclusions.

The wave pattern of the GBP/USD pair suggests a decline. My readers could have opened sell positions several weeks ago, as I advised, and now they can close them. The 1.2620 mark has been successfully reached. There is a risk of completing the current downward wave if it is wave d. In this case, the construction of wave 5 could begin from the current levels. However, in my opinion, we are now witnessing the construction of a corrective wave within a new downward trend segment. If this is the case, the pair will not rise much higher than the 1.2840 mark, and then the construction of a new downward wave will begin.

On a larger wave scale, the picture is similar to the EUR/USD pair, but there are still some differences. The downward corrective trend segment is completed, and the construction of a new upward trend is ongoing, which may already be completed, or it could take on a full five-wave form.