There are many paradoxes on Forex. Looking at the UK's economy teetering on the edge of recession, you would be surprised by the pound's leadership in the G10 currency race. So, what happened to the principle of fundamental analysis: a strong economy equals a strong currency? In fact, no one has cancelled it. Sooner or later, GDP weakness will make the central bank less "hawkish" than it is now, triggering a sell-off, which has already happened with GBP/USD. In July and August, a drop in the anticipated repo rate ceiling sent the pair into correction. However, by the end of summer, the situation has changed.

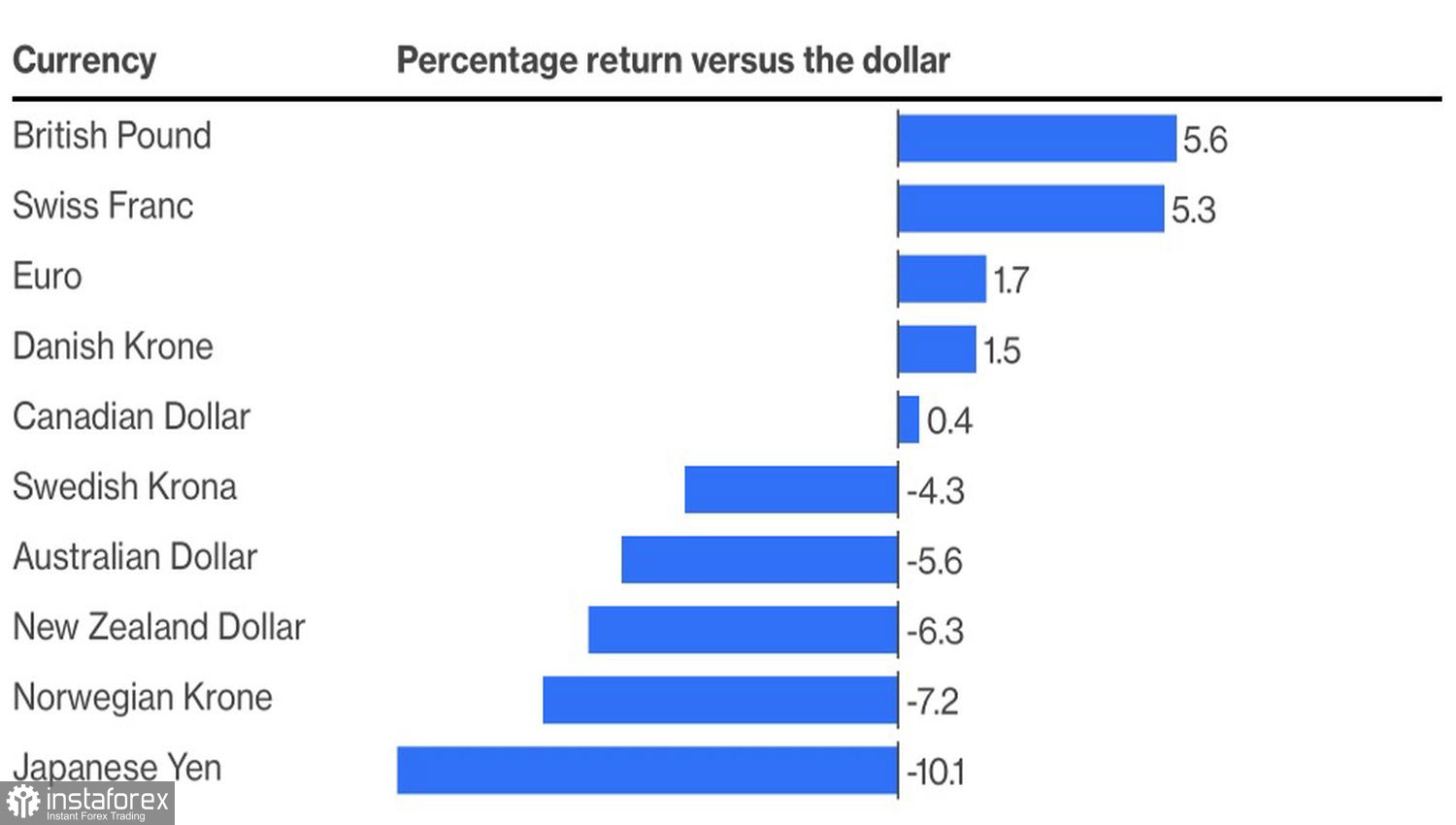

G10 Currency Effectiveness

Record wage growth, higher consumer price inflation in the UK than Bloomberg experts had predicted, and an acceleration of inflation in the services sector from 7.2% to 7.4% in July have forced the short-term market to adjust the expected peak of the repo rate from 5.75% to 6%. Considering rumors that the Fed is ready to halt its monetary policy tightening cycle, three 25 basis point rate hikes by the Bank of England paint a bullish future for GBP/USD.

