Analysis of transactions and trading tips on GBP/USD

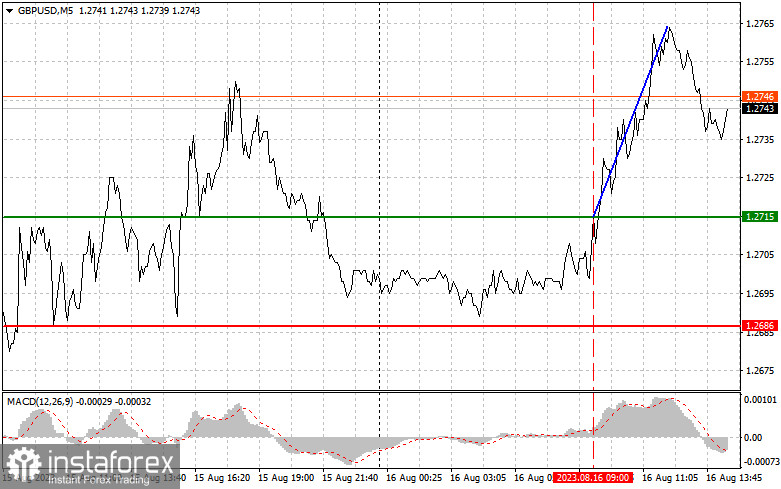

Although the test of 1.2715 coincided with the sharp rise of the MACD line from zero, pound rose by over 50 pips, as the latest data from the UK indicated that inflation remained at a high level. The Office for National Statistics said CPI increased by 6.8% in July, slightly higher than the expected 6.7%. Core prices remained unchanged, showing no decline.

Quite important reports lie ahead, such as the volume of building permits issued and the number of new foundations laid in the US. The change in industrial production volume will also come out, but this may negatively impact dollar demand.

With regards to the upcoming Fed minutes, a hawkish stance by the central bank and expectations of rate hikes will lead to a fall in GBP/USD, whereas an emphasis by Fed representatives on a softer position in the future will strengthen pound's position and lead to the pair's growth.

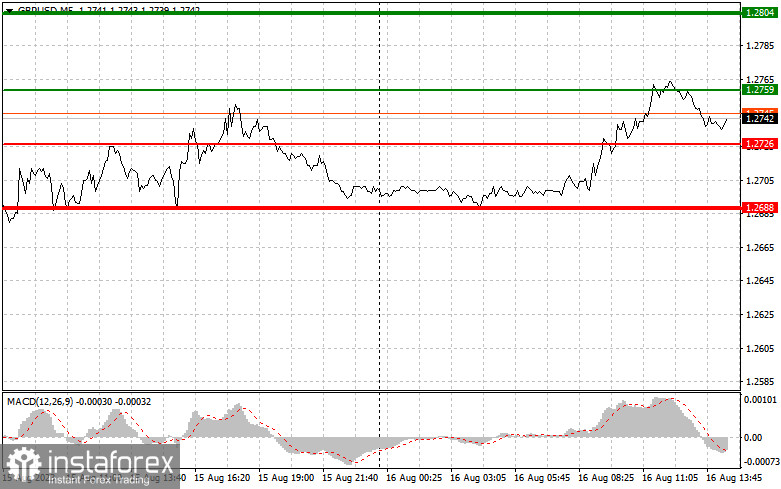

For long positions:

Buy when pound hits 1.2759 (green line on the chart) and take profit at the price of 1.2804 (thicker green line on the chart). Growth will occur in the case of a soft FOMC statement and weak US data. However, when buying, ensure that the MACD line lies above zero or rises from it.

Pound can also be bought after two consecutive price tests of 1.2726, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2759 and 1.2804.

For short positions:

Sell when pound reaches 1.2726 (red line on the chart) and take profit at the price of 1.2688. Pressure will return in the afternoon amid hawkish statements from the Fed. However, when selling, make sure that the MACD line lies below zero or drops down from it.

Pound can also be sold after two consecutive price tests of 1.2759, but the MACD line should be in the overbought area as only by that will the market reverse to 1.2726 and 1.2688.

What's on the chart:

Thin green line - entry price at which you can buy GBP/USD

Thick green line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

Thin red line - entry price at which you can sell GBP/USD

Thick red line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line- it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.