We have smoothly and imperceptibly entered the second half of 2023. All three central banks continue to raise rates, all three are close to the end of the tightening cycle. The market understands this, but there is still a significant difference between one more rate hike or three more, which is entirely possible in the case of the Bank of England. Lately, there have been many questions related to the Federal Reserve's interest rate. Remember that since the spring of 2023, there have been rumors that the tightening process is either finished or is coming to an end. However, each subsequent meeting and each subsequent batch of economic reports shows that the FOMC can continue to raise rates. And each time for different reasons.

The basis to start from is inflation. Inflation in the US has been falling for more than a year, dropping to a low of 3%, but rose to 3.2% last month. In my opinion, this event already indicates another tightening in 2023. However, leading economists surveyed by Reuters disagree with me. Of the 110 experts who participated in the survey, 99 stated that they do not expect the US central bank to raise rates in September, and 80% of those surveyed believe that the tightening process is over. For the next year, most experts forecast that the rate will be lowered at least once in the first half. As for the possibility of a recession, the probability of it occurring does not exceed 40%.

Personally, I don't presume to make such forecasts without knowing the inflation figures for August. Suppose the Consumer Price Index accelerates again this month, then the FOMC will be forced to raise rates again and "leave the door open" for another tightening. The members of the Board of Governors have not once hinted at a pause in September or that further tightening is no longer necessary. The US economy continues to grow at a good pace, which allows (and this is important) the central bank to continue tightening as needed. Based on this, I expect another rate hike.

For both instruments, this is no longer that important. Wave analysis is now at the forefront, along with the fact that both should build corrective wave sets. Therefore, I expect the euro and the pound to decline in any case.

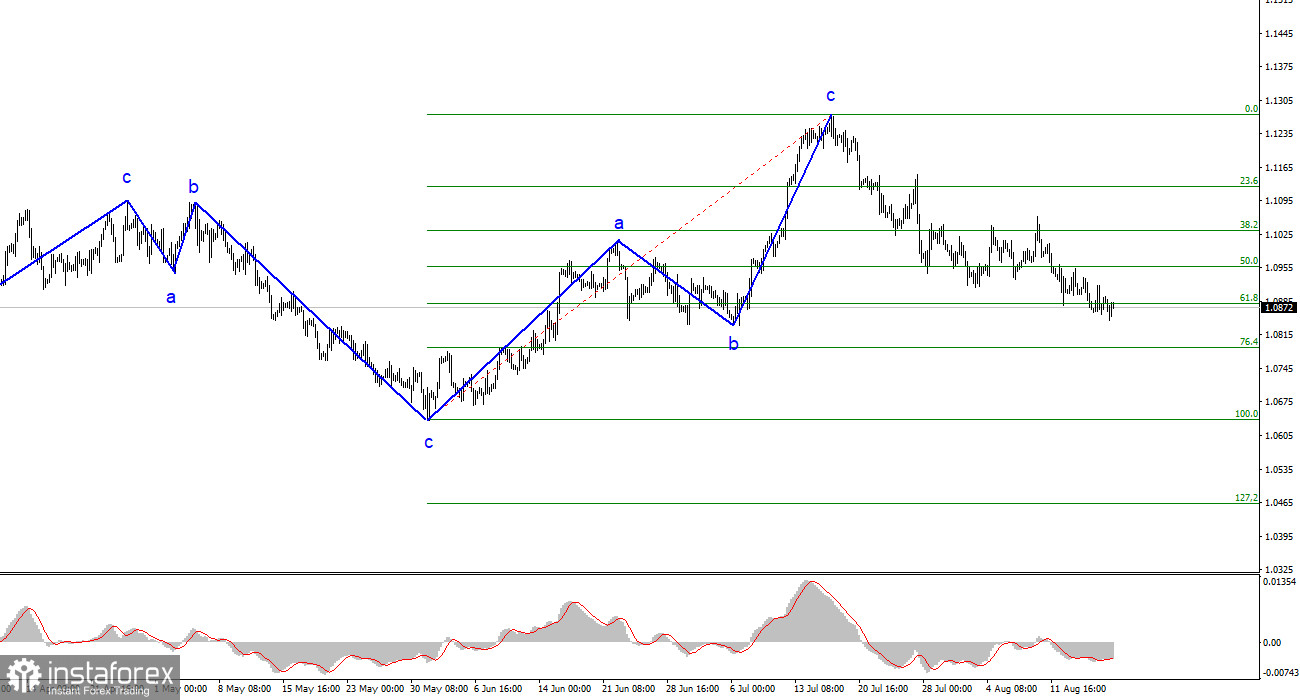

Based on the analysis, I conclude that the construction of the upward wave set is complete. I still believe that targets in the 1.0500-1.0600 range are quite realistic, and with these targets, I advise selling the instrument. The a-b-c structure appears complete and convincing. Therefore, I advise selling the instrument with targets around 1.0836 and below. I believe that the bearish segment will persist, and the successful attempt at 1.0880 indicates the market's readiness for new short positions.

The wave pattern of the GBP/USD pair suggests a decline. My readers could have opened shorts several weeks ago, as I advised, and now they can close them. The pair successfully reached the 1.2620 mark. There is a risk of ending the current downward wave if it is wave d. In that case, wave 5 could start from current levels. However, in my opinion, we are currently seeing the construction of a corrective wave within a new downtrend segment. If this is the case, the instrument will not sharply rise above 1.2840, and then a new downward wave will begin. We are preparing for new shorts.