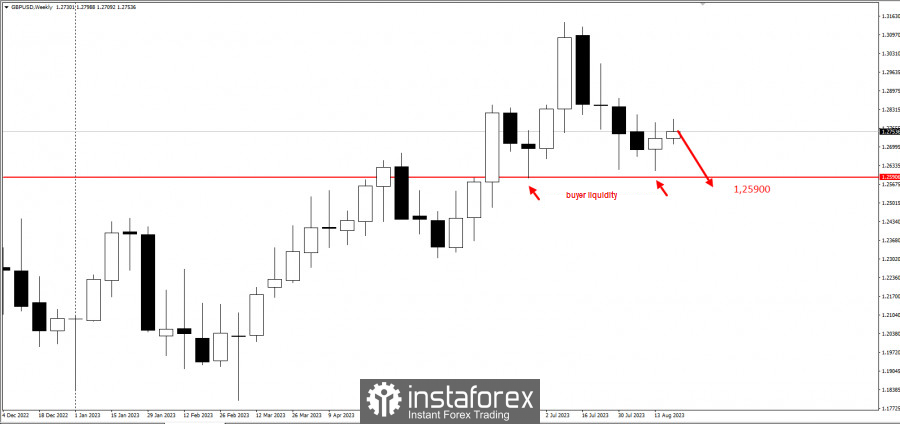

GBP/USD underwent a correction last week and saw buyer liquidity at 1.25900. This favors short positions, and now the potential for a price decrease stretched out to over 1,600 pips.

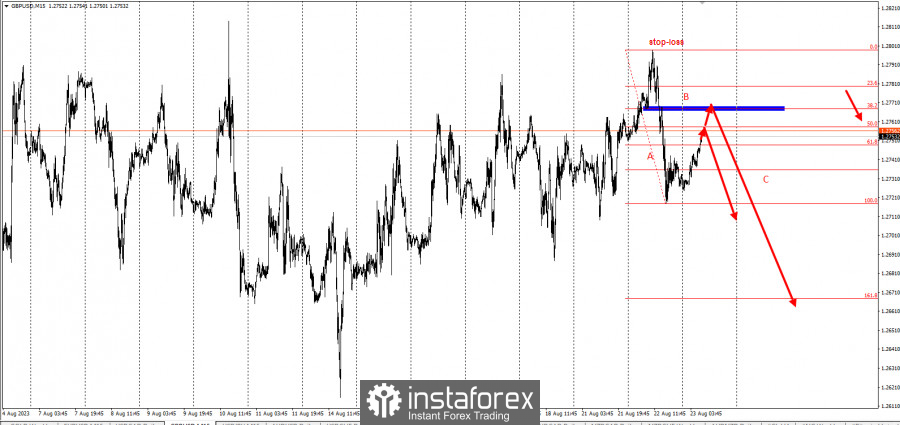

On higher timeframes, yesterday's momentum can be taken as a support, from which there may be two good areas to sell the pair - the 50% retracement level and the breakout area represented by the blue mark below.

Taking into account the three-wave pattern (ABC), in which wave A represents the downward movement, market players could sell the pair either from the 50% retracement level or from the breakdown. Set stop-loss at 1.27900 and take-profit at the breakout of 1.25900.

The trading idea came from the framework of the "Price Action" and "Stop Hunting" strategies.

Good luck in trading and don't forget to control the risks! Have a nice day.