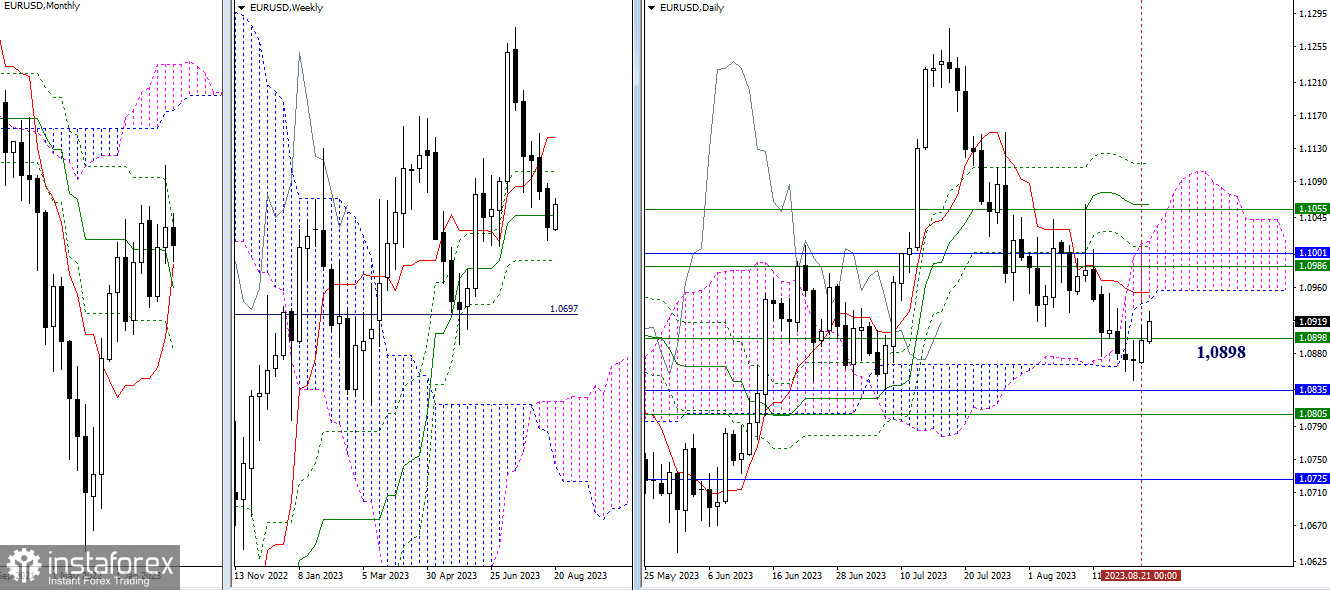

EUR/USD

Higher Timeframes

The attraction of the weekly medium-term trend (1.0898) is holding back the situation from developing. If bullish players manage to shake off the force of attraction first, the upward movement may persist. In this case, their nearest targets will be the resistance levels of various timeframes 1.0943 – 1.0954 – 1.0986 – 1.1001. If bearish players manage to break away from the zone of influence of the weekly medium-term trend, the nearest supports they will need to overcome for new perspectives can be considered in the area of 1.0805 – 1.0835 (monthly short-term trend + final level of the weekly Ichimoku cross).

