Although the pound was quite active, it's still in the same situation. The British currency rose slightly above the upper band of the range it had been trading in over the past few days, only to instantly revert back to its familiar confines. Today, the pair braces for PMI data. And the forecasts do not bode well for the pound. All the UK PMIs are expected to fall. The Services PMI may fall from 51.5 points to 50.5 points, while the Manufacturing PMI should drop from 45.3 points to 45.2 points. As a result, the composite PMI is likely to fall from 50.8 points to 50.5 points.

On the other hand, the situation in the United States is somewhat different. Although the Services PMI is expected to fall from 52.3 points to 52.0 points, the Manufacturing PMI will likely rise from 49.0 points to 49.5 points. Hence, the composite PMI should remain unchanged. In theory, the pound should get weaker because of this. However, lately, the market seems to be ignoring any economic reports. Especially since few want to take any risks ahead of the Jackson Hole event. Therefore, at best, the pound will shift towards the lower band of the recently formed range. So the decline will be rather symbolic.

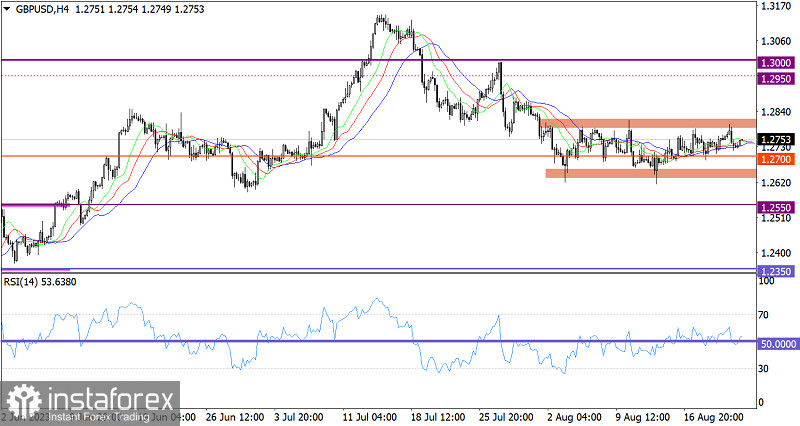

During its upward cycle, the GBP/USD pair reached the upper band of the sideways channel at 1.2650/1.2800. As a result, the volume of long positions decreased, leading to a price rebound.

The RSI technical instrument is hovering at around the average level of 50 on the 4-hour chart. It means a flat market.

The 4H Alligator is generating a faint signal, i.e. moving averages are behaving as appropriate along the borders of the flat market.

Outlook

In this situation, two methods can be applied simultaneously: a breakout or a rebound relative to the boundaries of the specified range.

The bearish scenario will come into play in case the price breaks the lower band of the flat and settles below 1.2650. This move will extend the downward correction.

The bullish scenario suggests that GBP/USD will recover after the ongoing correctional cycle. The instrument will generate the first technical signal of an upward move after the price settles above 1.2800.

Complex indicator analysis provides a mixed signal in the short- and long-term timeframes due to the sideways track.