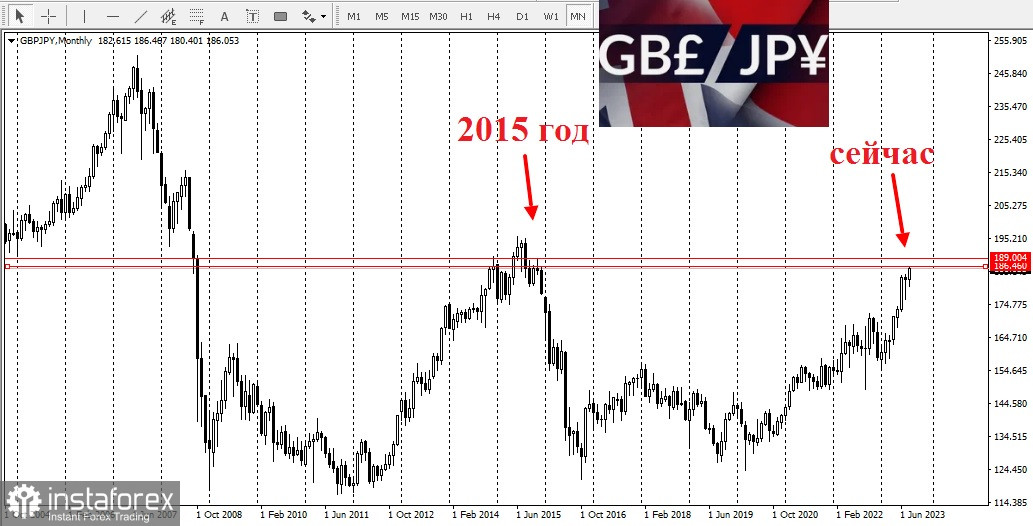

On the back of growing demand for the safe-haven yen, GBP/JPY has been pulling back from a multi-year peak notched up in November 2015.

The benign fundamental background keeps the instrument firmly above 185.00.

Speculation that the Japanese yen's recent weakness may cause some chit-chat from the Japanese authorities or even intervention in the foreign exchange market benefits the Japanese yen which has always been viewed by investors as a safe-haven currency. This, in turn, is a key factor putting the lid on the growth of the GBP/JPY pair.

Moreover, on Tuesday this week, chief Japanese diplomat Masato Kanda said that he would take appropriate steps against excessive currency movements.

However, a more dovish stance taken by the Bank of Japan, which is the only major central bank in the world to maintain negative interest rates, could dampen any meaningful rise in the JPY.

Accordingly, the BoJ's rhetoric is fundamentally different from the one of other major central banks, including the Bank of England, which is again going to raise interest rates at its next monetary policy meeting in September.

Recently, the UK released stronger-than-expected data. For example, the employment report showed on Tuesday that wages in the UK rose at a record fast pace in the second quarter. Accordingly, this increased concerns about stubborn inflation.

An upbeat UK GDP report last week and a higher-than-expected consumer price index released on Wednesday should allow the Bank of England to proceed with tightening monetary policy.

Therefore, this BoE's position will continue to support the British pound and suggests that the GBP/JPY cross is likely to head upward. Therefore, any corrective decline in the pair may still be seen as a buying opportunity. However, this opportunity could be limited ahead of the UK retail sales data due out on Friday.