EUR/USD

Yesterday, the euro lost 27 points, and this morning it reached the target level of 1.0865. This level is significant because it corresponds to the day when speculators began a large-scale campaign to buy euros against economic data (July 6th). The market took exactly a month to play back the weekly speculative growth of 4 figures.

Now it is logical to assume that after consolidating below 1.0834 (July 6th low), the euro will continue its medium-term decline. The first target is 1.0780 - the high on June 2nd.

On the four-hour chart, a slight convergence between the price and the Marlin oscillator is already forming. If the price consolidates below 1.0865, the convergence will not form, and the price will continue to move towards 1.0834.

If the convergence is confirmed, the price will linger in the 1.0865-1.0924 range for a while, as it did in late June-early July.

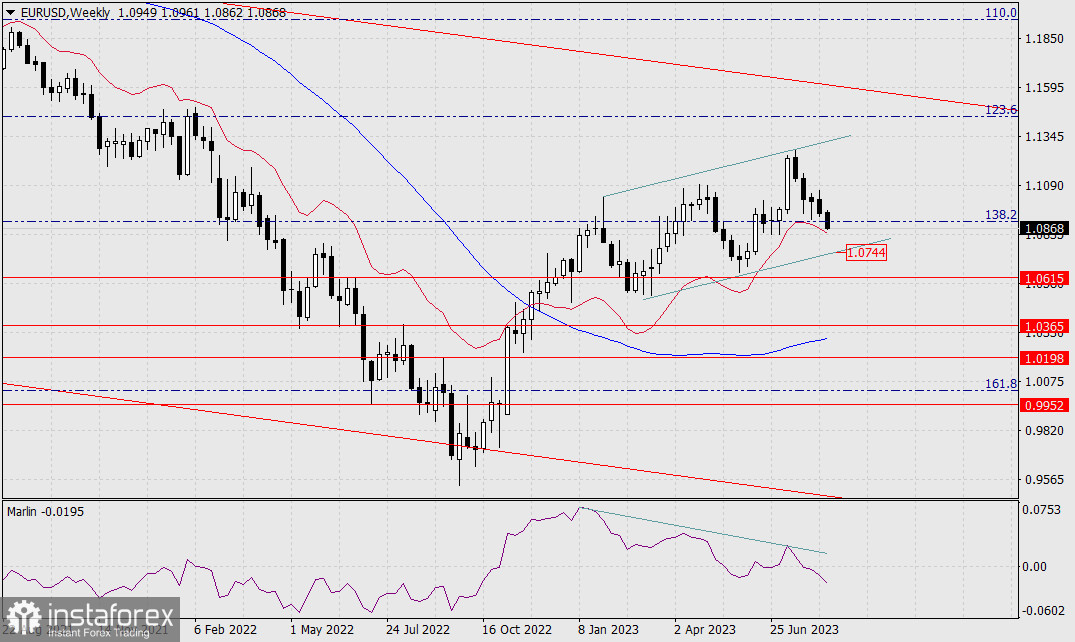

On the weekly chart, the price returned below the Fibonacci level of 138.2%. Since February, a flag-like structure has been forming with a double divergence. A breakout below the lower band of the bar (1.0744) opens deep bearish targets for the euro, even below parity. The Fibonacci level of 161.8% corresponds to the 1.0023 mark.