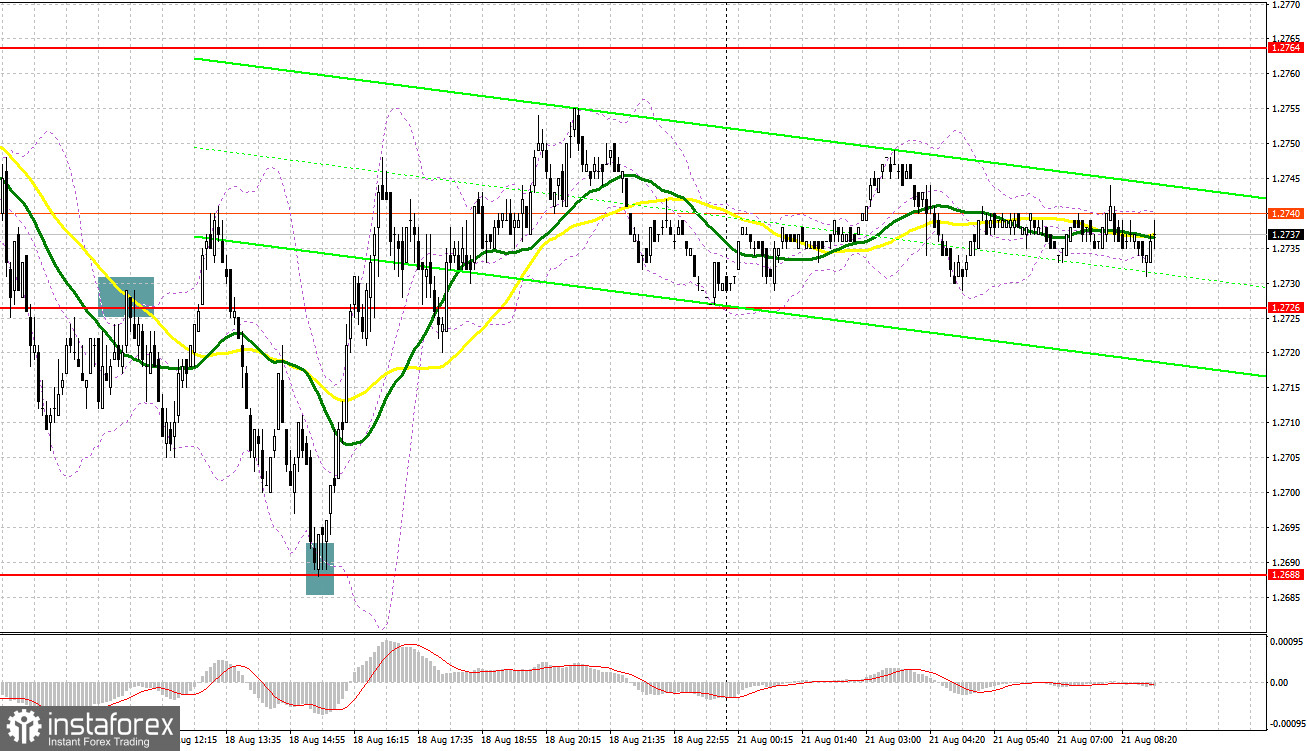

On Friday, there were quite a few signals to enter the market. Let's analyze what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2726 as a possible entry point. A breakout and retest of this range after a disappointing UK retail sales report produced a good sell signal. As a result, the pair fell by 20 pips. During the US session, a false breakout at 1.2688 gave a good buy signal. As a result, the pair rose by more than 50 pips.

For long positions on GBP/USD:

