It seems that August this year will remain the worst August month in history. Since early 2023, positive sentiment in the markets has increased significantly on a wave of expectations that inflation this year will fall in the US to the target level of 2% and, in turn, the Federal Reserve will stop further rate hikes. In practice, it became clear by August that such expectations are still not justified.

What is the underlying reason for the deterioration of market investor sentiment?

The theme of inflation in the US, which is projected onto other countries and financial hubs, and the Federal Reserve's future monetary policy proceeding from this, remains the crucial negative factor.

Recently, a slight rebound was recorded in the annual rate of the consumer price index (CPI) from 3.0% in June to 3.2% in July that assured the US central bank to raise interest rates by another 0.25%. Then, in Fed Chairman Jerome Powell and some policymakers of the rate-setting committee signaled another increase in the federal funds rate, although before that the regulator had refrained from raising rates. Of course, investors could not ignore such prospects in monetary policy, which led to a protracted downward correction in the stock markets and enabled growth in Treasury yields.

At the same time, the ICE dollar index continues to move in a sideways channel, albeit slightly declining since the beginning of this year. Since mid-July, the index has notably recovered after a local breakout of a strong support level of 100 points.

So, the investor community lack understanding about what will happen to inflation in America, whether it will continue to grow or resume its decline. Besides, investors are discouraged by regular threats from Fed policymakers about the possibility of further interest rate hikes. Therefore, a fog of uncertainty descended on the markets, which set the stage for the decline in local and global stock indices.

We believe that until the publication of August data on consumer inflation, which will serve as a benchmark for the Federal Reserve, the current market environment will not change. In this case, we expect a lower corrective decline in the US benchmark stock indices. Treasury yields are likely to continue their growth. However, but at the same time, the ICE US dollar index may remain in a rather narrow range of 101.00-105.00 until the end of the month, unless, of course, Powell will not tell the markets anything new regarding the prospects for monetary policy at the symposium in Jackson Hole, Wyoming, which will be held later this week. An unexpected message may come as a big surprise for investors, since in general they do not foresee anything from the Federal Reserve's leader yet.

Intraday outlook

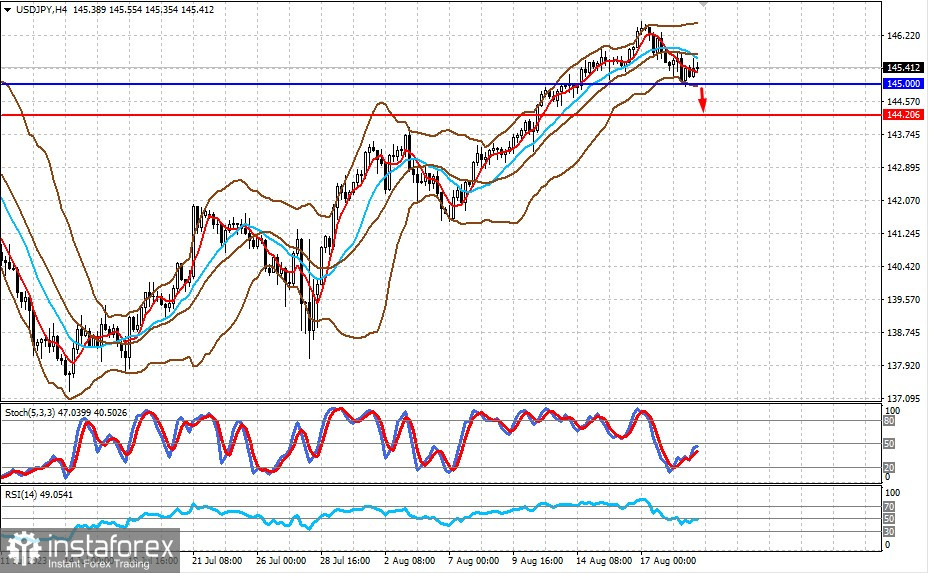

USD/JPY

The currency pair is consolidating above the level of 145.00. If the price falls below this level, there is a possibility of a limited decline towards 144.20.

XAU/USD

The price of gold remains under pressure due to the general negative market sentiment and expectations of another Fed rate hike, but the instrument may grow locally if it does not slip below 1,884.00. In this case, we should expect gold to rise to 1,900.50.