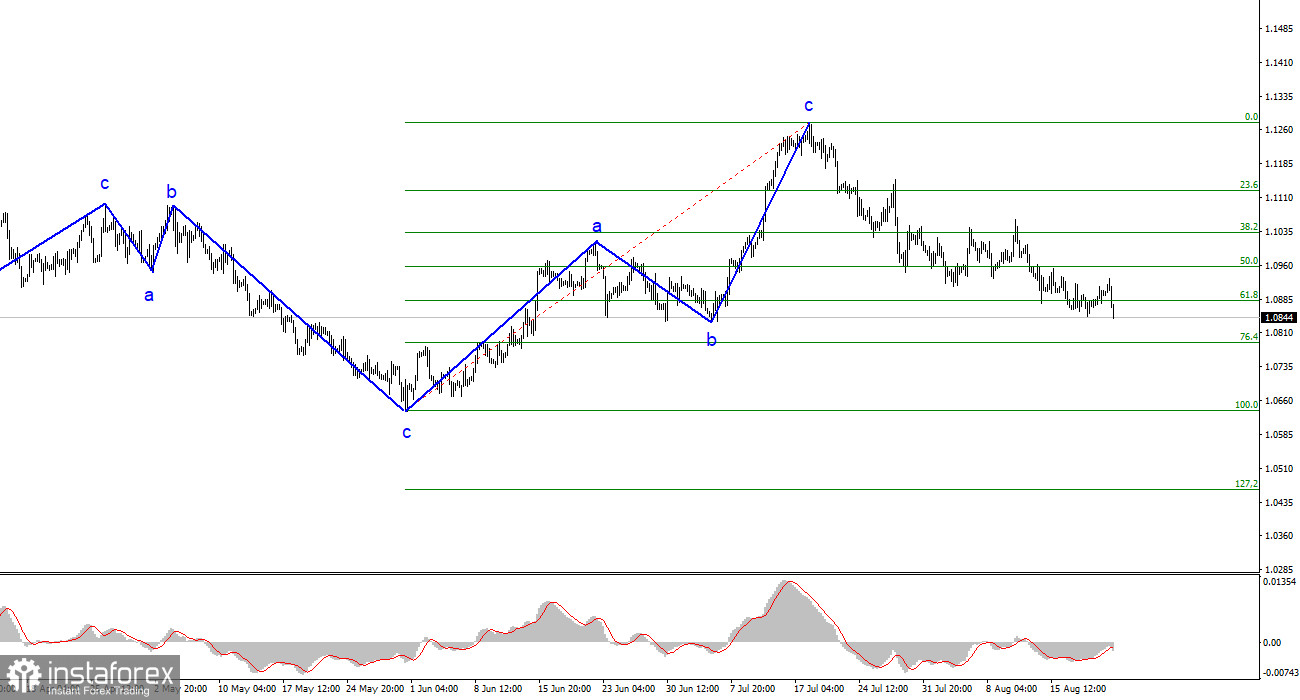

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. The entire ascending segment of the trend, which began its construction last year, has taken on a complex structure, and in the last six months, we have only seen three-wave structures alternating with each other. In recent times, I have regularly said that I expect the pair around the 5-figure mark, from where the construction of the last upward three-wave sequence began. I stand by my words. Another ascending three-wave structure has ended, and now the market has begun the construction of a downward trend segment.

Theoretically, the trend segment, which began on May 31, could still take on a five-wave form with an a-b-c-d-e structure, but the chances of this decrease every day. We will likely see another downward wave, at least a three-wave set. At the moment, even the first wave of this set still needs to be completed. The news background is weak for the euro and unlikely to provoke demand this week. Fibonacci levels continue to be overcome individually, indicating the market's readiness for new sales.

The euro has fallen from the heavens to the earth.

The euro/dollar exchange rate fell by 45 basis points on Tuesday. However, it would be more accurate to say that it fell by 90 points from the day's highs. The news background today was as scant as yesterday. I can only note the speech by Thomas Barkin of the Federal Reserve, which we will discuss later (in subsequent articles). For now, Barkin's speech did not cause an increase in demand for the dollar, at least because it took place only a couple of hours ago, and the US dollar began to rise much earlier. In such a situation, I can only give one explanation for what happened on Tuesday: the market continues to increase demand for the dollar, as indicated by the current wave markup.