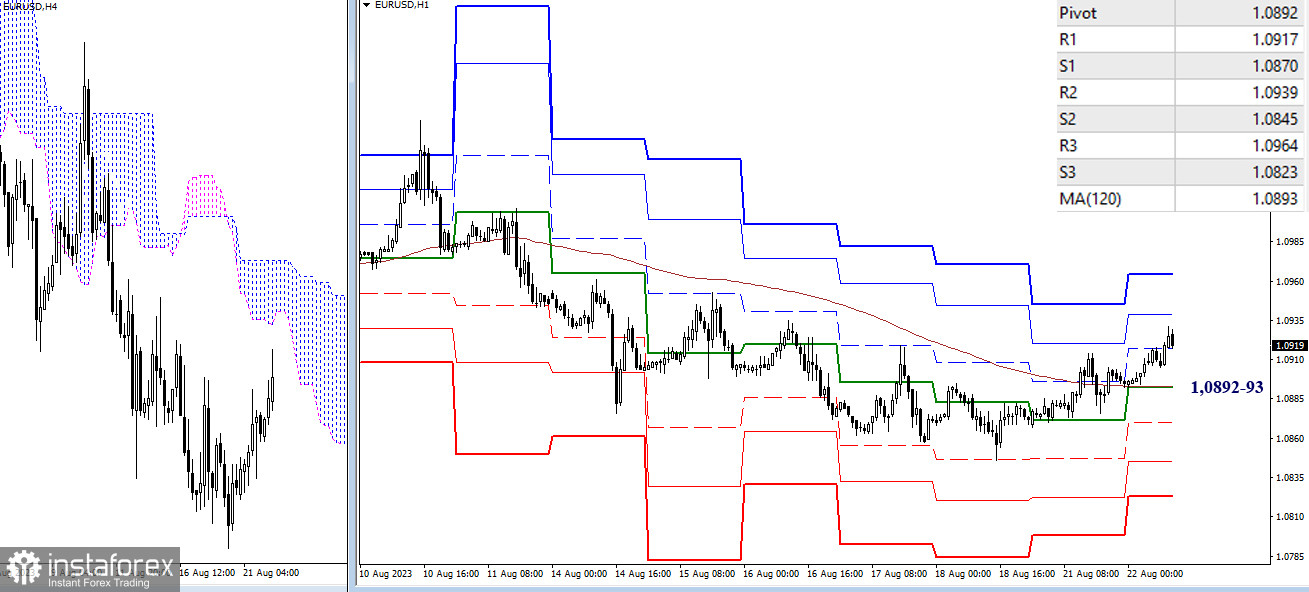

H4 – H1

The corrective rise made it possible to overcome the key levels of the lower timeframes. Today, the key levels are combined in the area of 1.0892–93. The current advantage has shifted in favor of the bulls. For the development of bullish sentiments, it is necessary to hold the achieved positions, turn the moving average and continue the upward movement, with intraday targets at the resistance levels of the classic pivot (1.0939 – 1.0964). In case of losing the attained level and returning below 1.0892–93, the current balance of power will change again. The targets for the development of bearish decline today are at 1.0870 – 1.0845 – 1.0823 (classic pivot points).

