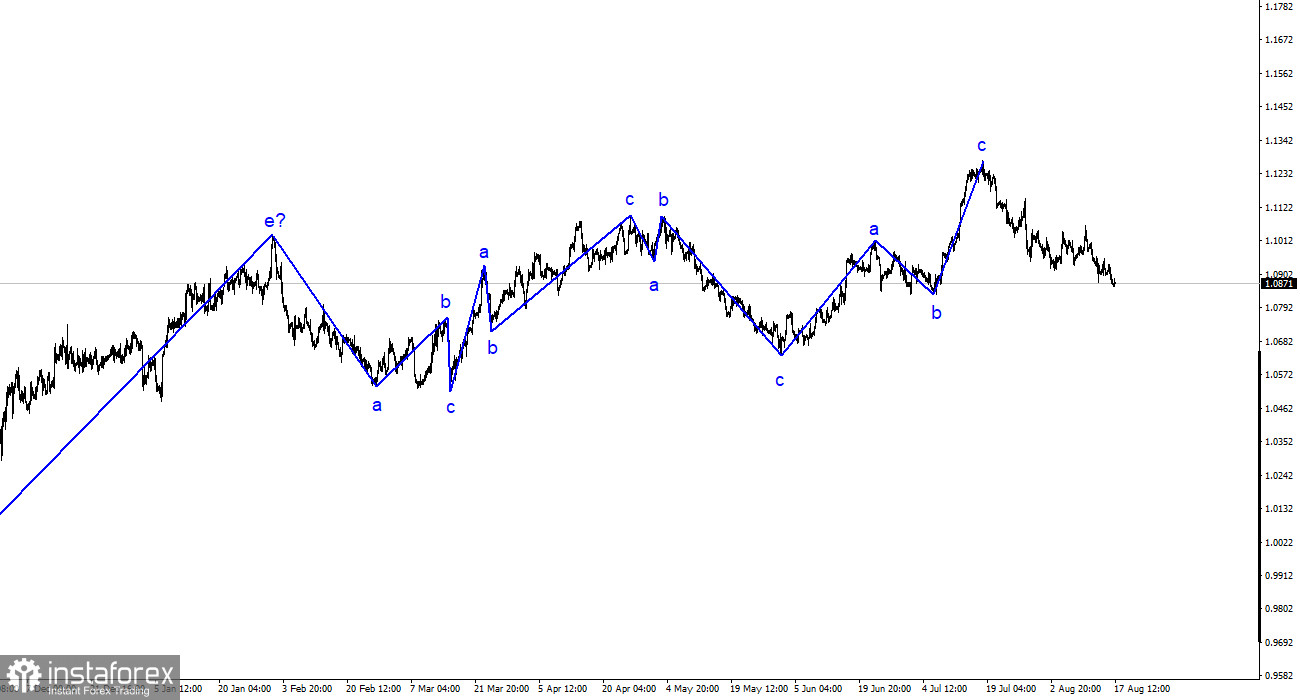

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite understandable. The entire ascending segment of the trend, which began its construction last year, has taken on a complex structure, and in the past six months, we have only seen three-wave structures alternating with each other. Over time, I have repeatedly stated that I expect the pair around the 5-figure mark, from where the construction of the last bullish three-wave structure began. I stand by my words. The next ascending three-wave structure is complete, so the market has begun building a bearish trend segment.

