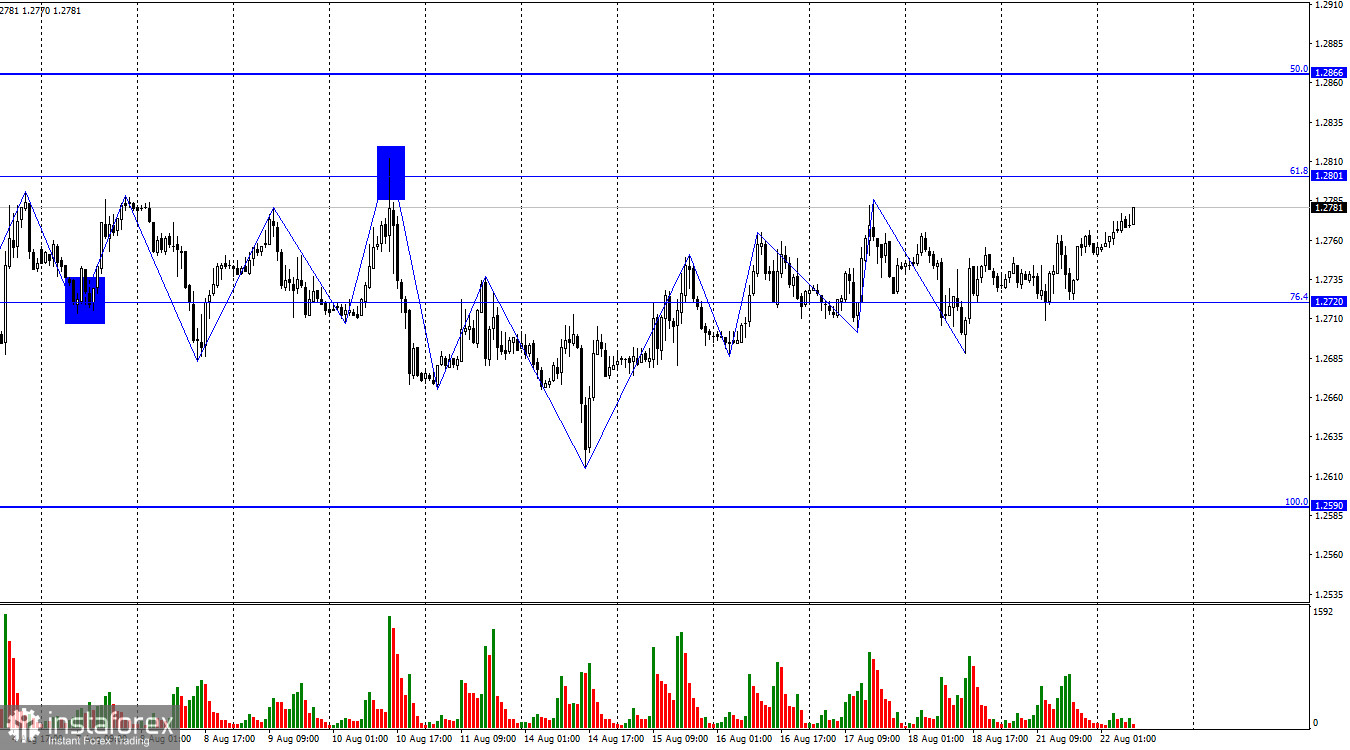

On Thursday, GBP/USD bounced off the 76.4% Fibonacci retracement level at 1.2720 and continued to rise toward the retracement level of 61.8% at 1.2801. A rebound from this level will favor the US dollar and will mean a decline toward 1.2720. If the quote settles above 1.2801, it may extend growth toward the next Fibonacci level of 50.0% at 1.2866.

Despite the most recent descending wave breaking below the low of the previous wave, the pair is still trading in the uptrend. This bullish trend is ensconced within a horizontal movement that has been going on for several weeks. Presently, the spotlight is on the 1.2801 level, which acts as the upper boundary of this horizontal channel. If bulls fail to surpass it, we might witness the onset of a bearish trend within the same sideways range.

The information backdrop for the GBP/USD pair was muted on Monday, and Tuesday promises a similarly quiet background. Noteworthy are speeches by FOMC members Michelle Bowman and Thomas Barkin. However, these events are unlikely to pull GBP out of its sideways drift. The tone of FOMC members could be dovish, especially as markets aren't betting on monetary policy tightening this September. While this could lend some support to the pound sterling, it is a lingering question whether this is enough to break from the current sideways channel.