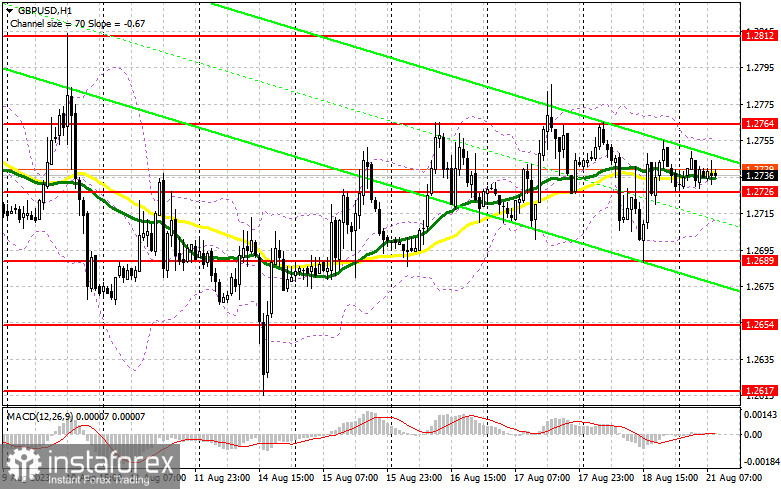

No economic reports lined up for today, so I expect the pair to trade within the sideways channel and go through low volatility. For this reason, it would be best to act from the support level at 1.2726. A false breakout of this level will confirm the presence of major players in the market and form a good entry point for long positions in hopes of updating the weekly highs, leading to an upward move targeting the resistance at 1.2764. A breakout and consolidation above this range could set the stage for a bullish market, with the goal of updating 1.2812 - a two-week high. The ultimate target remains the area of 1.2847 where I will be locking in profits. If GBP/USD declines and there is no buying activity at 1.2726, the pound will be under pressure. In this case, only the defense of the 1.2689 area and its false breakout would give a signal for opening long positions. I will open long positions immediately on a rebound from the monthly low of 1.2654, keeping in mind a daily correction of 30-35 pips.

For short positions on GBP/USD:

I expect new sellers to appear in the area of the nearest resistance level at 1.2764, formed by the results of last week. Unsuccessful consolidation at this level will produce a sell signal with a prospect of falling to the intermediate support at 1.2726, acting as the middle of the sideways channel. A breakout of this level and its upward retest would significantly dent the bulls' positions, offering a chance for a more substantial decline towards the low of 1.2689. The ultimate target is the low at 1.2654 where I will be locking in profits. If GBP/USD trends upward during the European session and if no selling activity is observed at 1.2764, which is possible, given how stubborn the pound is even as the US dollar firmed across the board, the bulls will not regain control of the market, but they will get a chance to start an upward correction towards 1.2812. Only a false breakout at this level would provide an entry point for going short. If there is no downward movement there, I would sell the pound right on a rebound from 1.2847, keeping in mind an intraday correction of 30-35 pips.

COT report:

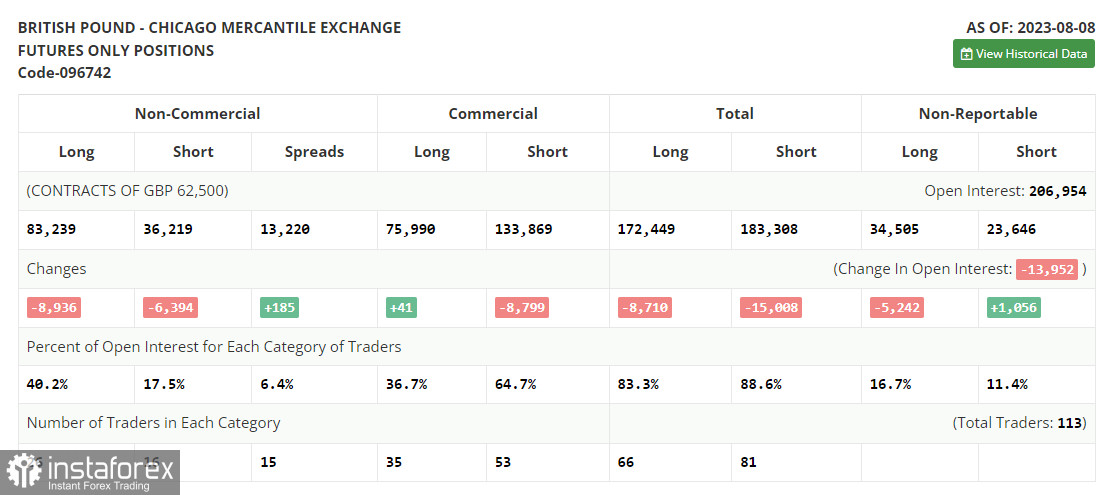

The Commitments of Traders (COT) report for August 8th recorded a decline in both long and short positions. Traders have been closing their positions ahead of important UK GDP data, realizing that the Bank of England would continue to raise interest rates, no matter the cost. Good data on the British economy allowed the market to maintain balance, preventing a significant sell-off of the British pound last week, which was triggered by another increase in inflation in the US. However, the optimal strategy is to buy the pound on dips, as the difference in the policies of the central banks will affect the prospects of the US dollar, putting pressure on it. The latest COT report indicates that long positions of the non-commercial group of traders have decreased by 8,936 to 93,239, while short positions fell by 6,394 to 36,219. As a result, the spread between long and short positions increased by 185. The weekly closing price dropped to 1.2749 compared to the prior value of 1.2775.

Indicator signals:

Moving Averages

Trading is taking place around the 30-day and 50-day moving averages, indicating a sideways market trend.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower border near 1.2710 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.