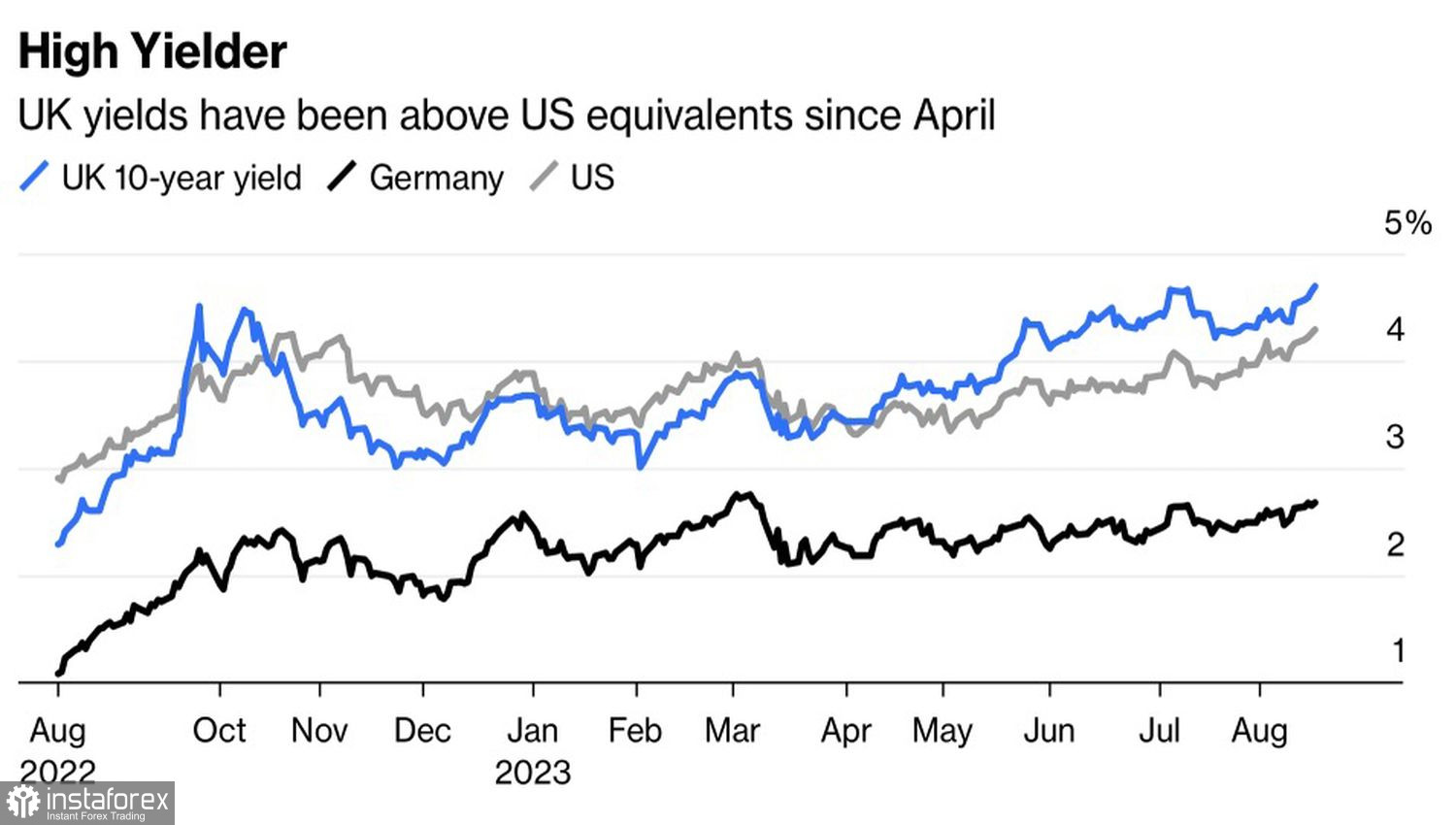

Indeed, British bond yields are rising faster than their American counterparts. The widening of the interest rate differential in the debt markets of the two countries favors pound buyers against the U.S. dollar. Increased bond yields in the UK are supported by large-scale bond issuance. Net sales in the current fiscal year are estimated at three times the average over the last decade. Total bond issuance is expected to reach £241 billion.

Bond Yield Dynamics

However, Unites States debt interest rates are also rising due to diminishing recession fears. Britain has little to boast about in this regard. Its economy is firmly stuck in stagflation. Low GDP growth rates are combined with higher inflation than in the U.S. or the eurozone. In theory, this should restrain the Bank of England's determination. The higher it raises the repo rate, the worse for the economy. Meanwhile, derivatives assess the chances of it rising to 5.5% in September at almost 90%.

