In my previous article, I speculated that the European Central Bank's interest rate would increase once or twice more. However, at the same time, take note that ECB President Christine Lagarde regularly makes statements that the rate should continue to rise for a more extended period, "until we see inflation returning to our 2% medium-term target in a timely manner." Lagarde did not clarify what she meant by "timely". She also didn't mention what rate is needed to return inflation to the target level. Based on this, the market has been openly guessing what level of rate will be the peak, but in recent months it has become disillusioned.

Lagarde's rhetoric increasingly does not correlate with the rhetoric of other members of the Governing Council. Some of them admit a pause as early as September, some think the end is near. Lagarde does not deny that inflation will remain high for a long time, which means that she does not expect the Federal Reserve's method of raising the rate until inflation falls to at least 3% to be realized. Therefore, the market does not envision the ECB rate above 5%, which will be the highest value for the last 20 years.

Other ECB members are also not keen on specifics. For example, Olli Rehn stated that policy easing should not be expected until core inflation slows down. He did not say what level core inflation should fall for the central bank to start lowering the rate. His colleague Klaas Knot said that more rate hikes could lead to stress in financial markets, and in his opinion, inflation expectations are optimistic. There is definitely no consensus in the Governing Council right now.

Therefore, I expect the euro to trade lower for the next few months. During this period of time a three wave structure can be built, which I am waiting for. What follows will depend on when the Fed starts lowering its rate and when the ECB starts lowering its rate. The Bank of England is also unlikely to raise rates in 2024, so we shouldn't expect the pound to rise above the 31 figure for now.

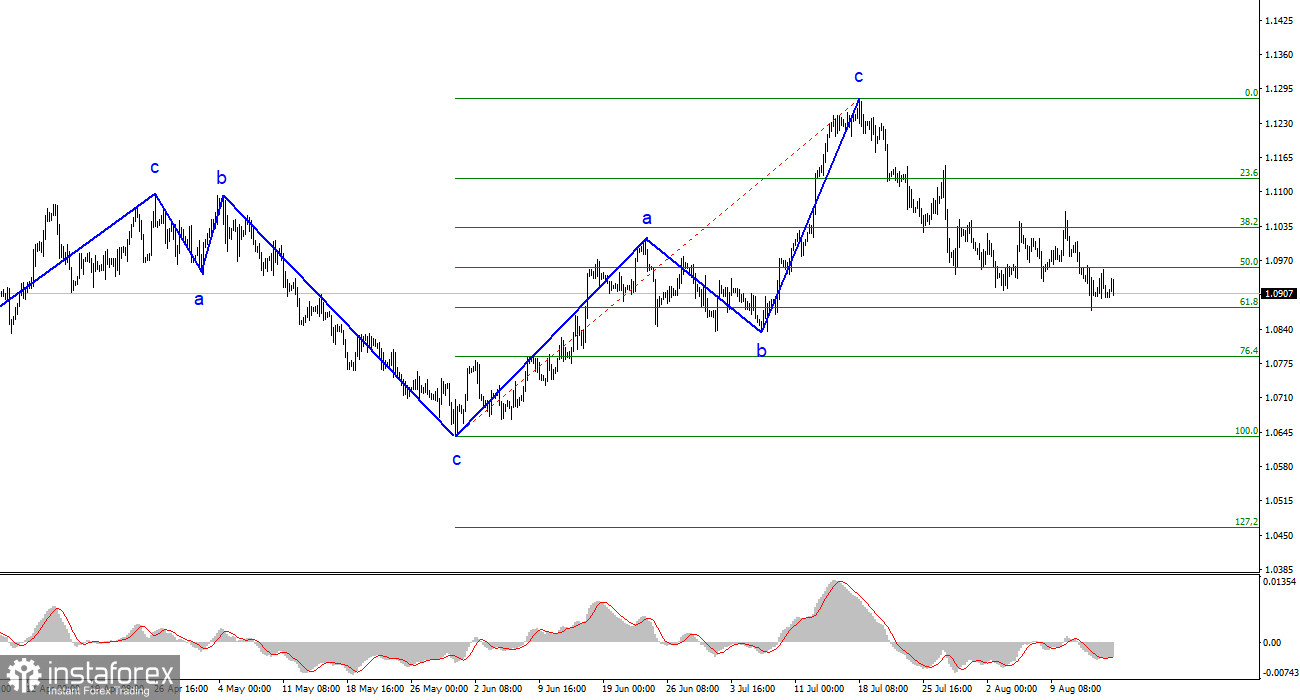

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still consider targets around 1.0500-1.0600 quite realistic, and with these targets in mind, I recommend selling the instrument. The a-b-c structure looks complete and convincing. Therefore, I advise selling the instrument with targets located around the 1.0836 mark and below. I believe that we will continue to see a bearish trend, and a successful attempt at 1.0880 will indicate the market's readiness for new short positions.

The wave pattern of the GBP/USD pair suggests a decline. You could have opened short positions a few weeks ago, as I advised, and now traders can close them. The pair has reached the 1.2620 mark. There's a possibility that the current downward wave could end if it is wave d. In this case, wave 5 could start from the current levels. However, in my opinion, we are currently witnessing the construction of a corrective wave within a new bearish trend segment. If that's the case, the instrument will not rise further above the 1.2840 mark, and then the construction of a new downward wave will begin.