Wave patterns and the 1.2801 level are paramount now as they will dictate the future course for GBP/USD.

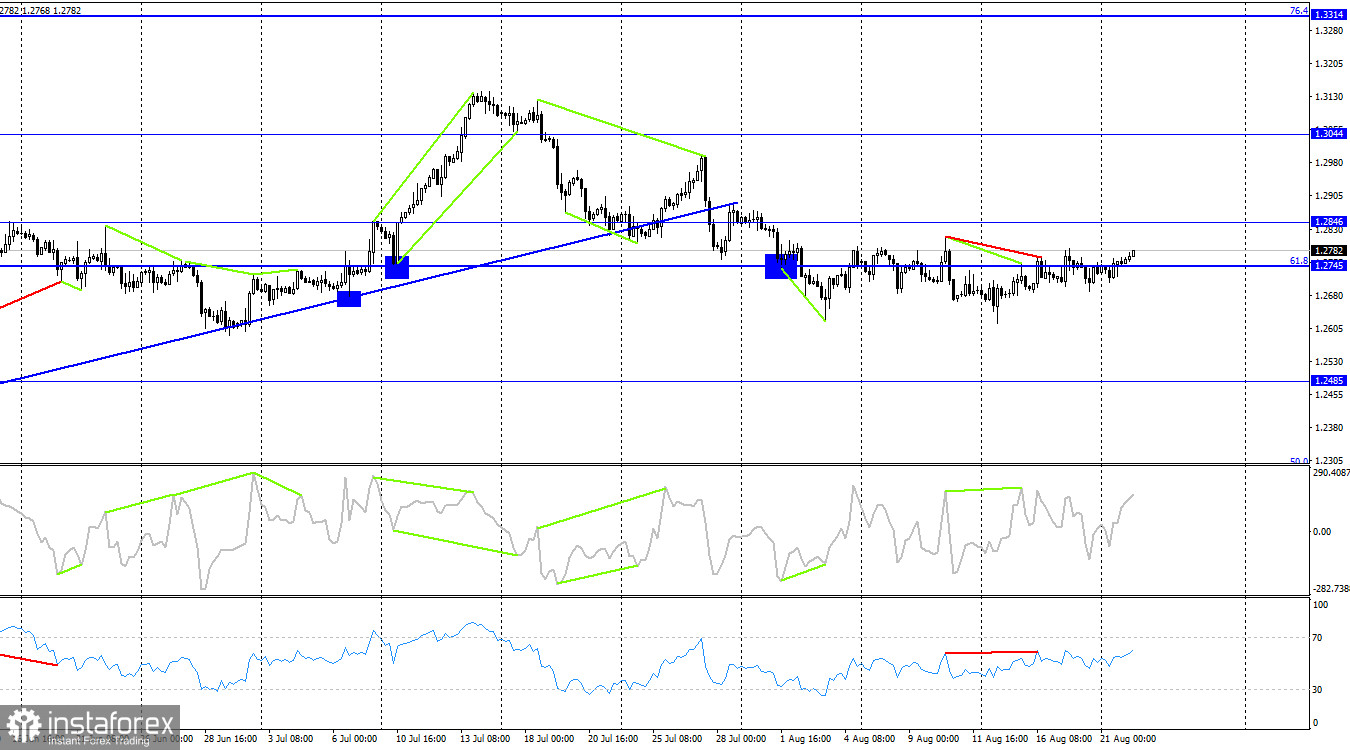

On the 4-hour chart, the pair reversed to the 61.8% Fibonacci retracement level at 1.2745. Before that, the CCI and the RSI had formed two bearish divergences. Therefore, I don't expect to see a strong upward movement in the pair. The more likely scenario is the strengthening of the US dollar and the reversal of the price toward 1.2485. Besides, the level of 1.2801 has more importance on the 1-hour chart than on the 4-hour chart.