It is clear that there will come a time when a weak economy will make the BoE less "hawkish" than it is now, which will cause the pound to fall. However, note that there are always two currencies in any pair. A strong U.S. dollar prevents GBP/USD from rising even in the face of accelerating wages and inflation in the UK. Investors are concerned that Fed Chairman Jerome Powell will hint at a federal funds rate hike to 5.75% in 2023 at Jackson Hole. If this does not happen, the dollar sell-off will allow the pound to lift its head.

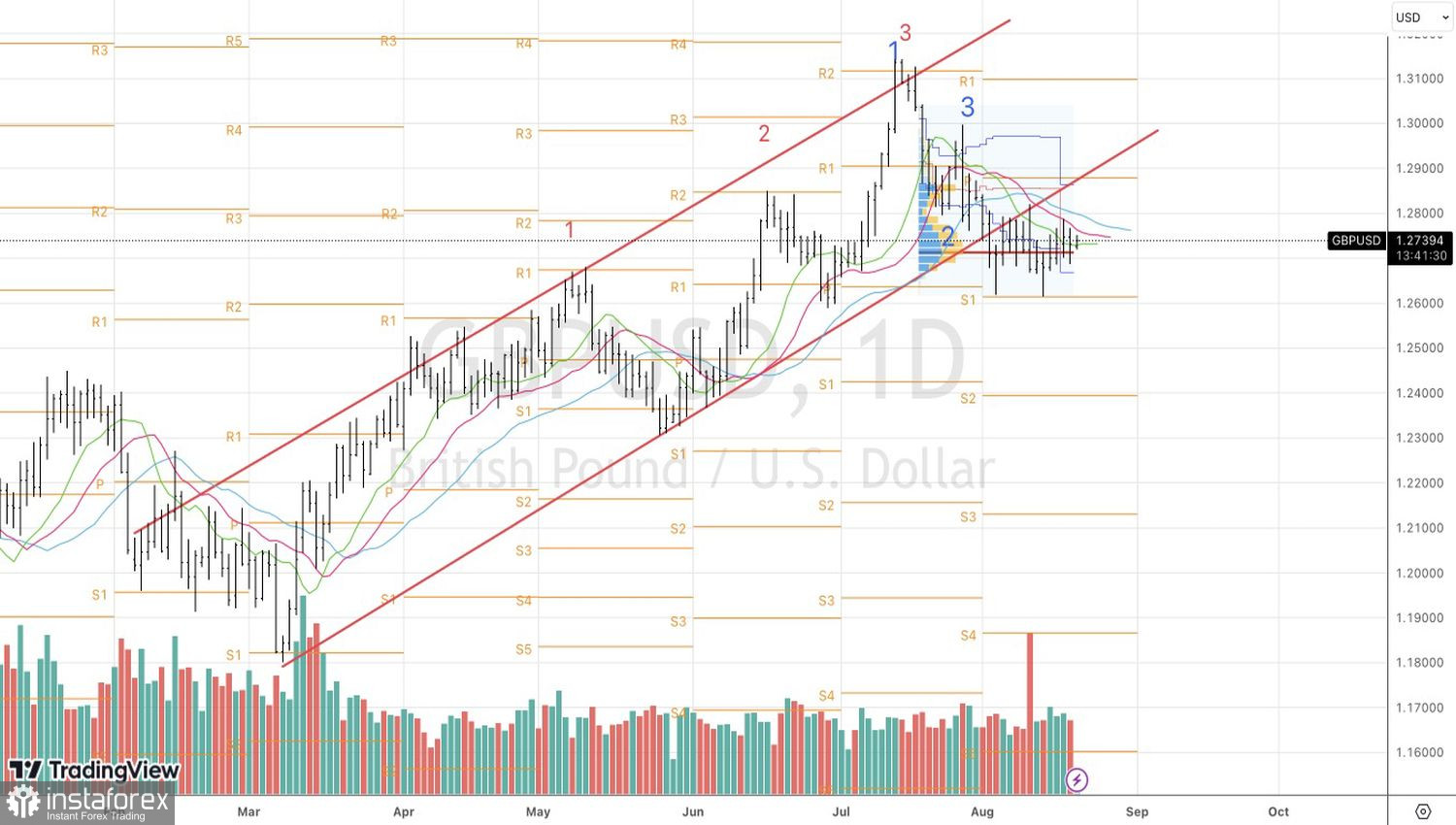

Technically, on the daily chart of GBP/USD, a Splash and Shelf pattern is forming based on 1-2-3. Only a breakout of the consolidation range of 1.2615–1.28 or "shelf" will allow the analyzed pair to determine the direction of further movement. In the event of a successful assault on the upper boundary near 1.28, it will rise above the moving averages. The risks of restoring an upward trend will increase, and we will have an entry point for a long position.