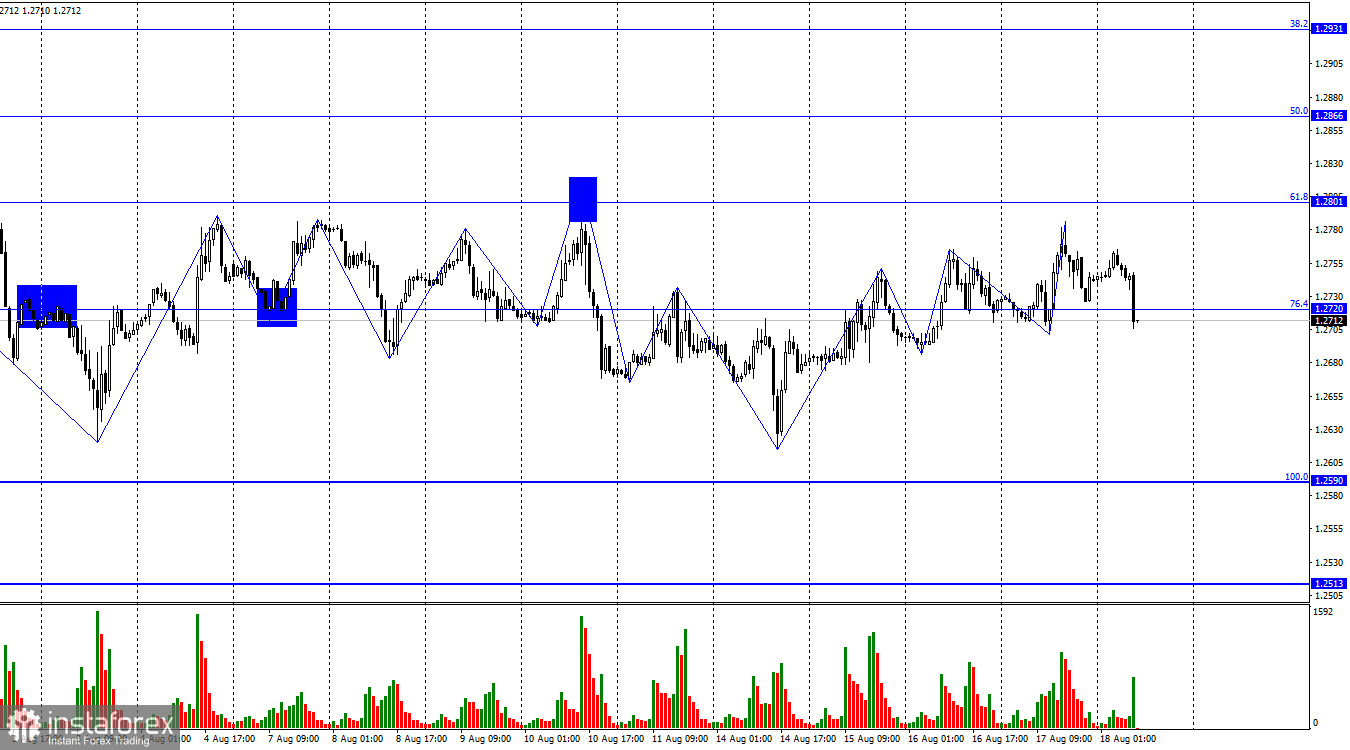

On the hourly chart, the GBP/USD pair on Thursday rose toward the corrective level of 61.8% (1.2801). Still, halfway through, it reversed in favor of the American currency and started falling, leading to consolidation below the Fibo level of 76.4% (1.2720). However, this consolidation does not necessarily indicate anything, as yesterday we saw the same thing, and it did not lead to a fall in the British pound. The pair has been moving horizontally for three weeks, frequently alternating between rising and falling segments.

Waves also indicate a horizontal movement, within which a very weak "bullish" trend exists. As we can see, the last six waves consistently broke through the peaks but could not break through the lows. This is a "bullish" sign. But it has no long-term significance because the pound is moving horizontally. Today, the last low might be broken, and the pair may begin to form a "ladder" downward.

Yesterday's news background for the pound was no different from that for the euro. The report on unemployment benefit claims in the US had no impact on traders' sentiment. This morning, a retail sales report was released in the UK. Volumes fell by 3.2%, although a month earlier, the decline was only 1.6%, and traders expected a drop of 2.1%. As the data turned out to be negative, traders preferred to get rid of the British currency on Friday morning, leading me to believe that we will see a decline in the pair today, becoming a new segment in the horizontal corridor.