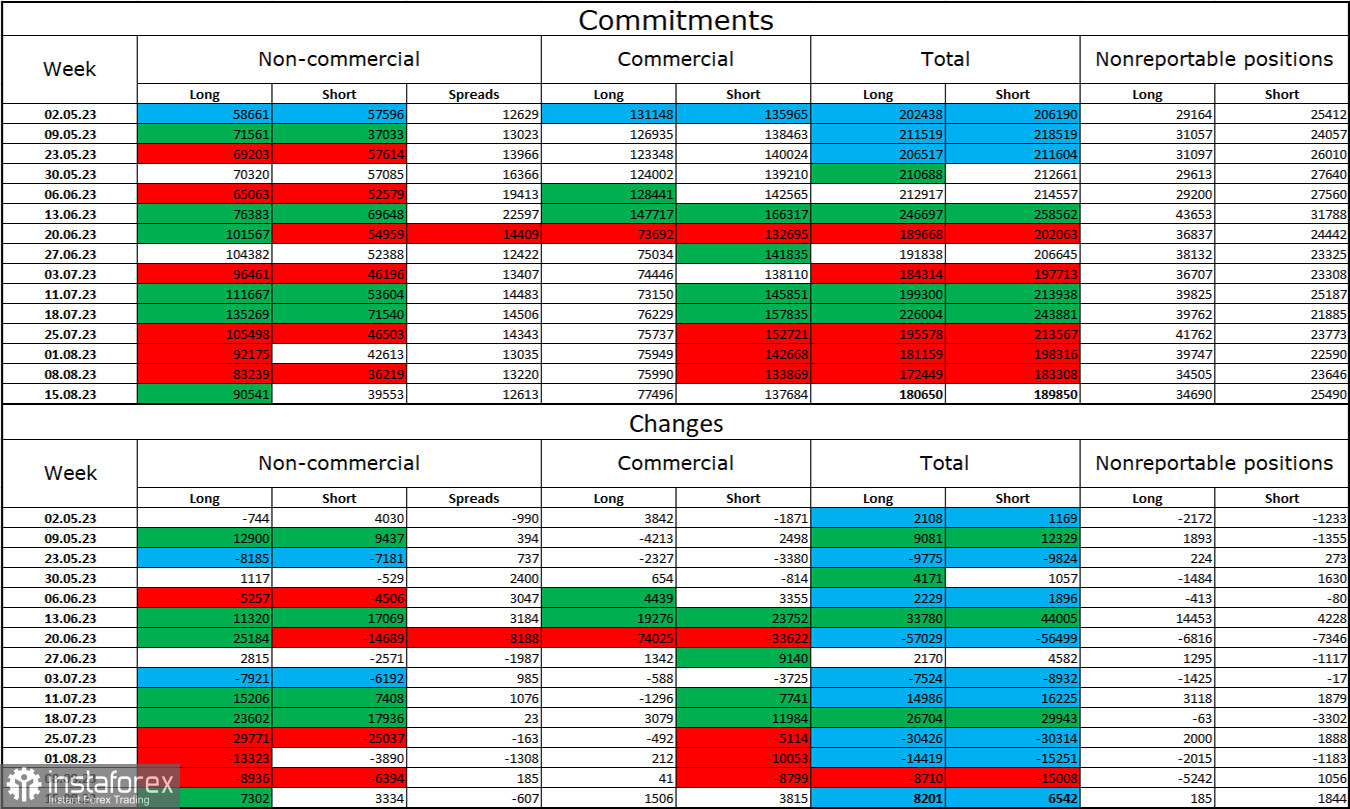

Commitments of Traders (COT) report:

The sentiment of the non-commercial group of traders has become more bullish over the last reporting week. The number of long contracts held by speculators increased by 7,302, while short contracts increased by 3,334. Overall, major market players remain bullish on the pair, with more than a twofold gap between long and short contracts: 90,000 versus 39,000. GBP had good prospects for continued growth a few weeks back, but several factors have since tilted the balance toward the US dollar. Betting on a strong GBP surge now seems risky. In recent weeks, bullish positions have decreased by almost 50,000. Short positions are also declining, but the gap between the two categories is widening.

Economic Calendar for US and UK:

US – Existing Home Sales (14-00 UTC).

Tuesday's economic calendar presents a rather subdued day, with just a minor report from the US. For the rest of the day, the influence of news-driven sentiment on the market will be minimal.

GBP/USD forecast and trading tips:

Selling the pound will be possible after a rebound from the 1.2801 level on the 1-hour chart. The nearest downward target is the low of the closest wave on the H1 chart. Only one signal today should be interpreted as a buying opportunity, which is the closure above 1.2801. But be careful here as the pound may fail to show a proper upside momentum. The upward target in this case will be the level of 1.2866.