I want to remind you that, at the moment, even the first wave of the new downward trend segment cannot be considered complete. And if it is incomplete, what rise can we talk about? The market continues to sell the euro as the ECB has begun to send unambiguous signals about the end of the monetary tightening process. Agree that this is a very serious factor of decline. And if we recall that the dollar fell for almost a whole year, although the Federal Reserve also raised interest rates all this time, it suggests a need to reach a balance between the two currencies. And the pair's decline can and should continue without a news background.

General conclusions.

Based on the analysis, the construction of the upward wave pattern has been completed. I still consider targets in the range of 1.0500-1.0600 to be entirely feasible, and with these targets in mind, I recommend selling the pair. The a-b-c structure appears complete and convincing, and as such, it is likely concluded. Therefore, I recommend selling the pair with targets around 1.0788 and 1.0637. The construction of the downward trend segment will continue, and a successful attempt at 1.0880 indicates the market's readiness for new sales.

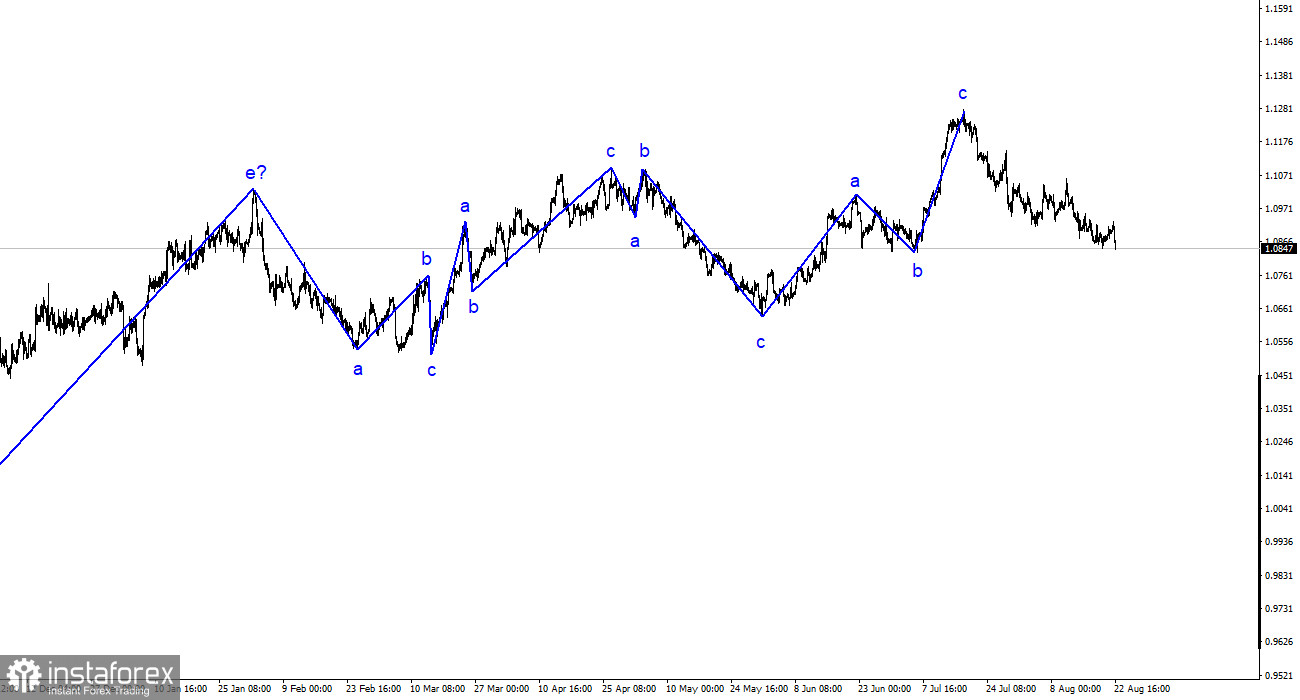

On the larger wave scale, the wave analysis of the ascending trend segment took an extended form but is likely completed. We saw five upward waves, which are most likely an a-b-c-d-e structure. Subsequently, the pair constructed four three-wave patterns: two downward and two upward. Now, it has likely transitioned into the phase of constructing another descending three-wave structure.