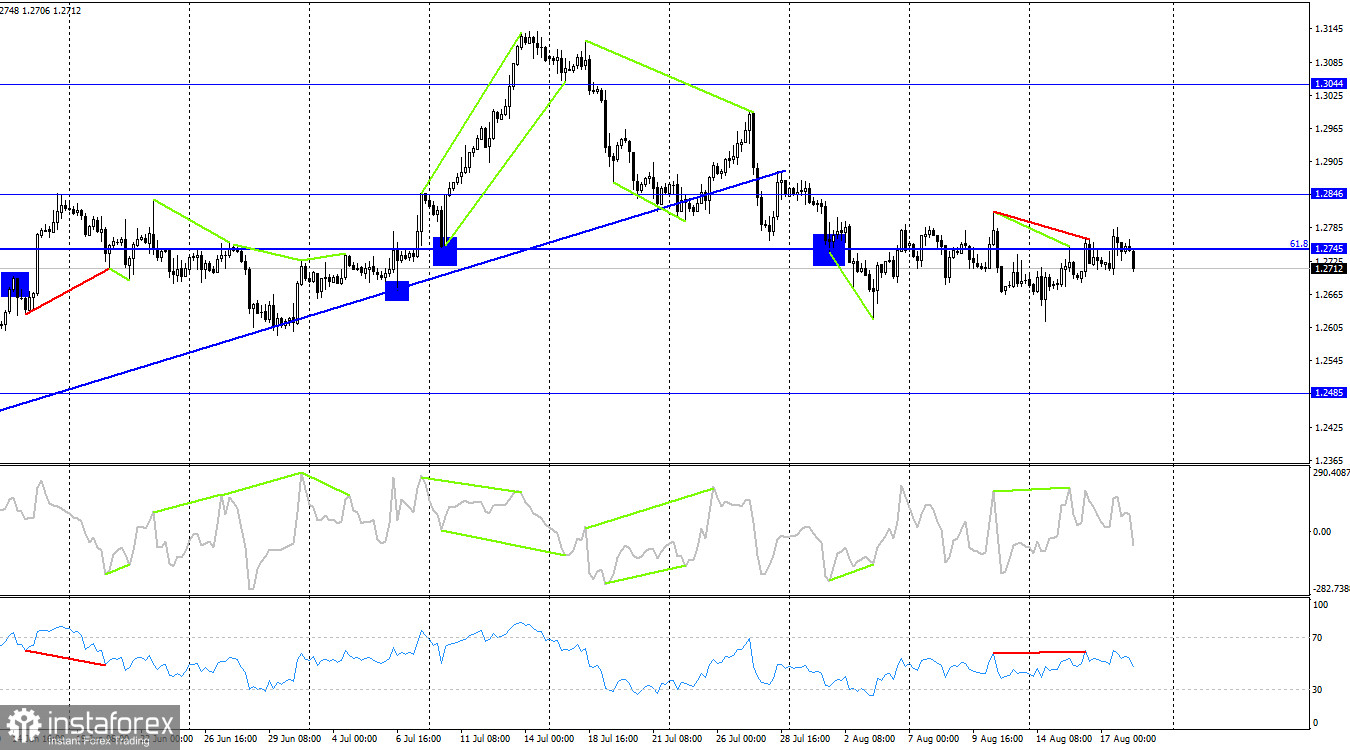

On the 4-hour chart, the pair has returned to the corrective level of 61.8% (1.2745), but two "bearish" divergences have already formed in the CCI and RSI indicators. Therefore, as I mentioned earlier, I don't expect strong growth in the pair. A reversal in favor of the US dollar and a resumption of the fall toward the 1.2485 level are more likely. However, a full consolidation above the 1.2745 level would allow us to anticipate continued growth towards the 1.2846 level and cancel the divergences.

