The first set of interesting reports for the week will be released on Wednesday. And there will be 12 of them. I usually don't pay attention to composite business activity indices because I believe that the service and manufacturing sectors are more important. Therefore, we're talking about eight Purchasing Managers' Indices in Germany, the EU, the UK, and the US. Of course, PMIs are published for all countries of the European Union, but I see no sense in analyzing each country separately, especially ones like Greece or Italy. I believe it's enough to look at the German and European PMIs.

Let's start with Germany. According to market expectations, business activity in the manufacturing sector will drop to 38.7 points. The decline in August is expected to be marginal, but this gauge has been below the 50.0 mark for a long time, and any value below this mark is considered a contraction. The Services PMI might also fall to 51.5 points. Although this indicator still indicates growth or expansion, it has also been falling for several consecutive months, and sooner or later, it will also drop below 50.

In the European Union, the manufacturing sector might drop to 42.6 points, and the services sector to 50.5. So by the end of August, the services sector could be on the border between favorable and unfavorable territory. Undoubtedly, such figures are unlikely to please the euro bulls.

In the UK, the services sector index is expected to drop to 51.0, while the manufacturing sector is forecasted to dip to 45.0. This is the same negative trend that has been observed for several months. In the US, the manufacturing sector is expected to rise from 49 to 49.3, while the services sector will see a marginal decrease from 52.3 to 52.2. Take note that in the US, the ISM index is considered a key indicator of the state of the economy, which is why the markets focus on this instead.

The fact that PMIs are falling in European countries is not surprising. Monetary policy is tightening, but its "strictness" is lower compared to the US. And the state of business activity in the US is much better than in the EU. I believe this factor alone is enough to see a persistent decline in demand for the European and British currency on Wednesday unless we see much stronger numbers from the European gauges.

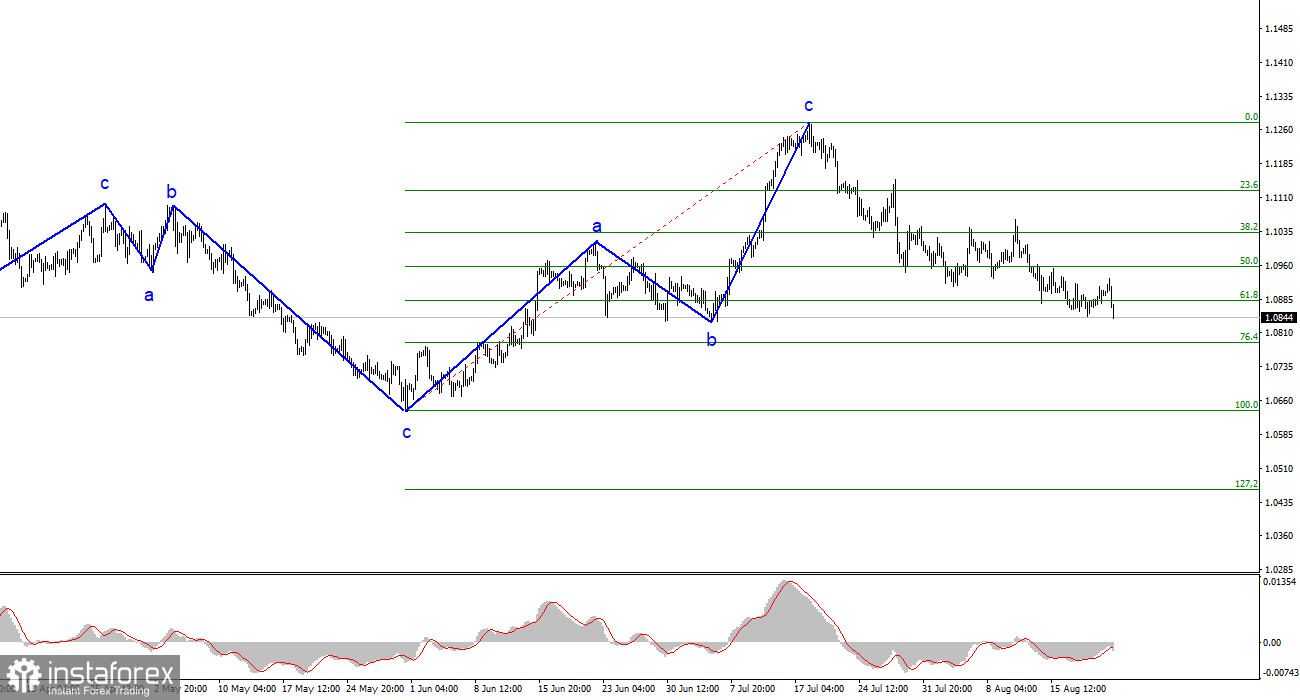

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range are quite realistic, and with these targets in mind, I advise selling the instrument. The a-b-c structure appears complete and convincing. Therefore, I advise selling the instrument with targets set around the 1.0788 and 1.0637 marks. I believe that the bearish segment will persist, and a successful attempt at 1.0880 indicates the market's readiness for new short positions.

The wave pattern of the GBP/USD pair suggests a decline within the downtrend segment. There is a risk of ending the current downward wave if it is wave "d" and not "1". In that case, wave 5 could start from current levels. However, in my opinion, we are currently seeing the construction of a corrective wave within a new downtrend segment. If this is the case, the instrument will not rise much above the 1.2840 mark, and then a new downward wave will commence. We should prepare for new short positions.