***

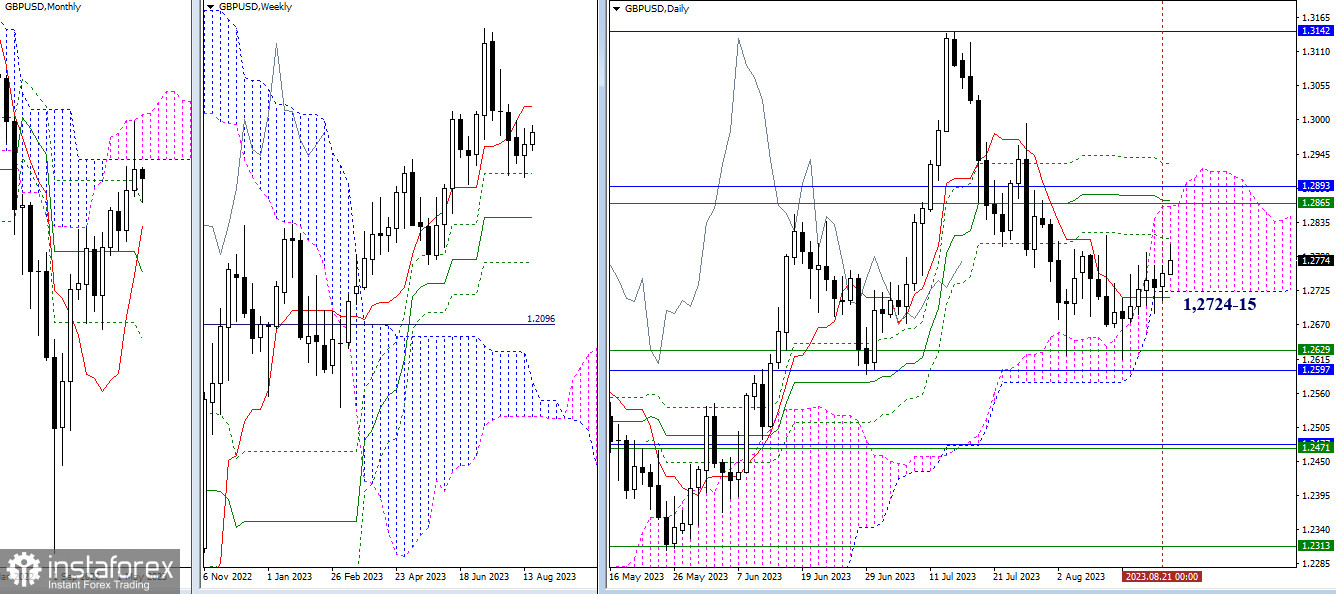

GBP/USD

Higher Timeframes

Bullish players continue to hold positions above the daily short-term trend (1.2715). Working in the Ichimoku cloud implies movement from one border to another, so maintaining the bullish advantage and activity will push the pair to the upper border of the cloud (1.2860). This line is strengthened by the accumulation of resistance levels (1.2865 – 1.2870 – 1.2893)—the daily Fibo Kijun (1.2809) may provide intermediate resistance along this path. Losing the current supports (1.2715 – 1.2724) would allow a consolidation within the bearish zone relative to the daily cloud. After that, the nearest targets for further decline will be the levels of weekly and monthly timeframes (1.2597 – 1.2629).

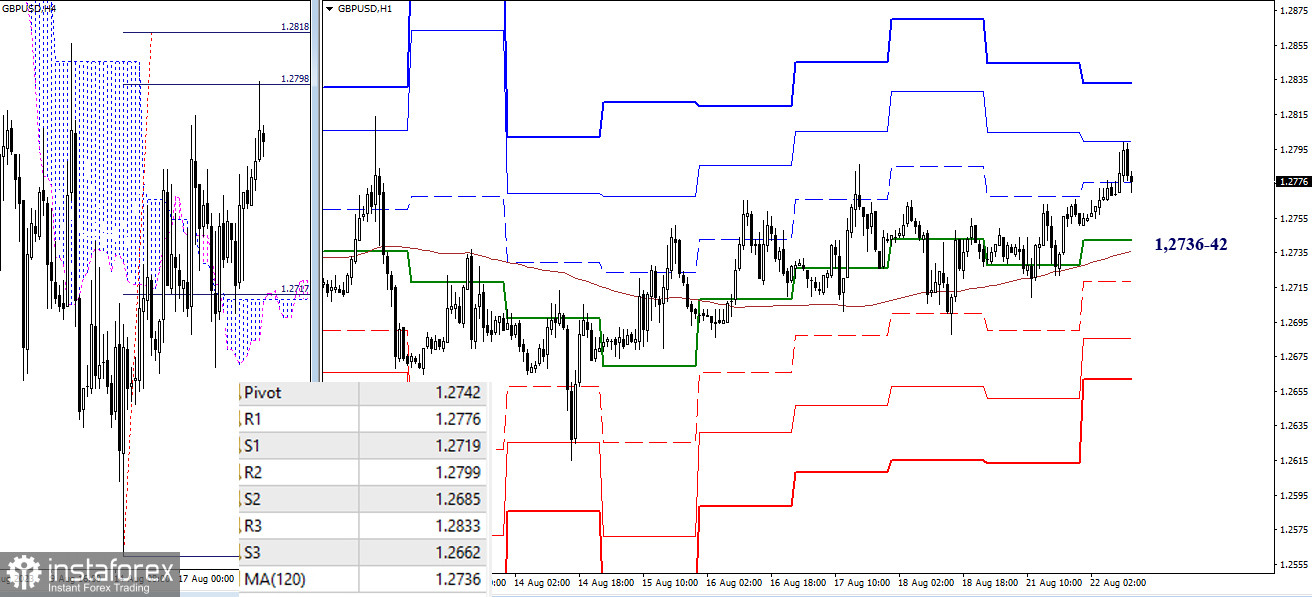

H4 – H1

On lower timeframes, bulls are trying to develop their advantages. The resistances of 1.2799 (R2) and 1.2798 (first target benchmark for breaking the H4 cloud) have been tested. The next upward targets are 1.2833 (R3) and 1.2818 (100% achievement of the H4 target). Key levels currently act as supports and join forces around 1.2736–42 (central pivot point of the day + weekly long-term trend). Their loss can change the current balance of power. The supports of the classic pivot points today are located at 1.2719 – 1.2685 – 1.2662.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)