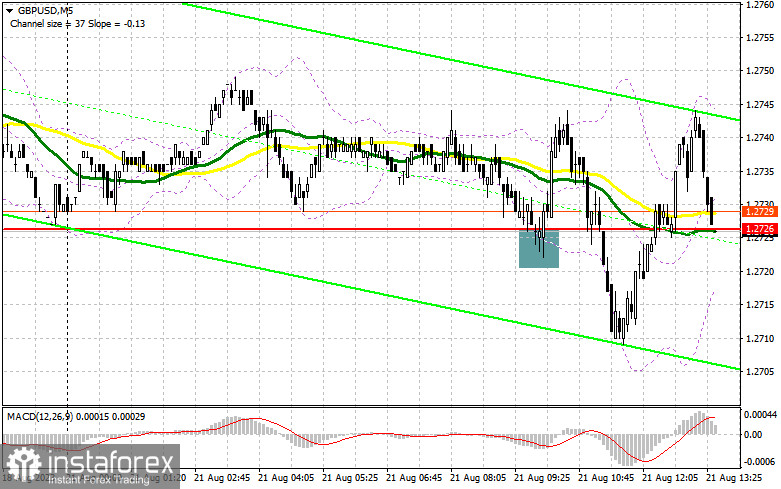

In my morning forecast, I drew attention to the level of 1.2726 and recommended making market entry decisions from it. Let's take a look at the 5-minute chart and figure out what happened there. A decline and a false breakout at this level gave a good signal to buy the pound, which resulted in a small rise of 15 points. Considering the low volatility of GBP/USD from a technical point of view, the picture has changed minimally.

For opening long positions in GBP/USD, it is necessary:

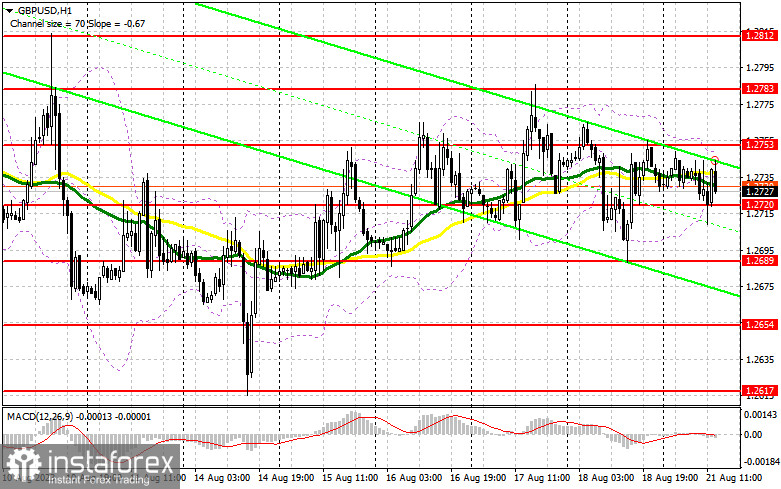

During the American session, there is no US data that could seriously affect the market direction, so pound buyers, who emerged in the first half of the day, still have chances for further growth of the pair. However, I plan to act similarly to the European session only after a decrease and the formation of a false breakout in the area of the nearest support of 1.2720. This will provide an excellent entry point to rise to resistance at 1.2753. A breakthrough and a top-down test of this range will form an additional buying signal, returning strength to the pound and allowing it to reach a maximum of 1.2783. In case of moving above this range, we can talk about a surge to 1.2812, where I will fix the profit. If the GBP/USD falls and there are no buyers at 1.2720 in the second half of the day, the pressure on the pair will only increase, leading to a larger sell-off. If that happens, I will postpone long positions to 1.2689. I will only buy there on a false breakout. Opening long positions in GBP/USD immediately on the rebound is possible from 1.2654 with a correction target of 30-35 points within the day.

For opening short positions in GBP/USD, it is necessary:

The bears tried, but nothing worked out. In case of a pair increase in the second half of the day, only the formation of a false breakout in the area of 1.2753 will form a sell signal with the aim of a decline to the nearest support at 1.2720, which withstood the pressure of sellers in the first half of the day. A breakthrough and a bottom-up test of this range will provide an entry point for selling to update 1.2689. A further target will be the area of 1.2654, where I will fix the profit. In the scenario of GBP/USD growth and the absence of bears at 1.2753 in the second half of the day, the bulls will take control of the market. In this case, only a false breakout in the area of the next resistance at 1.2783 will form an entry point for short positions. In the absence of activity, I recommend selling GBP/USD from 1.2812, counting on a pair's rebound down by 30-35 points within the day.

In the COT (Commitment of Traders) report for August 8th, a reduction was observed in both long and short positions. Traders closed positions ahead of important UK GDP data, realizing that the Bank of England will continue to raise interest rates, regardless of the cost. Data on the pace of growth in the British economy allowed the market to maintain balance, preventing a significant sell-off of the British pound last week, which was triggered by another rise in US inflation. However, as before, the optimal strategy remains to buy the pound on declines, as the difference in policies of central banks will impact the prospects of the US dollar, putting pressure on it. In the latest COT report, it was stated that long non-commercial positions decreased by 8,936 to 93,239, while short non-commercial positions fell by 6,394 to 36,219. As a result, the spread between long and short positions increased by 185. The weekly price dropped and was 1.2749 against 1.2775.

Indicator signals:

Moving Averages

Trading is taking place around the 30 and 50-day moving averages, indicating a sideways market trend.

Note: The moving average period and prices are considered by the author on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator at 1.2720 will serve as support.

Description of indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.