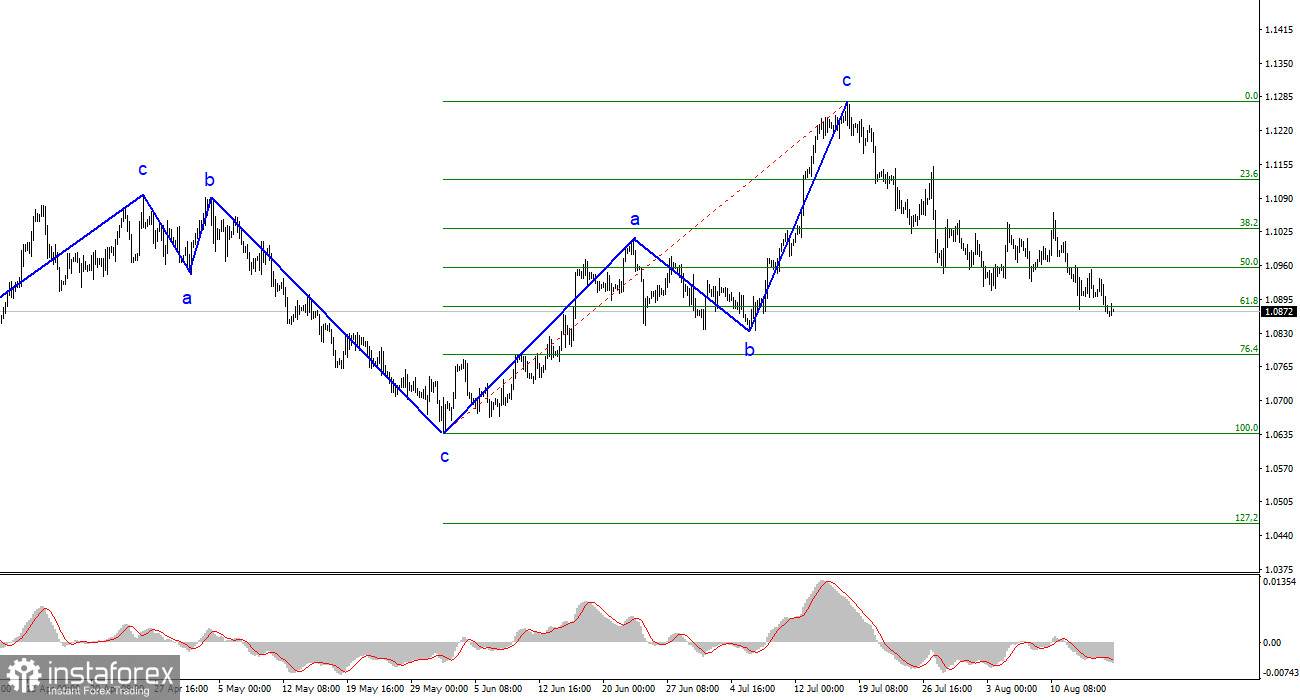

Theoretically, the trend segment that began on May 31 could take on a five-wave form with the structure a-b-c-d-e, but the chances of this happening diminish daily. We will likely see another descending set of waves, at least three-wave. The news background is not strong enough for the euro currency (and sometimes downright weak), so demand for it remains consistently high. The unsuccessful attempt to break the 1.1032 mark, corresponding to 38.2% of Fibonacci, indicates the market's readiness to sell again.

The dollar is harder to rise, but there is no danger.

The euro/dollar pair rate rose by 30 basis points on Thursday, which is not much to speak of as the start of a new upward wave construction. Yesterday was full of reports, including GDP and industrial production in the European Union and industrial production in the US. Still, they couldn't change the market sentiment or the wave pattern. In the evening, the minutes of the FOMC meeting were released, also known as the "Fed minutes," which only made one thing clear to the markets: the regulator is now doubting the need for further rate hikes, but the threat of new inflation forces it to keep a finger on the pulse and consider another rate hike. Based on the latest US inflation report, the Fed will decide on another tightening of monetary policy in September. However, much will depend on the next inflation report, which will be released just a few days before the next Fed meeting.

The Fed will scrutinize both inflation reports when deciding on the rate. In the meantime, the Norwegian Central Bank announced today that there will be a final rate hike to 4.25% in September. The Norwegian Central Bank has no influence or relation to the ECB. Still, one of Europe's most successful economies can draw attention when forecasting the ECB rate, which is already 4.25% and can rise to 4.5%. The European currency may build a corrective wave, but its decline should resume.

General conclusions.

Based on the analysis, the construction of the bullish wave set is complete. I still consider targets in the range of 1.0500-1.0600 to be quite realistic, and with these targets, I advise selling the pair. The structure of a-b-c looks complete and convincing and is therefore finished. Therefore, I advise selling the pair with targets around the 1.0836 mark and below. The construction of the bearish segment of the trend will continue.

On the larger wave scale, the wave marking of the ascending segment of the trend has taken on an extended form but is likely completed. We saw five waves upward, which are most likely the structure of a-b-c-d-e. Then the pair built four three-wave structures: two down and two up. Now it has likely entered the stage of building another downward three-wave structure.