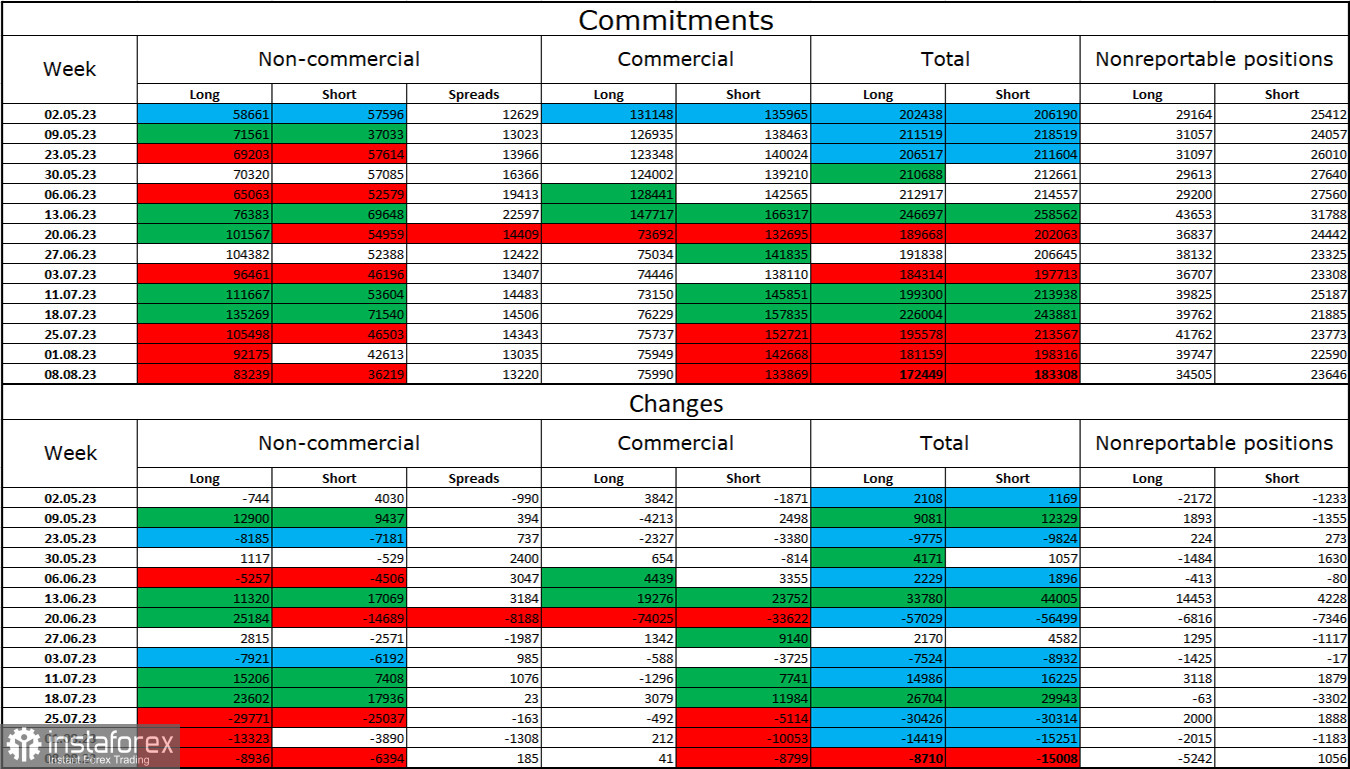

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" category of traders over the last reporting week has become less "bullish." The number of long contracts held by speculators decreased by 8,936 units, while the number of short contracts decreased by 6,394. The overall sentiment of major players remains "bullish," with a more than twofold gap forming between the number of long and short contracts: 83,000 versus 36,000. The British pound had good prospects for continuing growth a few weeks ago, but many factors have favored the US dollar. Expecting a strong rise in the pound is becoming more and more difficult. In recent weeks, we have seen bulls reduce their positions, which have decreased by almost 50,000. The positions of the bears are also falling, but the gap between them is only increasing.

News calendar for the US and the UK:

UK - Retail Sales Volume (06:00 UTC).

On Friday, the economic events calendar included only one report, which had already been released and caused a decline in the pound. For the rest of the day, the influence of the news background on market sentiment will be absent.

GBP/USD forecast and advice for traders:

Selling the pound is now possible when rebounding from 1.2801 on the hourly chart or 1.2745 on the hourly chart. Targets - the nearest low waves on the hourly chart. I advised purchases when closing above the level of 1.2720, but the pound's rise was weak, and the target of 1.2801 was not reached. Today, I don't see any signals for purchases.